REQUIREMENT

Complete a tax research project memo. The memo should be typed and, in the format, provided below (labeled Appendix A-6). It will be graded on accurately and insightfully analyzing the given facts with proper tax law and citation, as well as presentation (clarity and conciseness of the writing). See the grading rubric below for additional details. Note that only primary sources should be cited. Primary sources include the Internal Revenue Code (IRC), Revenue Rulings, and court cases, but do not include anything from the IRS.

Topic

Elisa just made partner at a local public accounting firm. She receives a salary of $90,000. She decides to purchase another home in Colorado that she will rent out via Airbnb when she's not there. She would like to spend the summers, & a few weeks in winter, in Colorado, but will stay in her condo in Portland the rest of the year. She will receive $250 per night from Airbnb when it is rented. She will also hire a cleaning company that will come after each guest. Some other expenses will include keeping supplies stocked (toilet paper, coffee, etc.), buying some additional supplies, such as a smart key lock, new sheets, a new coffee maker, blackout curtains, some additional maintenance that will be required due to having extra people in her place (painting touch ups, special carpet cleaning, etc.), and there is also depreciation of this second home & its furnishings. She pays a mortgage on the house and annual property taxes. Depending on how this all works out, she's contemplating renting out her condo when she's in Colorado as well. Using the tax law, determine how these items will affect her taxes, and if you would recommend also renting out her condo or not.

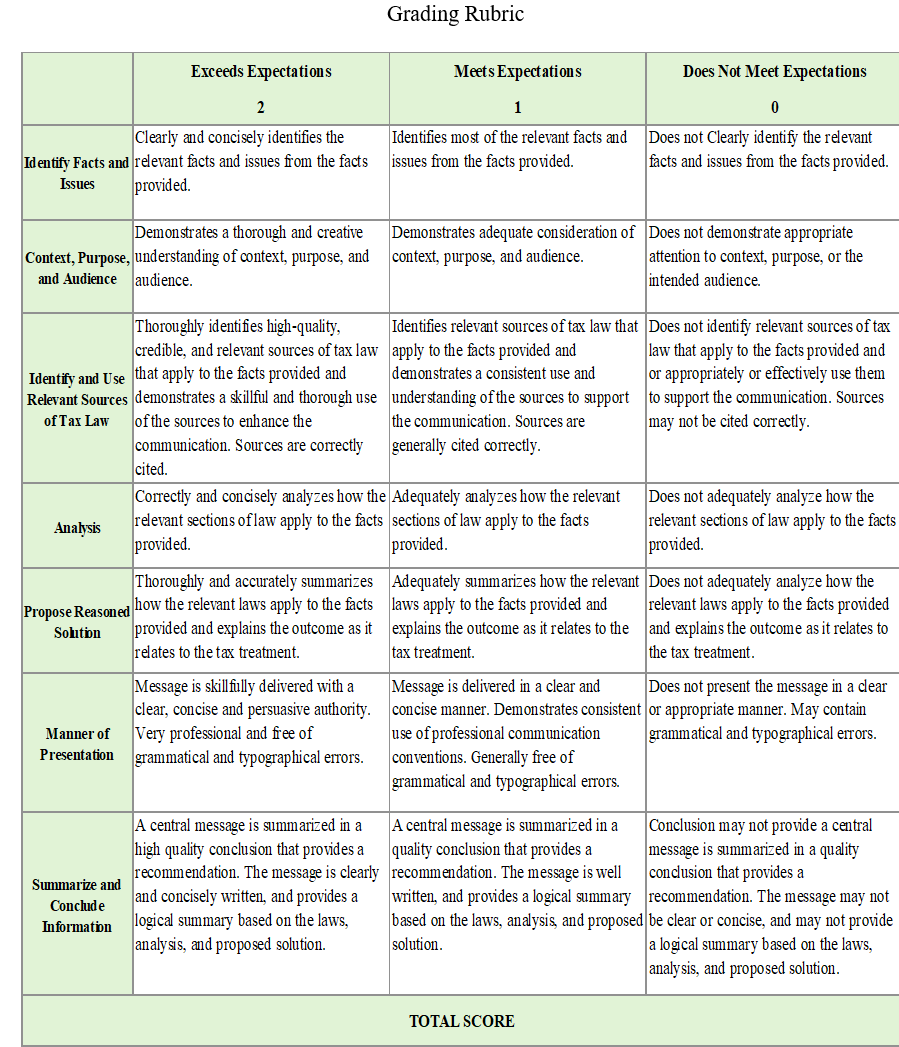

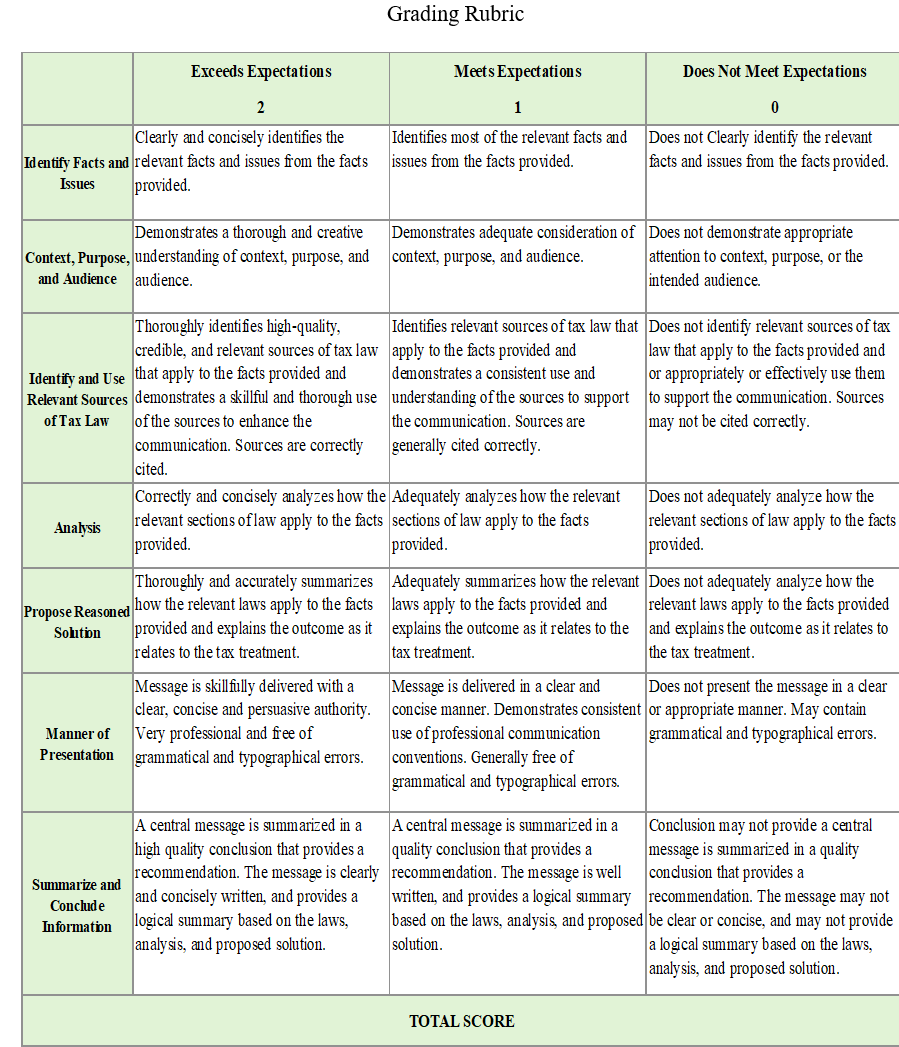

Grading rubric

Format

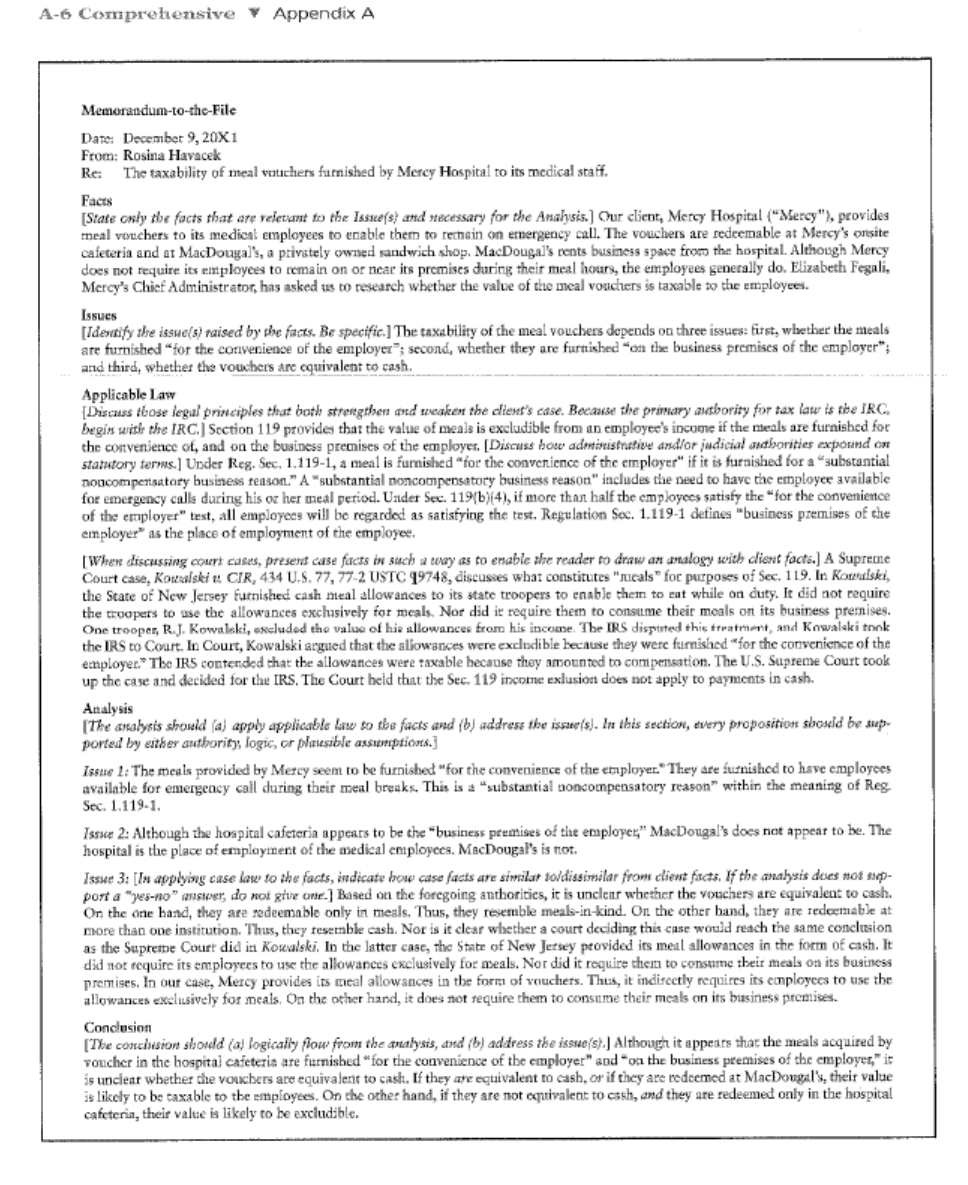

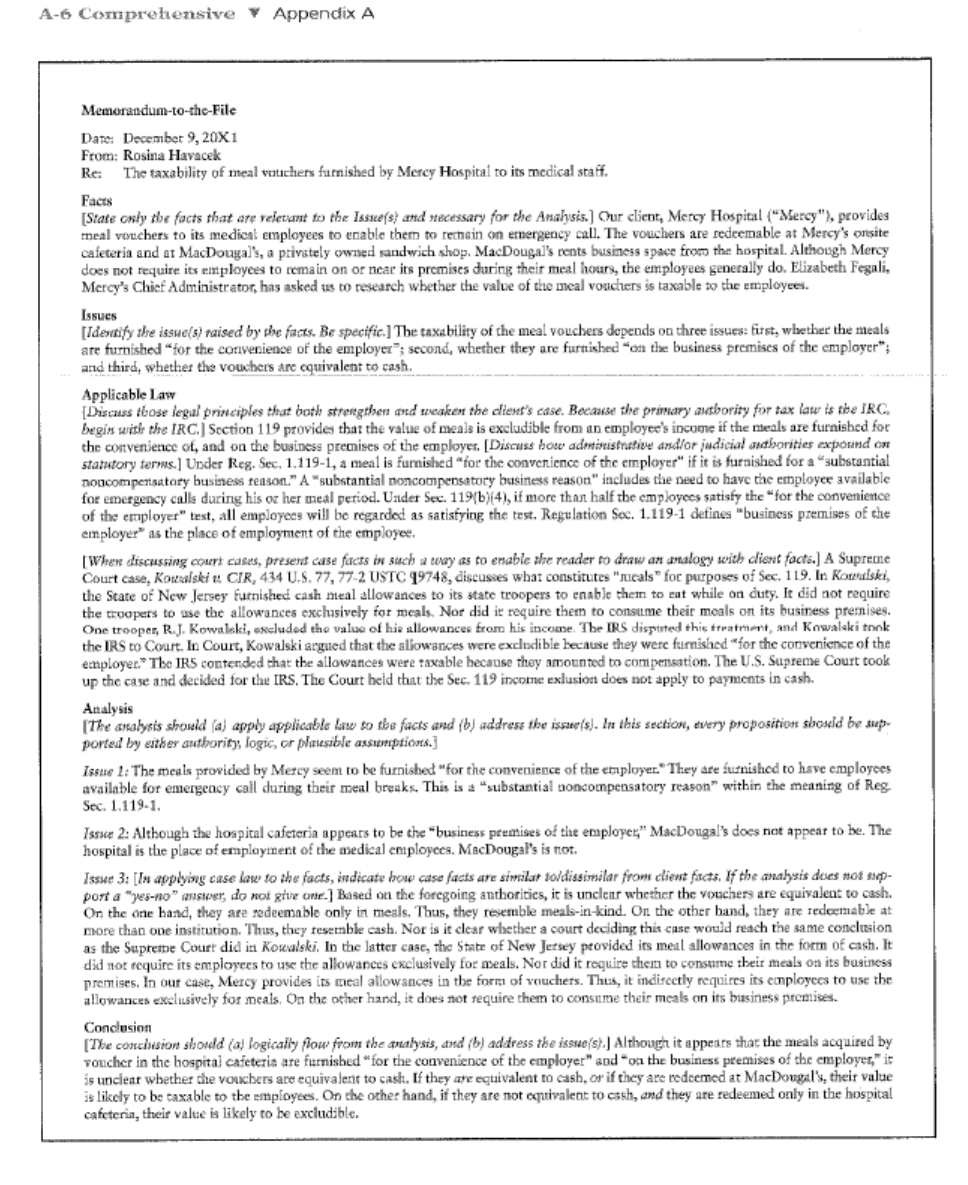

Grading Rubric Exceeds Expectations Meets Expectations Does Not Meet Expectations 2 Clearly and concisely identifies the Identify Facts and relevant facts and issues from the facts Issues provided. 1 0 Identifies most of the relevant facts and Does not Clearly identify the relevant issues from the facts provided. facts and issues from the facts provided. Demonstrates a thorough and creative Context, Purpose, understanding of context, purpose, and and Audience audience. Demonstrates adequate consideration of Does not demonstrate appropriate context, purpose, and audience. attention to context, purpose, or the intended audience. Thoroughly identifies high-quality, Identifies relevant sources of tax law that Does not identify relevant sources of tax credible, and relevant sources of tax law apply to the facts provided and law that apply to the facts provided and