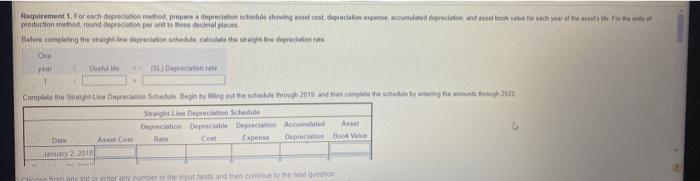

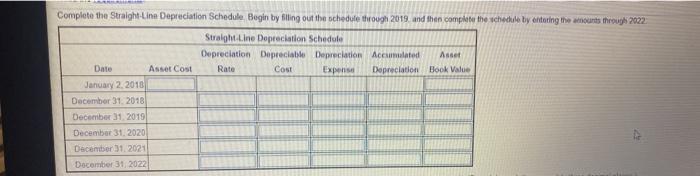

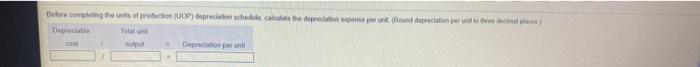

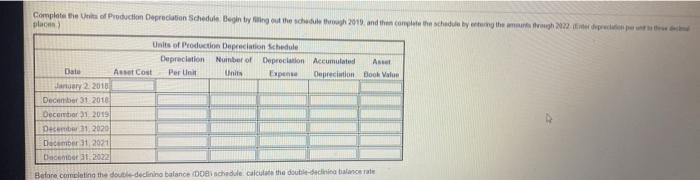

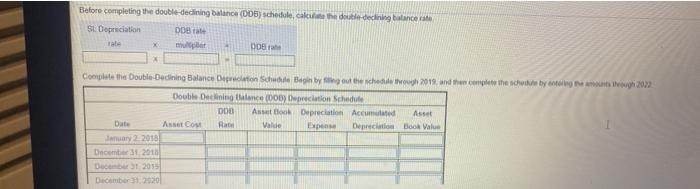

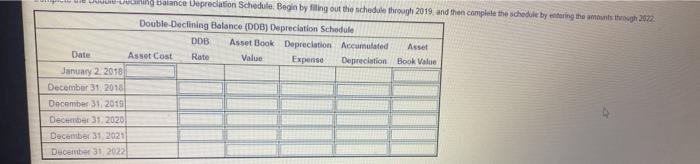

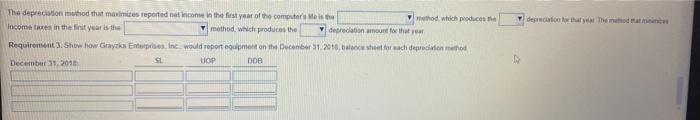

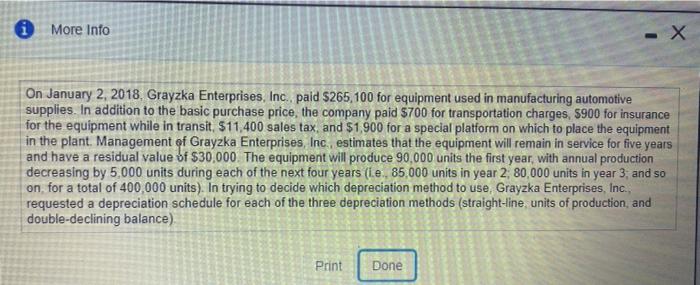

Requirement. For each doplation method, prepreden schedule showing cost deprecationem cum relation and book ach year of the new production method and depreciation per te detalle Badou celluing the straight intercamion schedule entitate the same prieten om cine yen 1 Complete eine Depreciation Schedule Begin by iting the through 2019 and has come the the lyringe 22 Str. Depeche Schedule Depreciation Depreciate Depreciation Acco AS Date Asset Cou Na Cont Espese Deprecation tool any 2 2010 rehand then cho Complete the Straight-Line Depreciation Schedule Begin by filling out the schedule through 2019. and then complete the schedule by entering the amounts through 2022 Straight Line Dopreciation Schedule Depreciation Depreciate Depreciation Accumulated Asset Date Asset Cost Rate Cost Expense Depreciation Book Value January 2, 2018 December 31, 2018 December 31, 2019 December 31, 2020 December 31, 2021 December 31, 2022 Before completing the production (OP) deprecation schedule Calcio di pertanddepreciation into the decat Deprecate Out Depreciation on Complete the United Production Depreciation Schedule Begin toying out the schede 2010. and the complete the schedule by the 2022. dec place) Units of Production Depreciation Schedule Depreciation Number of Depreciation Accumulated A Data As Cost Per Unit Unit Exp Depreciation Book Valen January 2 2010 December 31 2010 December 2015 December 11, 2020 December 31, 2021 DO 11.2022 Before coming the double declining balance schede calcul the double- da balance rate Before completing the double declining balance (005) schedule, calculate the double declining balance to SL Depreciation DOB mu DO Complete the Double-Dedining Balance Direction School Bag by the outchedule 2019, and the complete the sole by 2022 Double Declining ance) wpreciation Schedule DOO Asseto Depreciation Accumulated Asset Date Asset Com Rate Valde EX Depreciation Book Value January 2 2018 December 2010 December 2013 December 2020 UW- balance Depreciation Schedule. Begin by filing out the schedule through 2019 and then complete the schedule by entering the amounts tough 2072 Double Declining Balance (DDB) Depreciation Schedule DDB Asset Book Depreciation Accumulated Asset Date Asset Cost Rate Value Expense Depreciation Book Value January 2 2018 December 31 2018 December 31, 2019 December 31, 2020 December 31, 2021 December 31, 2022 The depreciation muhod that mais reported nation in the first year of the computer's Mis the Income taxes in the first year is the method, which produces the deprecation amount for that method which produce der that the moment Requirement 3. Show how Grayska Enterprises Inc. would report equipment on the December 31, 2010, forach depreciation method SL December 31, 2016 UOP DDB More Info -X On January 2, 2018. Grayzka Enterprises, Inc., paid $265,100 for equipment used in manufacturing automotive supplies. In addition to the basic purchase price, the company paid $700 for transportation charges, 5900 for insurance for the equipment while in transit, $11,400 sales tax and $1,900 for a special platform on which to place the equipment in the plant Management of Grayzka Enterprises, Inc., estimates that the equipment will remain in service for five years and have a residual value of $30,000. The equipment will produce 90,000 units the first year, with annual production decreasing by 5,000 units during each of the next four years (.e. 85,000 units in year 2, 80,000 units in year 3, and so on for a total of 400,000 units). In trying to decide which depreciation method to use Grayzka Enterprises Inc., requested a depreciation schedule for each of the three depreciation methods (straight-line units of production, and double-declining balance) Print Done