Requirement: File 2017 Federal Income Tax Return for Samantha. You will fill out form 1040, Sch A, Sch SE, Form 2441 and Form 8812.

Taxpayers main facts:

Samanthas husband died in March 2014. She has not remarried.

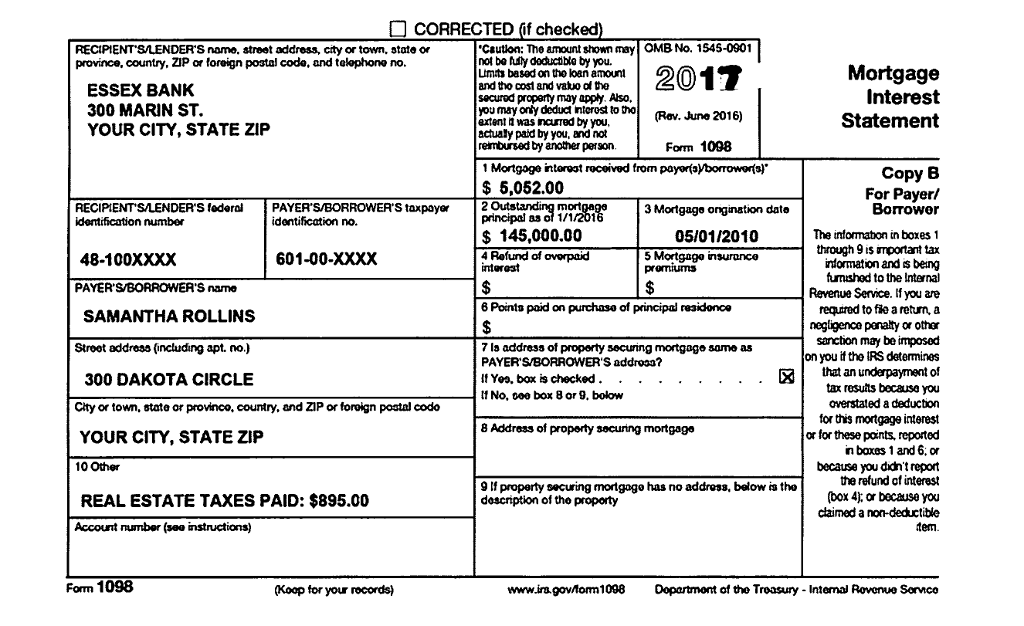

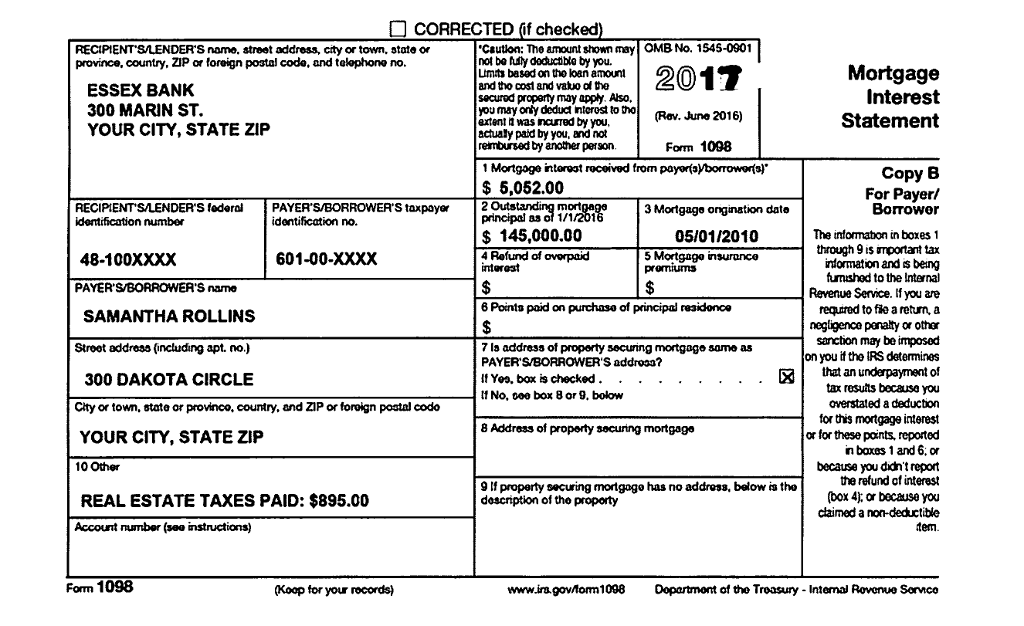

Samantha lives in the same house she purchased in 2011.