Identfy and Use that apply to the facts provided and demonstrates a consistent use and or appropriately or effectively use them Relevant Sources demonstrates a skillful and thorough use understanding of the sources to support to support the communication. Sources of Tax Law of the sources to enhance the the communication. Sources are may not be cited correctly. communication. Sources are correctly generally cited correctly. cited. Correctly and concisely analyzes how the Adequately analyzes how the relevant Does not adequately analyze how the Analysis relevant sections of law apply to the facts sections of law apply to the facts relevant sections of law apply to the facts provided. provided. provided. Thoroughly and accurately summarizes Adequately summarizes how the relevant Does not adequately analyze how the Propose Reasoned how the relevant laws apply to the facts laws apply to the facts provided and relevant laws apply to the facts provided Soliton provided and explains the outcome as it explains the outcome as it relates to the and explains the outcome as it relates to relates to the tax treatment. tax treatment. the tax treatment Message is skillfully delivered with a Message is delivered in a clear and Does not present the message in a dear clear, concise and persuasive authority. concise manner. Demonstrates consistent or appropriate manner. May contain Manner of Very professional and free of use of professional communication grammatical and typographical errors. Presentation grammatical and typographical errors. conventions. Generally free of grammatical and typographical errors. Summarize and Conclude Information A central message is summarized in a A central message is summarized in a Conclusion may not provide a central high quality conclusion that provides a quality conclusion that provides a message is summarized in a quality recommendation. The message is clearly recommendation. The message is well conclusion that provides a and concisely written, and provides a written, and provides a logical summary recommendation. The message may not logical summary based on the laws, based on the laws, analysis, and proposed be clear or concise, and may not provide analysis, and proposed solution. solution. logical summary based on the laws, analysis, and proposed solution. TOTAL SCORE A-6 Comprehensive Appendix A Memorandum-to-the-File Date: December 9, 20X1 From: Rosina Havacek Re: The taxability of meal vatchers furnished by Mercy Hospital to its medical staff. Facts [State only the facts that are veletant to the Issute(s) and necessary for the Analysis. ] Our client, Mercy Hospital (Merey"), provides meal vouchers to its medical employees to enable them to retain on emergency call. The vouchers are redeemable at Mercy's ortsite cafeteria