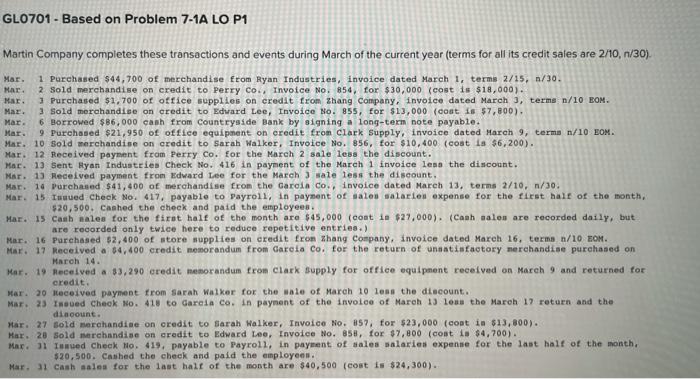

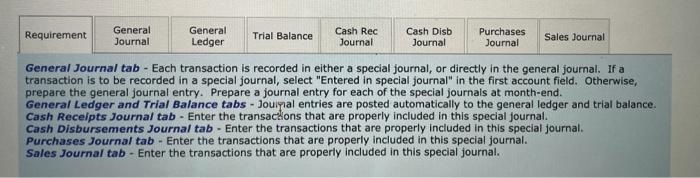

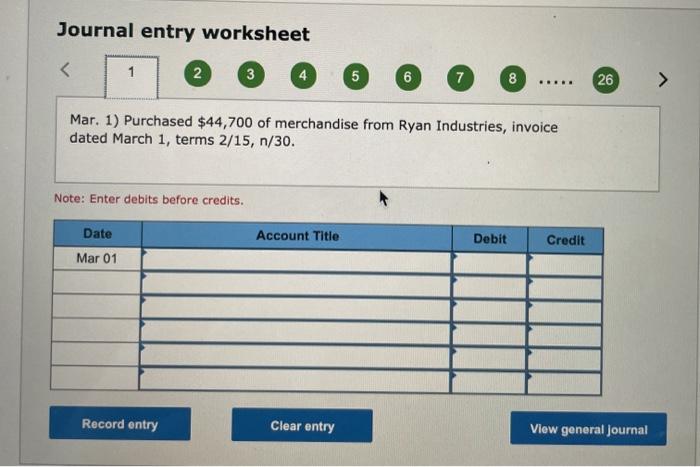

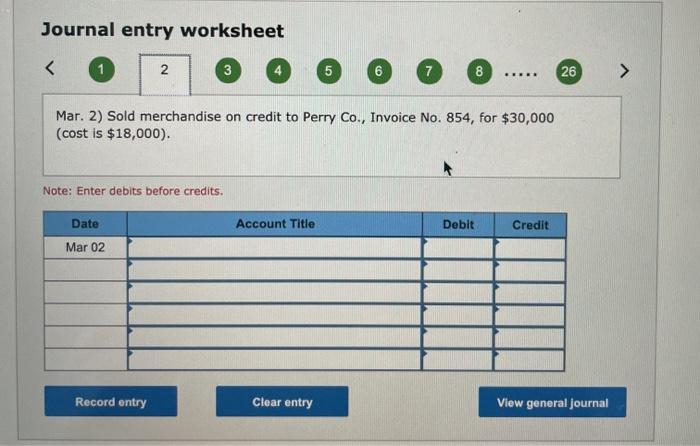

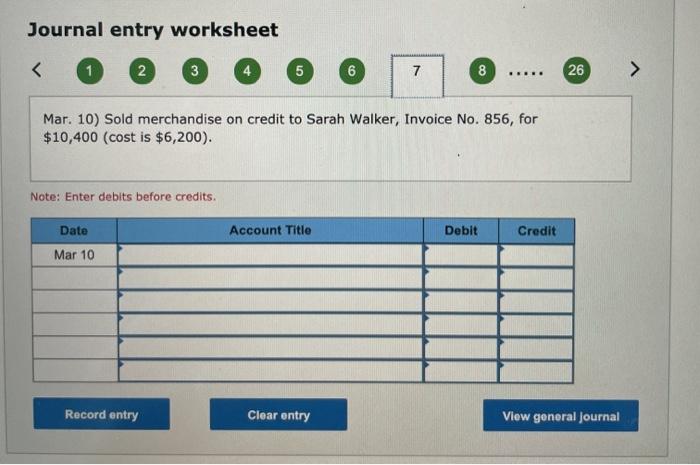

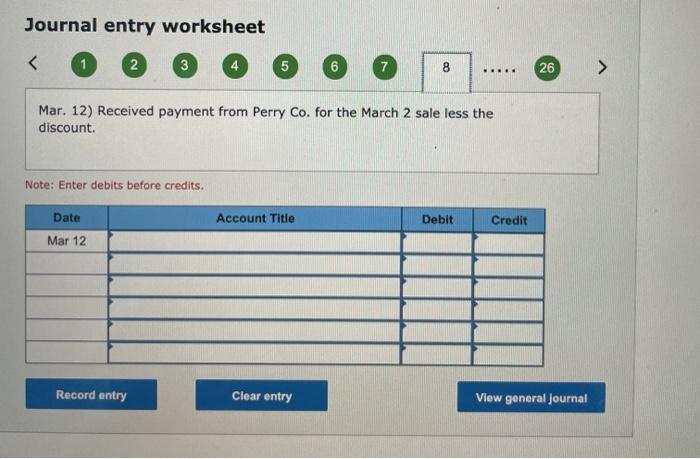

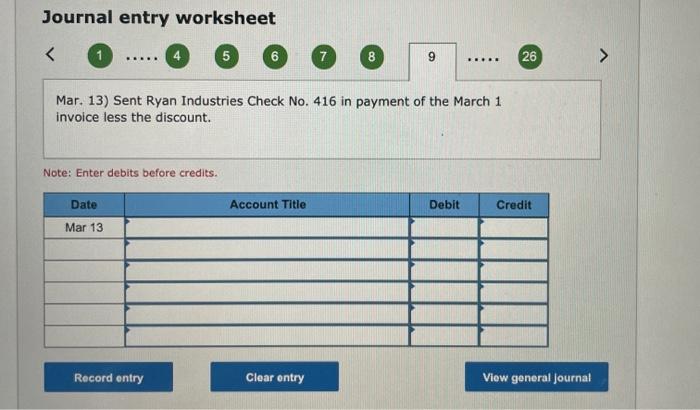

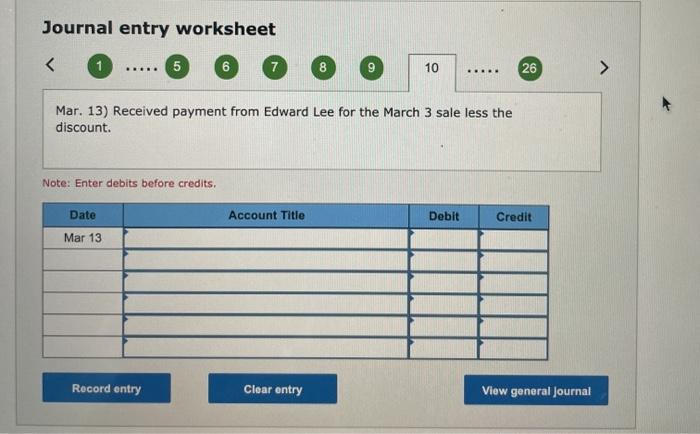

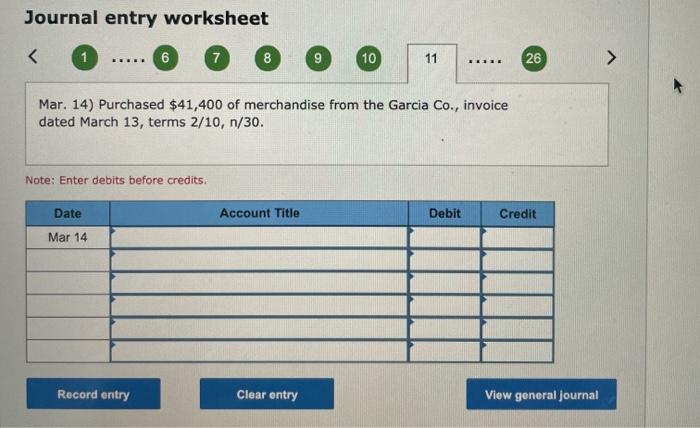

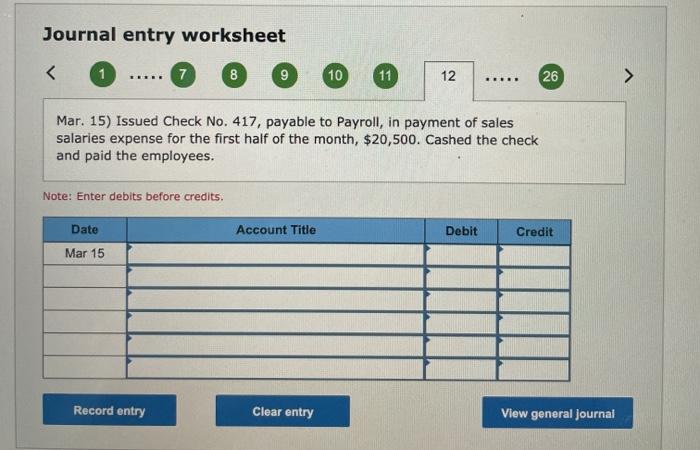

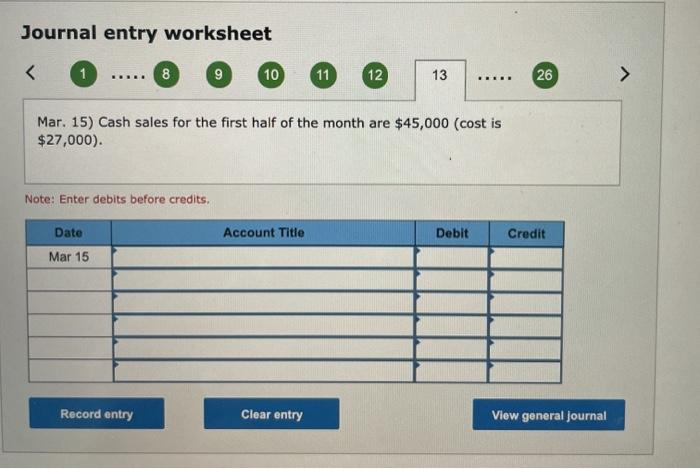

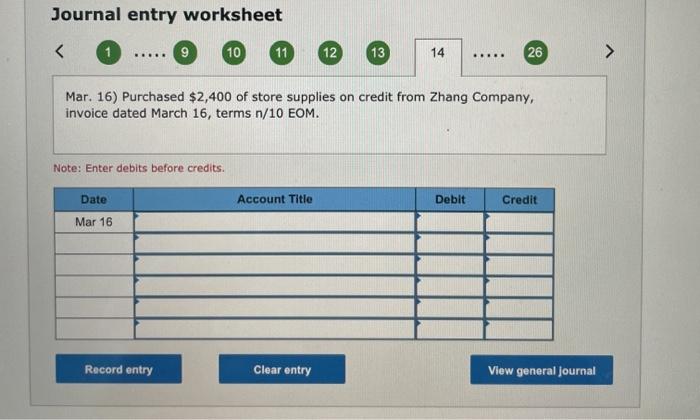

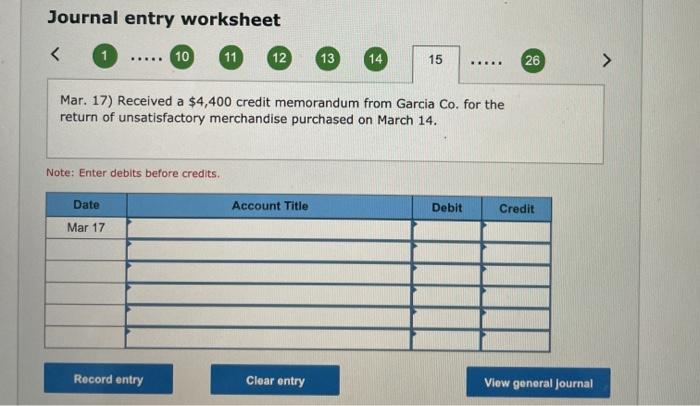

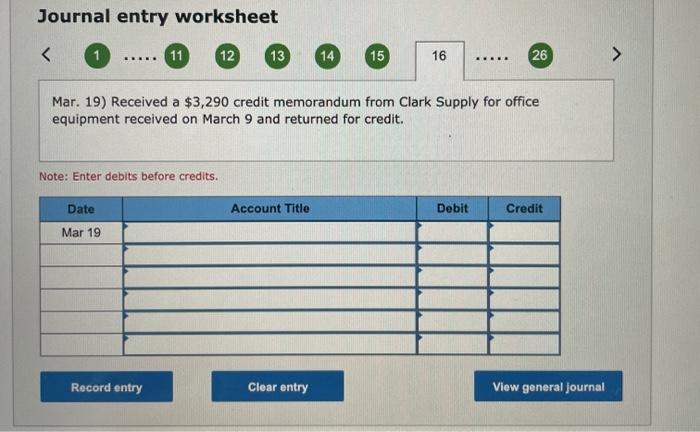

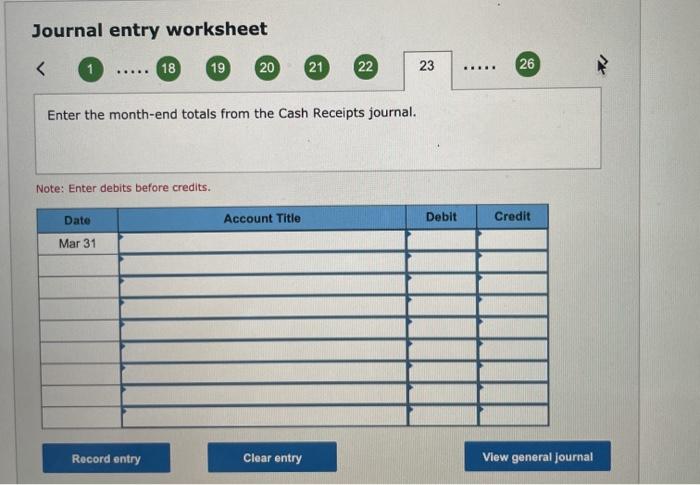

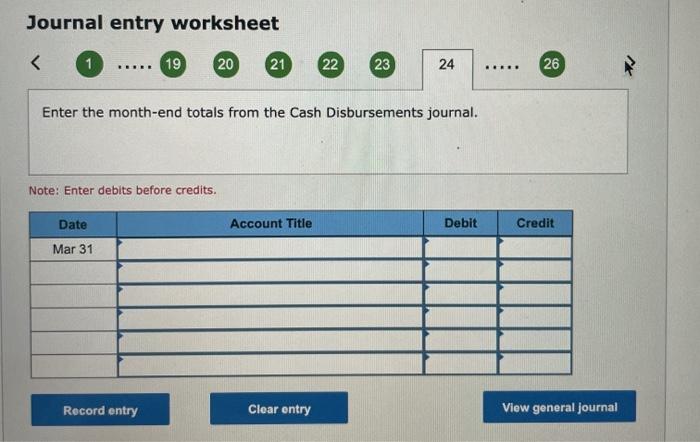

