Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirement A1 - B2: During July, Laesch Company, which uses a perpetual Inventory system, sold 1,320 units from its LIFO-based Inventory, which had originally cost

Requirement A1 - B2:

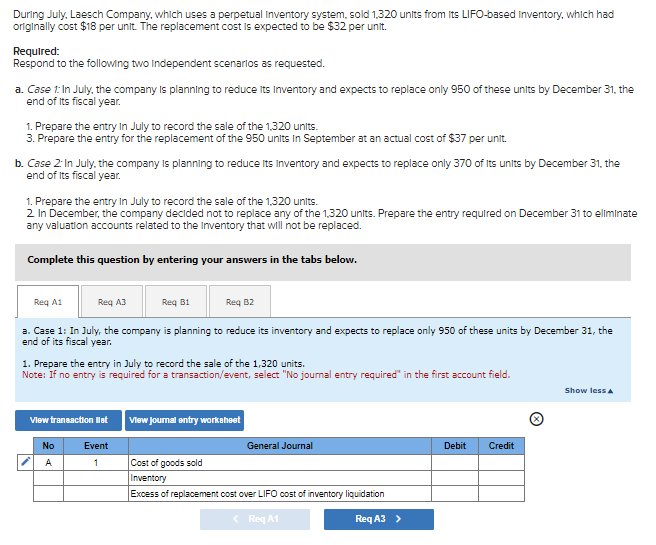

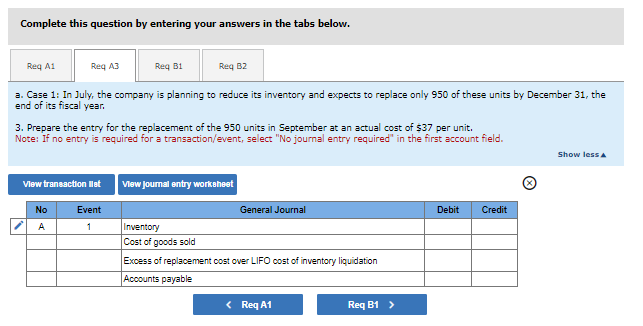

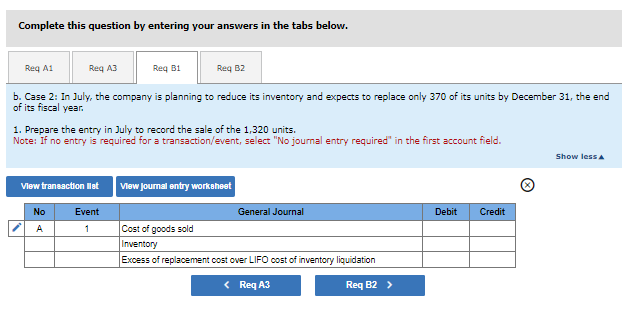

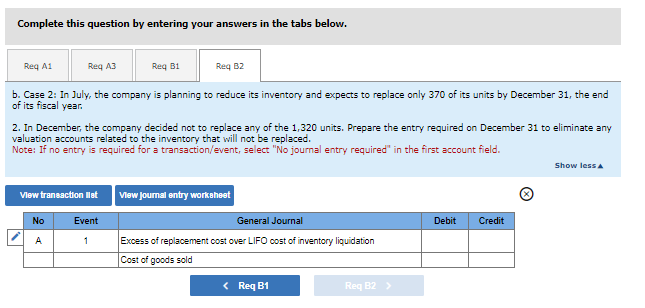

During July, Laesch Company, which uses a perpetual Inventory system, sold 1,320 units from its LIFO-based Inventory, which had originally cost $18 per unit. The replacement cost is expected to be $32 per unit. Required: Respond to the following two independent scenarios as requested. a. Case 1: In July, the company is planning to reduce its Inventory and expects to replace only 950 of these units by December 31, the end of its fiscal year. 1. Prepare the entry in July to record the sale of the 1,320 units. 3. Prepare the entry for the replacement of the 950 units in September at an actual cost of $37 per unit. b. Case 2: In July, the company is planning to reduce its Inventory and expects to replace only 370 of its units by December 31, the end of its fiscal year. 1. Prepare the entry in July to record the sale of the 1,320 units. 2 In December, the company decided not to replace any of the 1,320 units. Prepare the entry required on December 31 to eliminate any valuation accounts related to the Inventory that will not be replaced. Complete this question by entering your answers in the tabs below. Req A1 Req A3 Req B1 Req B2 a. Case 1: In July, the company is planning to reduce its inventory and expects to replace only 950 of these units by December 31, the end of its fiscal year. 1. Prepare the entry in July to record the sale of the 1,320 units. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list View journal entry worksheet No Event General Journal A 1 Cost of goods sold Inventory Excess of replacement cost over LIFO cost of inventory liquidation < Req A1 Req A3 > Debit Credit Show less A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The provided scenario discusses accounting entries related to the sale and replacement of inventory using the LIFO LastIn FirstOut method Lets address ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started