and at MacDougal's, a privately owned sandwich shop. MacDougal's rents business space from the hospital. Although Mercy does not require its employees to remain on or near its premises during their meal hours, the employees generally do. Elizabeth Fegali, Mercy's Chief Administrator, has asked us to research whether the value of the meal voucliers is taxable to the employees. Issues [Identify the issue/s) raised by the facts. Be specific.] The taxability of the meal vouchers depends on three issues: first, whether the meals are furnished for the convenience of the employer"; second, whether they are furtished on the business premises of the employer"; and third, whether the vouchers are cquivalent to cash. Applicable Law [Discuss tbose legal principles that both strengthen and weaken the client's case. Because the primary authority for tax law is the iRC. begins with the IRC Section 119 provides that the value of meals is excludible from an employee's income if the meals are furnished for the convenience of, and on the business premises of the employer. [Discuss how administrative and/or judicial andhorities expound on statutory terms] Under Reg. Sec, 1.119-1, a is furnished "for the convenie of the employer" if it is furnished for a substantial noncompensatory business reason." A "substantial noncompensatory business reason" includes the need to have the employee available for emergency calls during his or her meal period. Under Sec. 119(b)(4), it more than half the employees satisfy the "for the convenience of the employer" test, all employees will be regarded as satisfying the test. Regulation Soc. 1.119-1 detines "business premises of the employer" as the place of employment of the employee, When discussing court cases, present case facts is such a way as to enable the reader to draw an analogy with client facts.] A Supreme Court case, Kowalski : CIR, 434 U.S. 77, 77-2 USTC 99748, discusses what constituites "rucals" for purposes of Sec. 119. In Kowalski, the State of New Jersey furnished cash meal allowances to its state troopers to enable them to eat while on duty. It did not require the troopers to use the allowances exclusively for meals. Nor did it require them to consume their meals on its business premises. One trooper, R. J. Kowalski, excluded the value of his allowances from his income. The IRS dispuited this tramment, and Kowalski took the IRS to Court. In Court, Kowalski argued that the allowances were excludible because they were furnished for the convenience of the employer." The IRS contended that the allowances were taxable because they amounted to compensation. The U.S. Supreme Court took up the case and decided for the IRS. The Court held that the Sec. 119 income exlusion does not apply to payments in cash. Analysis [The