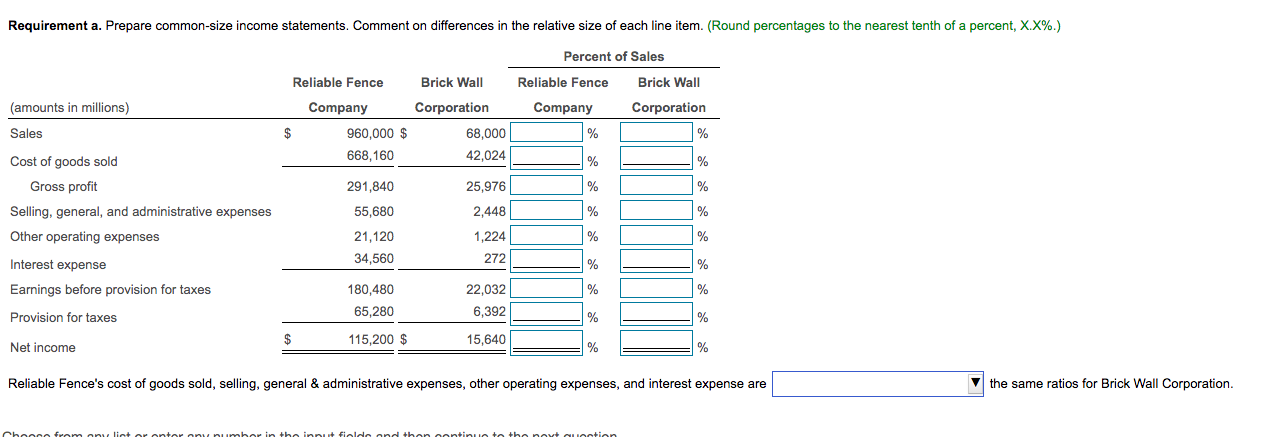

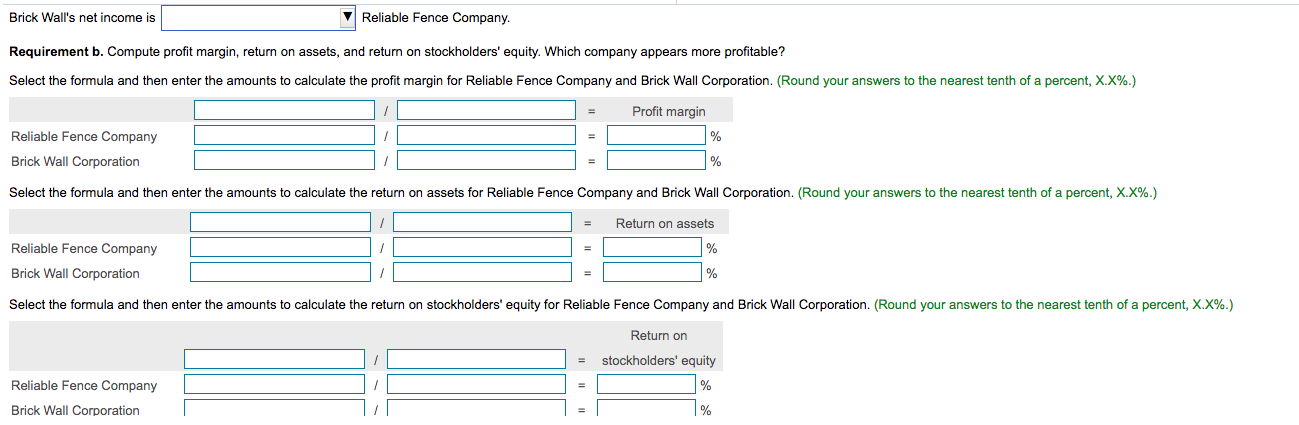

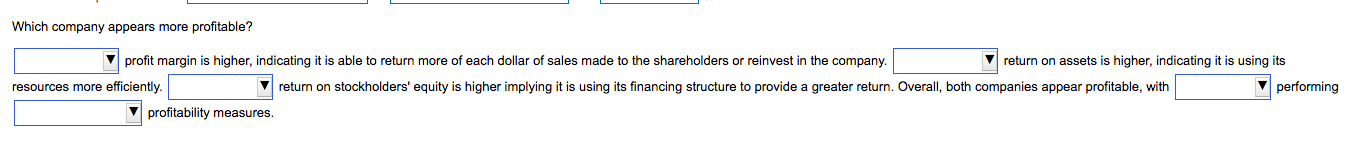

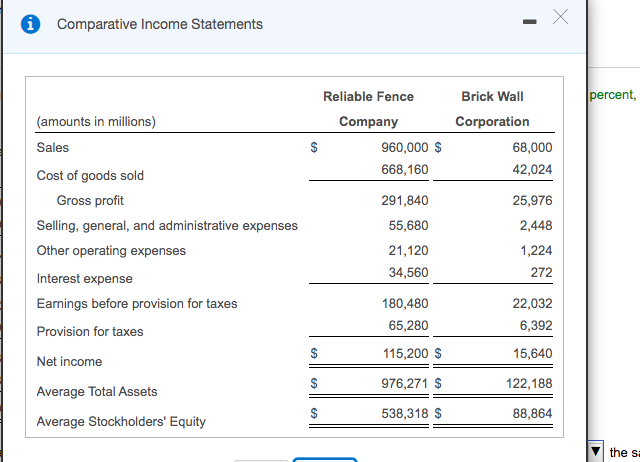

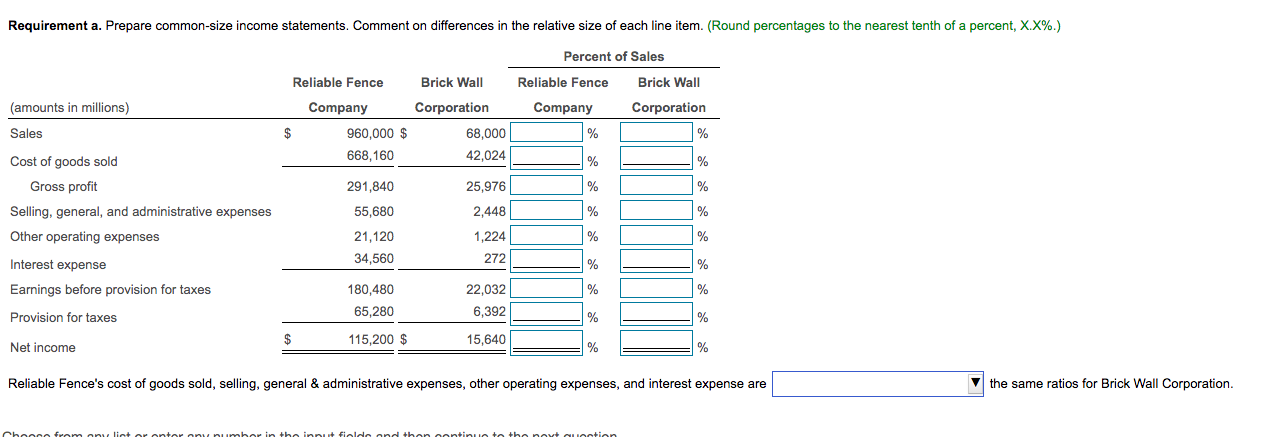

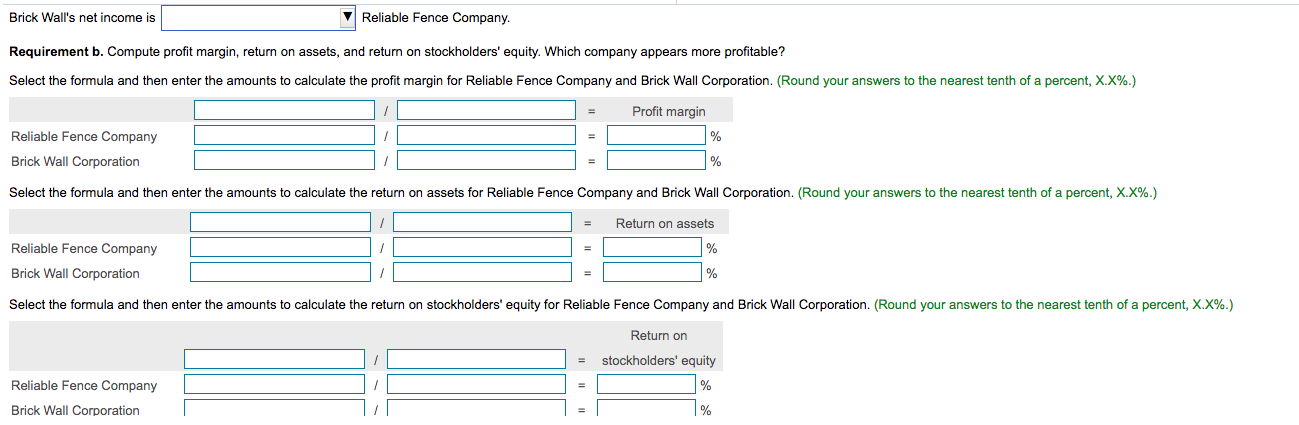

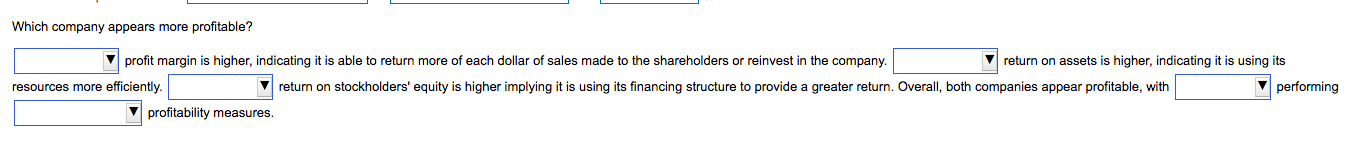

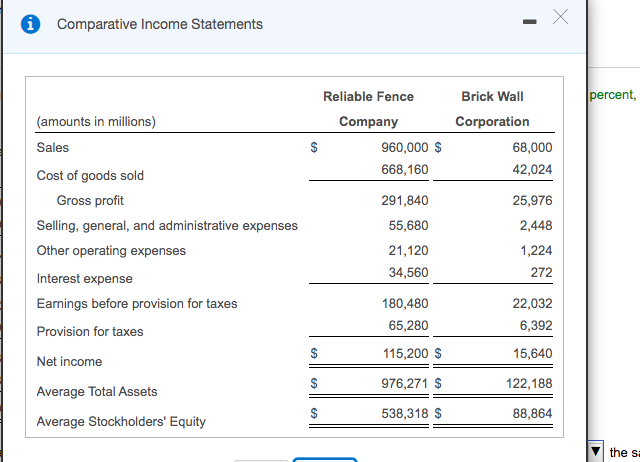

Requirement a. Prepare common-size income statements. Comment on differences in the relative size of each line item. (Round percentages to the nearest tenth of a percent, X.X%.) Percent of Sales Reliable Fence Brick Wall Reliable Fence Brick Wall (amounts in millions) Corporation Sales Company 960,000 $ 668,160 $ Company % Corporation 68,000 42,024 % % % 291,840 25,976 % % Cost of goods sold Gross profit Selling, general, and administrative expenses Other operating expenses 2,448 % % 55,680 21,120 34,560 % % 1,224 272 Interest expense % % Earnings before provision for taxes % % 180,480 65,280 22,032 6,392 Provision for taxes % % $ 115,200 $ Net income 15,640 % % Reliable Fence's cost of goods sold, selling, general & administrative