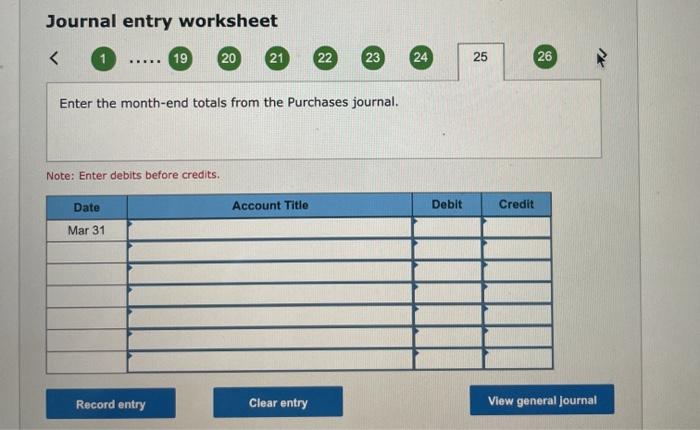

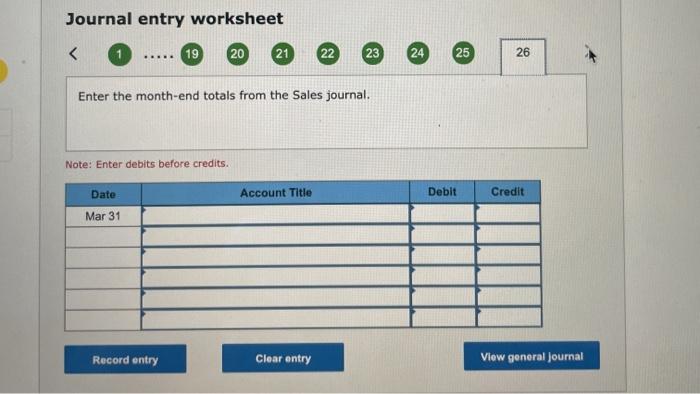

Requirement General Journal General Ledger Trial Balance Cash Rec Journal Cash Disb Journal Purchases Journal Sales Journal General Journal tab - Each transaction is recorded in either a special journal, or directly in the general journal. If a transaction is to be recorded in a special journal, select "Entered in special journal" in the first account field. Otherwise, prepare the general journal entry. Prepare a journal entry for each of the special journals at month-end. General Ledger and Trial Balance tabs - Jouiyal entries are posted