analysis should (a) apply applicable law to the facts and (b) address the issues). In this section, every proposition should be sup ported by either authority, logic, or plaisible assumptions] Issue 1: The meals provided by Mercy seem to be furnished "for the convenience of the employer. They are furnished to have employees available for emergency call during their meal breaks, This is a "substantial concompensatory reason within the meaning of Reg Sec. 1.119-1 Issue 2: Although the hospital cafeteria appears to be the "business premises of the employe," MacDougal's does tiot appear to be. The hospital is the place of employment of the medical employees. MacDougal's is not Issue 3: [I applying case law to the facts, indicate how case facts are similar sodissimilar from dient facts. If the analysis does noss- port a "yes-nonser, do not give one. Based on the foregoing anthorities, it is unclear whether the vouchers are equivalent to cash. On the one hand, they are redeemable only in meals. Thus, they resemble meals-in-kind. On the other hand, they are redeemable at more than one institution. Thus, they resemble cash. Nor is it clear whether a court deciding this case would reach the same conclusion as the Supreme Court did in Kowalski. In the latter case, the State of New Jersey provided its meil allowances in the form of cash. It did not require its employees to use the allowances exclusively for meals. Nor did it require them to consume their meals on its business premises. In our case, Mercy provides its meal allowances in form of vouchers. Thus, it indirectly requires its comployees to use the allowances exclusively for mcals. On the ocher hand, it does not require them to consume their meals on its business promises. Conclusion [The conclusion shodd (a) logically flow from the analysis, and (b) address the issues). Although it appears that the meals acquired by voucher in the hospital cafeteria are furnished "for the convenience of the employer" and on the business premises of the employer," it is unclear whether the vouchers are equivalent to cast. If they are equivalent to cash, or if they are redeemed at MacDougal's, their value is likely to be taxable to the employees. On the other hand, if they are not equivalent to cash, and they are redeemed only in the hospital cafeterin, their value is likely to be excludible. Grading Rubric Exceeds Expectations Meets Expectations Does Not Meet Expectations 2 Clearly and concisely identifies the Identify Facts and relevant facts and issues from the facts Issues provided. 