expenses, other operating expenses, and interest expense are the same ratios for Brick Wall Corporation. been from any liat So in this field and then continue tothonovation Brick Wall's net income is Reliable Fence Company. Requirement b. Compute profit margin, return on assets, and return on stockholders' equity. Which company appears more profitable? Select the formula and then enter the amounts to calculate the profit margin for Reliable Fence Company and Brick Wall Corporation. (Round your answers to the nearest tenth of a percent, X.X%.) Profit margin Reliable Fence Company Brick Wall Corporation Select the formula and then enter the amounts to calculate the return on assets for Reliable Fence Company and Brick Wall Corporation. (Round your answers to the nearest tenth of a percent, X.X%.) Return on assets % Reliable Fence Company Brick Wall Corporation Select the formula and then enter the amounts to calculate the return on stockholders' equity for Reliable Fence Company and Brick Wall Corporation. (Round your answers to the nearest tenth of a percent, X.X%.) Return on stockholders' equity % Reliable Fence Company Brick Wall Corporation % Which company appears more profitable? V profit margin is higher, indicating it is able to return more of each dollar of sales made to the shareholders or reinvest in the company. return on assets is higher, indicating it is using its resources more efficiently. return on stockholders' equity is higher implying it is using its financing structure to provide a greater return. Overall, both companies appear profitable, with V performing profitability measures. Comparative Income Statements - X percent, Reliable Fence Company $ 960,000 $ 668,160 Brick Wall Corporation 68,000 42,024 $ 25,976 (amounts in millions) Sales Cost of goods sold Gross profit Selling, general, and administrative expenses Other operating expenses Interest expense Earnings before provision for taxes Provision for taxes Net income Average Total Assets Average Stockholders' Equity 291,840 55,680 21,120 34,560 2,448 1,224 272 180,480 65,280 22,032 6,392 15,640 $ 115,200 $ $ 976,271 $ 122,188 $ 538,318 $ 88,864 the se