Samantha provided the entire cost of maintaining the household and all the support for her children, Meredith and Oliver, in 2017.

Her younger Brother, Howard, is permanently and totally disabled. He received disability income which he used to provide more than half of his own support.

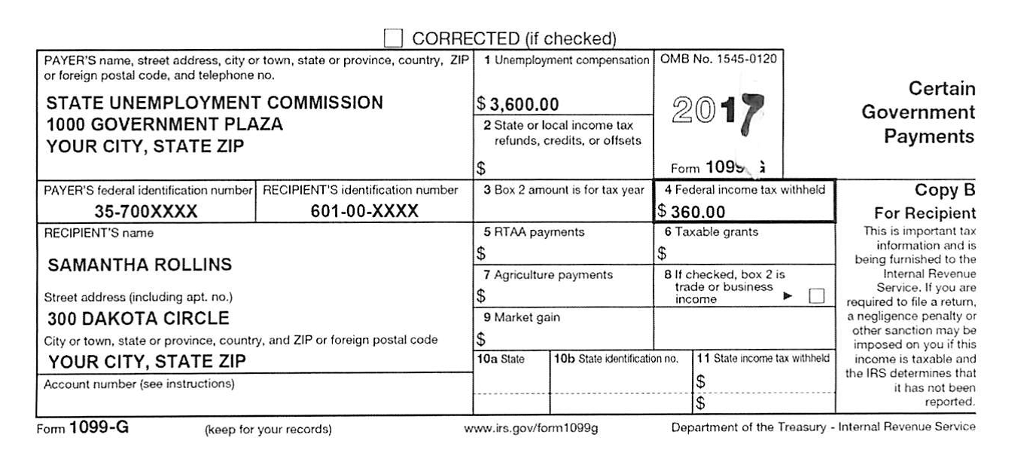

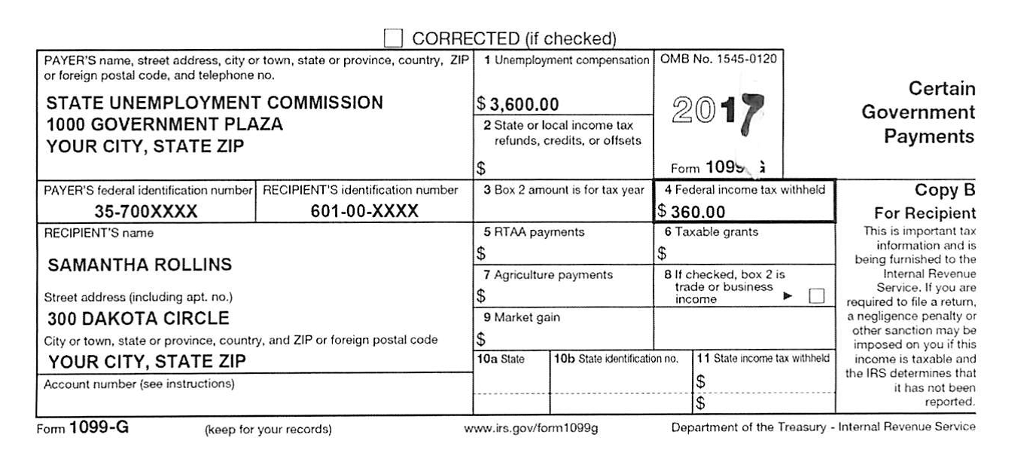

Samantha lost her job in December 2016. She received unemployment for two months in 2017 until she found a new job.