1 0 Identifies most of the relevant facts and Does not Clearly identify the relevant issues from the facts provided. facts and issues from the facts provided. Demonstrates a thorough and creative Context, Purpose, understanding of context, purpose, and and Audience audience. Demonstrates adequate consideration of Does not demonstrate appropriate context, purpose, and audience. attention to context, purpose, or the intended audience. Thoroughly identifies high-quality, Identifies relevant sources of tax law that Does not identify relevant sources of tax credible, and relevant sources of tax law apply to the facts provided and law that apply to the facts provided and Identfy and Use that apply to the facts provided and demonstrates a consistent use and or appropriately or effectively use them Relevant Sources demonstrates a skillful and thorough use understanding of the sources to support to support the communication. Sources of Tax Law of the sources to enhance the the communication. Sources are may not be cited correctly. communication. Sources are correctly generally cited correctly. cited. Correctly and concisely analyzes how the Adequately analyzes how the relevant Does not adequately analyze how the Analysis relevant sections of law apply to the facts sections of law apply to the facts relevant sections of law apply to the facts provided. provided. provided. Thoroughly and accurately summarizes Adequately summarizes how the relevant Does not adequately analyze how the Propose Reasoned how the relevant laws apply to the facts laws apply to the facts provided and relevant laws apply to the facts provided Soliton provided and explains the outcome as it explains the outcome as it relates to the and explains the outcome as it relates to relates to the tax treatment. tax treatment. the tax treatment Message is skillfully delivered with a Message is delivered in a clear and Does not present the message in a dear clear, concise and persuasive authority. concise manner. Demonstrates consistent or appropriate manner. May contain Manner of Very professional and free of use of professional communication grammatical and typographical errors. Presentation grammatical and typographical errors. conventions. Generally free of grammatical and typographical errors. Summarize and Conclude Information A central message is summarized in a A central message is summarized in a Conclusion may not provide a central high quality conclusion that provides a quality conclusion that provides a message is summarized in a quality recommendation. The message is clearly recommendation. The message is well conclusion that provides a and concisely written, and provides a written, and provides a logical summary recommendation. The message may not logical summary based on the laws, based on the laws, analysis, and proposed be clear or concise, and may not provide analysis, and proposed solution. solution. logical summary based on the laws, analysis, and proposed solution. TOTAL SCORE A-6 Comprehensive Appendix A