automatically to the general ledger and trial balance. Cash Receipts Journal tab - Enter the transactions that are properly included in this special journal. Cash Disbursements Journal tab - Enter the transactions that are properly included in this special journal. Purchases Journal tab - Enter the transactions that are properly included in this special journal. Sales Journal tab - Enter the transactions that are properly included in this special journal. Journal entry worksheet Mar. 10) Sold merchandise on credit to Sarah Walker, Invoice No. 856, for $10,400 (cost is $6,200). Note: Enter debits before credits. Date Account Title Debit Credit Mar 10 Record entry Clear entry View general Journal Journal entry worksheet Mar. 12) Received payment from Perry Co. for the March 2 sale less the discount Note: Enter debits before credits. Date Account Title Debit Credit Mar 12 Record entry Clear entry View general Journal Journal entry worksheet ..... Mar. 13) Received payment from Edward Lee for the March 3 sale less the discount. Note: Enter debits before credits. Date Account Title Debit Credit Mar 13 Record entry Clear entry View general Journal Journal entry worksheet Mar. 15) Cash sales for the first half of the month are $45,000 (cost is $27,000). Note: Enter debits before credits. Date Account Title Debit Credit Mar 15 Record entry Clear entry View general journal Journal entry worksheet Mar. 17) Received a $4,400 credit memorandum from Garcia Co. for the return of unsatisfactory merchandise purchased on March 14. Note: Enter debits before credits Account Title Debit Credit Date Mar 17 Record entry Clear entry View general Journal Journal entry worksheet ..... 26 Mar. 19) Received a $3,290 credit memorandum from Clark Supply for office equipment received on March 9 and returned for credit. Note: Enter debits before credits. Date Account Title Debit Credit Mar 19 Record entry Clear entry View general journal Journal entry worksheet