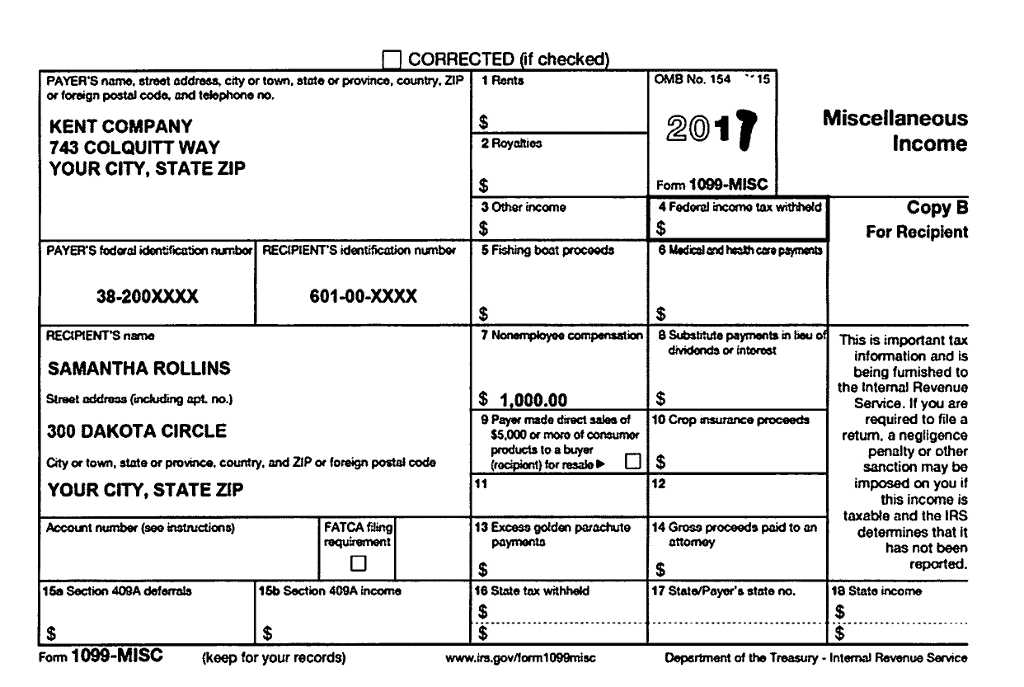

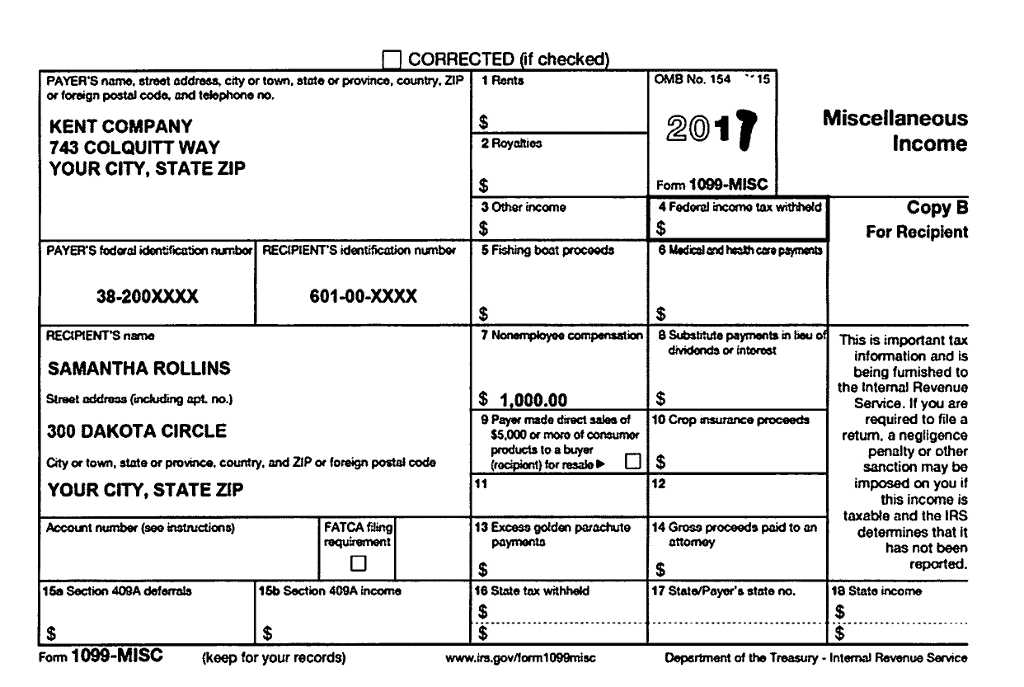

Samantha provides translation services to earn extra income. She received a Form 1099-MiSC. Her only expense related to this income was $50 in office supplies.