Memorandum-to-the-File Date: December 9, 20X1 From: Rosina Havacek Re: The taxability of meal vatchers furnished by Mercy Hospital to its medical staff. Facts [State only the facts that are veletant to the Issute(s) and necessary for the Analysis. ] Our client, Mercy Hospital (Merey"), provides meal vouchers to its medical employees to enable them to retain on emergency call. The vouchers are redeemable at Mercy's ortsite cafeteria and at MacDougal's, a privately owned sandwich shop. MacDougal's rents business space from the hospital. Although Mercy does not require its employees to remain on or near its premises during their meal hours, the employees generally do. Elizabeth Fegali, Mercy's Chief Administrator, has asked us to research whether the value of the meal voucliers is taxable to the employees. Issues [Identify the issue/s) raised by the facts. Be specific.] The taxability of the meal vouchers depends on three issues: first, whether the meals are furnished for the convenience of the employer"; second, whether they are furtished on the business premises of the employer"; and third, whether the vouchers are cquivalent to cash. Applicable Law [Discuss tbose legal principles that both strengthen and weaken the client's case. Because the primary authority for tax law is the iRC. begins with the IRC Section 119 provides that the value of meals is excludible from an employee's income if the meals are furnished for the convenience of, and on the business premises of the employer. [Discuss how administrative and/or judicial andhorities expound on statutory terms] Under Reg. Sec, 1.119-1, a is furnished "for the convenie of the employer" if it is furnished for a substantial noncompensatory business reason." A "substantial noncompensatory business reason" includes the need to have the employee available for emergency calls during his or her meal period. Under Sec. 119(b)(4), it more than half the employees satisfy the "for the convenience of the employer" test, all employees will be regarded as satisfying the test. Regulation Soc. 1.119-1 detines "business premises of the employer" as the place of employment of the employee, When discussing court cases, present case facts is such a way as to enable the reader to draw an analogy with client facts.] A Supreme Court case, Kowalski : CIR, 434 U.S. 77, 77-2 USTC 99748, discusses what constituites "rucals" for purposes of Sec. 119. In Kowalski, the State of New Jersey furnished cash meal allowances to its state troopers to enable them to eat while on duty. It did not require the troopers to use the allowances exclusively for meals. Nor did it require them to consume their meals on its business premises. One trooper, R. J. Kowalski, excluded the value of his allowances from his income. The IRS dispuited this tramment, and Kowalski took the IRS to Court. In Court, Kowalski argued that the allowances were excludible because they were furnished for the convenience of the employer." The IRS contended that the allowances were taxable because they amounted to compensation. The U.S. Supreme Court took up the case and decided for the IRS. The Court held that the Sec. 119 income exlusion does not apply to payments in cash. Analysis [The analysis should (a) apply applicable law to the facts and (b) address the issues). In this section, every proposition should be sup ported by either authority, logic, or plaisible assumptions] Issue 1: The meals provided by Mercy seem to be furnished "for the convenience of the employer. They are furnished to have employees available for emergency call during their meal breaks, This is a "substantial concompensatory reason within the meaning of Reg Sec. 1.119-1 Issue 2: Although the hospital cafeteria appears to be the "business premises of the employe," MacDougal's does tiot appear to be. The hospital is the place of employment of the medical employees. MacDougal's is not Issue 3: [I applying case law to the facts, indicate how case facts are similar sodissimilar from dient facts. If the analysis does noss- port a "yes-nonser, do not give one. Based on the foregoing anthorities, it is unclear whether the vouchers are equivalent to cash. On the one hand, they are redeemable only in meals. Thus, they resemble meals-in-kind. On the other hand, they are redeemable at more than one institution. Thus, they resemble cash. Nor is it clear whether a court deciding this case would reach the same conclusion as the Supreme Court did in Kowalski. In the latter case, the State of New Jersey provided its meil allowances in the form of cash. It did not require its employees to use the allowances exclusively for meals. Nor did it require them to consume their meals on its business premises. In our case, Mercy provides its meal allowances in form of vouchers. Thus, it indirectly requires its comployees to use the allowances exclusively for mcals. On the ocher hand, it does not require them to consume their meals on its business promises. Conclusion [The conclusion shodd (a) logically flow from the analysis, and (b) address the issues). Although it appears that the meals acquired by voucher in the hospital cafeteria are furnished "for the convenience of the employer" and on the business premises of the employer," it is unclear whether the vouchers are equivalent to cast. If they are equivalent to cash, or if they are redeemed at MacDougal's, their value is likely to be taxable to the employees. On the other hand, if they are not equivalent to cash, and they are redeemed only in the hospital cafeterin, their value is likely to be excludible