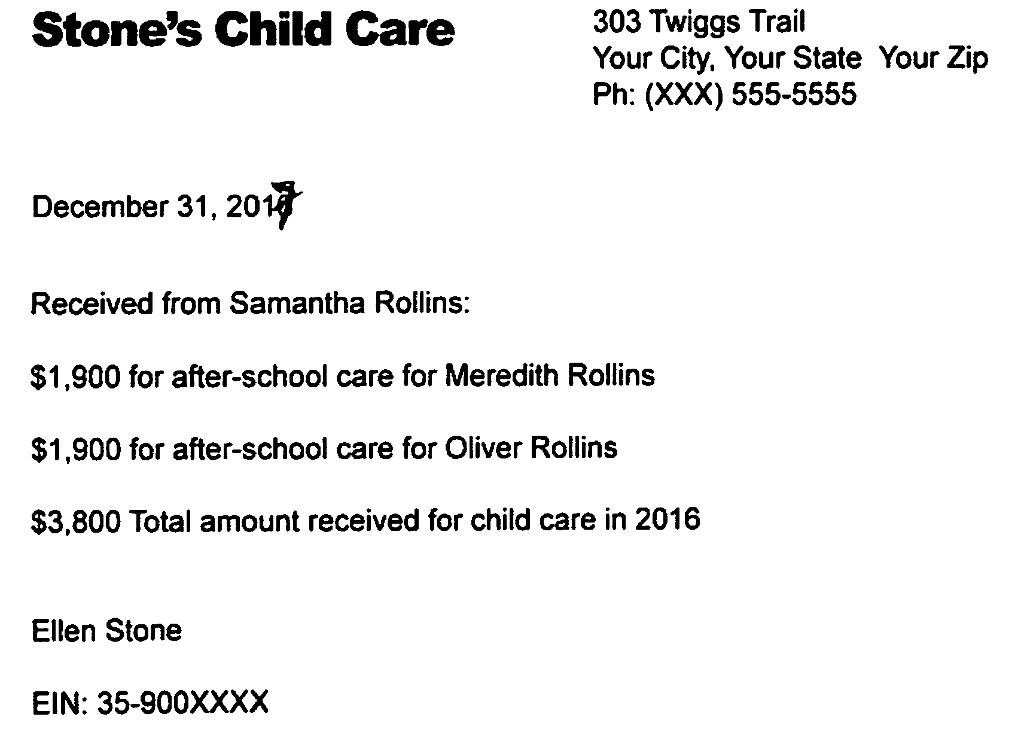

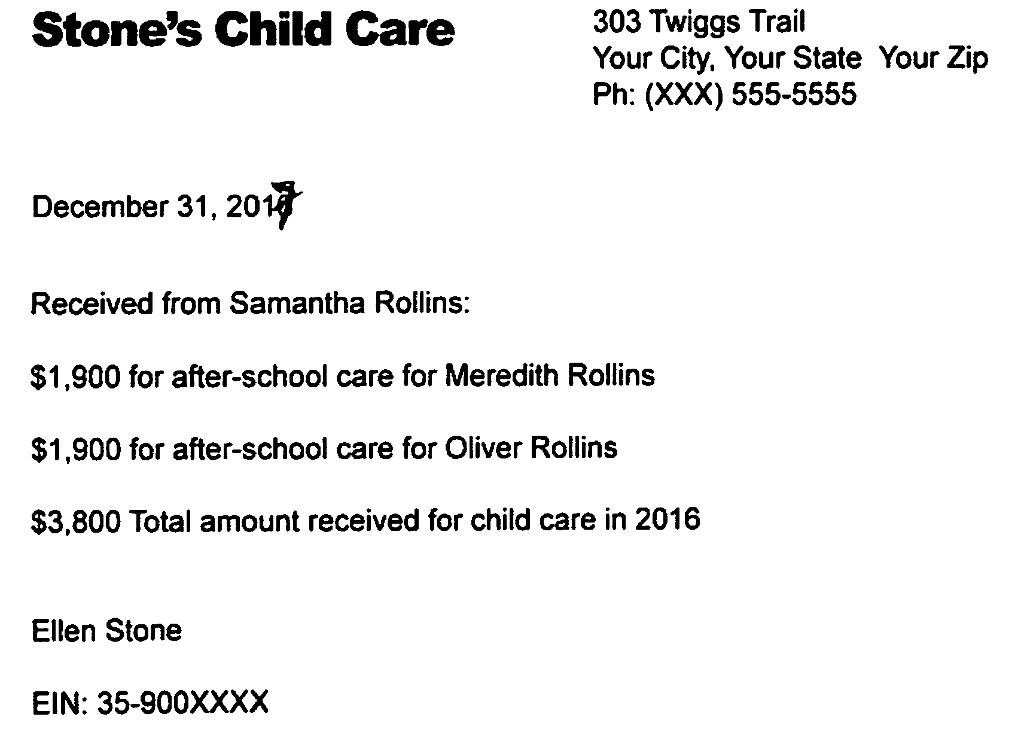

Meredith and Oliver attended day care while Samantha worked.

Samantha, Meredith and Oliver have qualified health insurance coverage

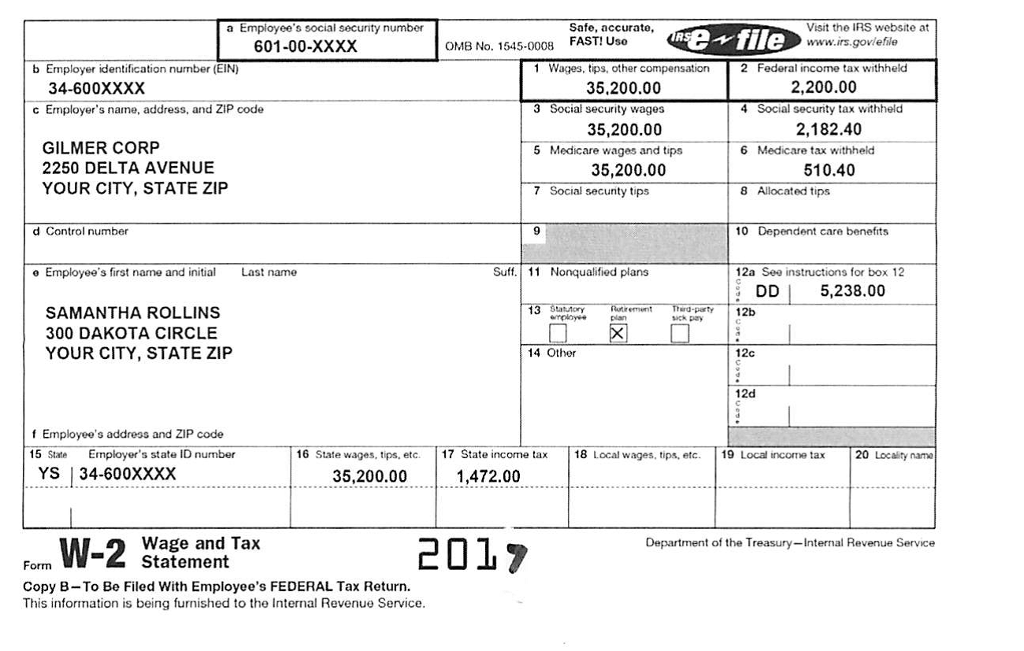

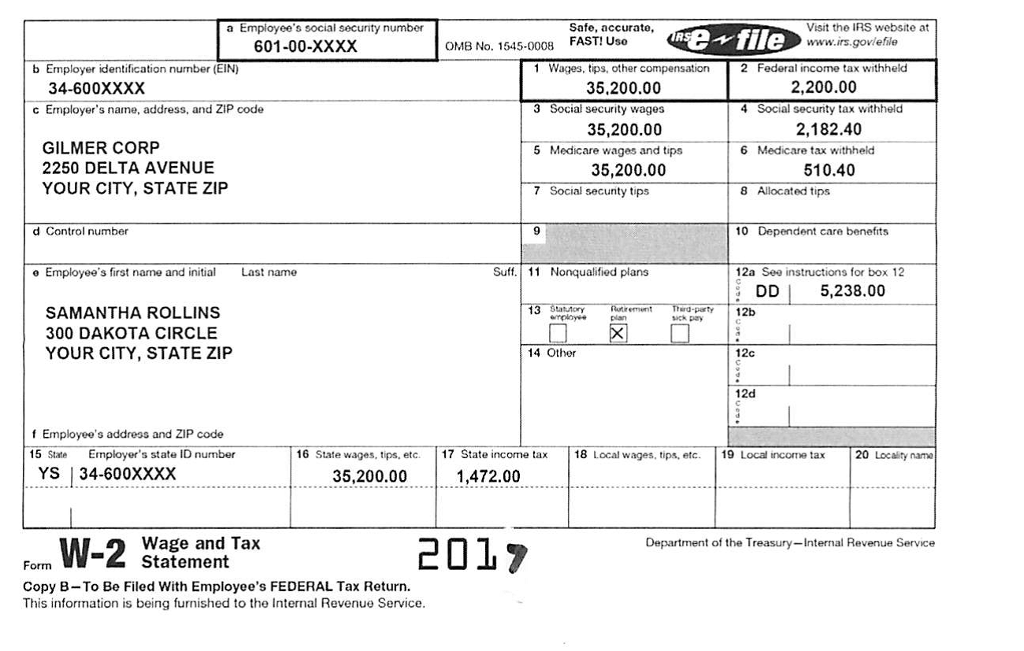

The following are Samanthas W-2, 1099s, and related expenses information:

Safe, accurate, Visit the IRS website at www.irs.govlefive a Employee's social security number FAST! Uso e file 601-00-XXXX OMB No. 1545-0008 b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld 35,200.00 35,200.00 35,200.00 2,200.00 2,182.40 510.40 34-600XXXX c Employer's name, address, and ZiP code 3 Social security wages 4 Social security tax withheld GILMER CORP 2250 DELTA AVENUE YOUR CITY, STATE ZIP 5 Medicare wages and tips 6 Medicare tax withhelod 7 Social security tips 8 Allocated tips d Control number 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 DDI 5,238.00 Trard-party 12b atutory SAMANTHA ROLLINS 300 DAKOTA CIRCLE YOUR CITY, STATE ZIP sick pay 14 Other 12c 12d Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name YS 34-600XXXX 1,472.00. 35,200.00 Wage and Tax Statement 2017 Department of the Treasury Internal Revenue Service Form Copy B-To Be Filed With Employee's FEDERAL Tax Return. This infomation is being furnished to the Internal Revenue Service Safe, accurate, Visit the IRS website at www.irs.govlefive a Employee's social security number FAST! Uso e file 601-00-XXXX OMB No. 1545-0008 b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld 35,200.00 35,200.00 35,200.00 2,200.00 2,182.40 510.40 34-600XXXX c Employer's name, address, and ZiP code 3 Social security wages 4 Social security tax withheld GILMER CORP 2250 DELTA AVENUE YOUR CITY, STATE ZIP 5 Medicare wages and tips 6 Medicare tax withhelod 7 Social security tips 8 Allocated tips d Control number 10 Dependent care benefits e Employee's first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12 DDI 5,238.00 Trard-party 12b atutory SAMANTHA ROLLINS 300 DAKOTA CIRCLE YOUR CITY, STATE ZIP sick pay 14 Other 12c 12d Employee's address and ZIP code 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name YS 34-600XXXX 1,472.00. 35,200.00 Wage and Tax Statement 2017 Department of the Treasury Internal Revenue Service Form Copy B-To Be Filed With Employee's FEDERAL Tax Return. This infomation is being furnished to the Internal Revenue Service