Answered step by step

Verified Expert Solution

Question

1 Approved Answer

REQUIREMENT: Record the transactions for the last quarter in the general journal. Omit explanations. Round off figures to the nearest whole number. Please follow this

REQUIREMENT: Record the transactions for the last quarter in the general journal. Omit explanations. Round off figures to the nearest whole number. Please follow this format (Quarter/Seq# - Account titles - PR - Dr - Cr)

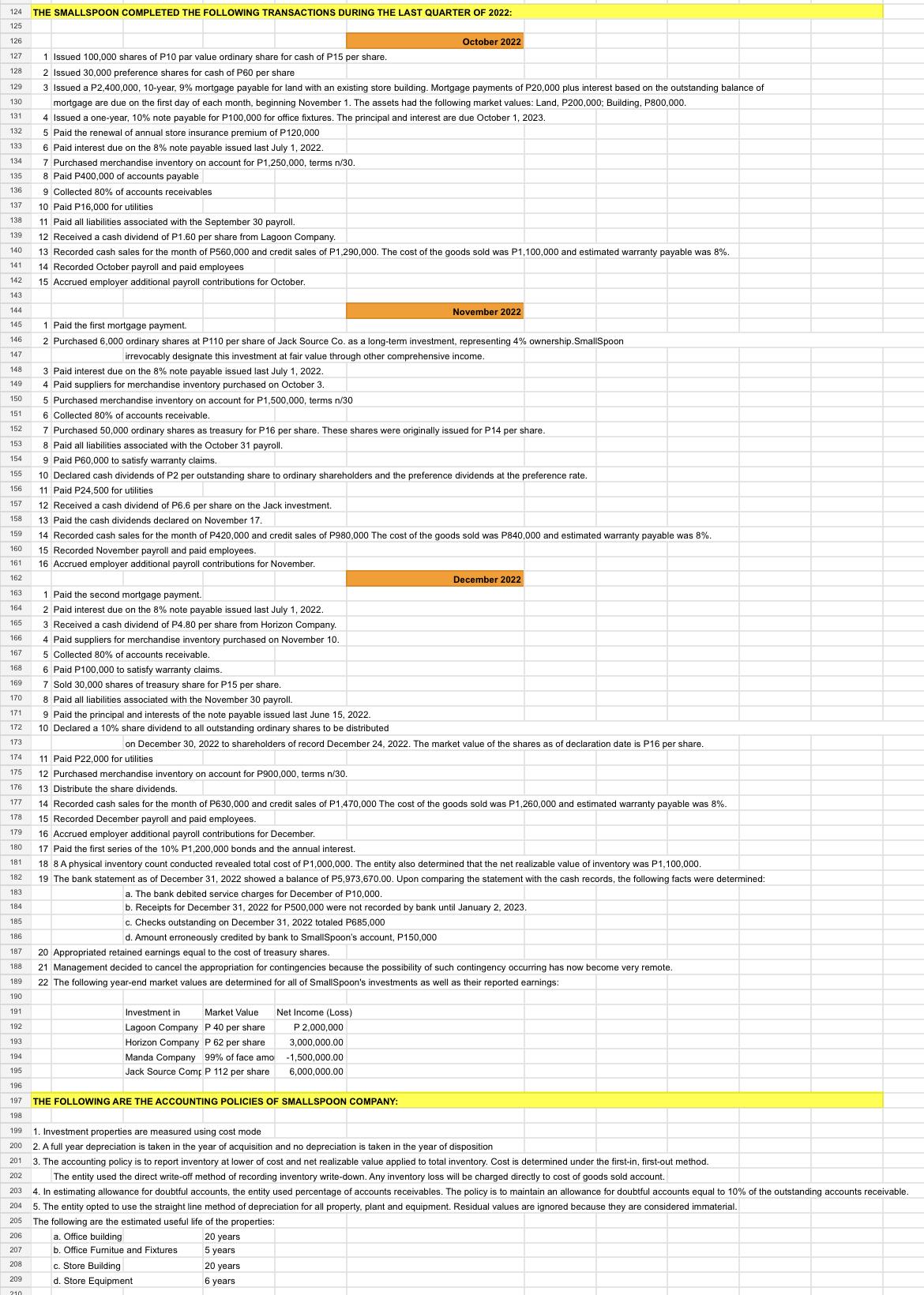

124 THE SMALLSPOON COMPLETED THE FOLLOWING TRANSACTIONS DURING THE LAST QUARTER OF 2022: 125 126 127 128 129 130 131 132 133 134 135 136 137 138 139 140 141 142 143 144 145 146 147 148 149 150 151 152 153 154 155 156 157 158 159 160 161 162 163 164 165 166 167 168 169 170 171 172 173 174 175 176 177 178 179 180 181 182 183 184 185 186 187 188 189 190 191 192 193 194 195 208 209 1 Issued 100,000 shares of P10 par value ordinary share for cash of P15 per share. 2 Issued 30,000 preference shares for cash of P60 per share 3 Issued a P2,400,000, 10-year, 9% mortgage payable for land with an existing store building. Mortgage payments of P20,000 plus interest based on the outstanding balance of mortgage are due on the first day of each month, beginning November 1. The assets had the following market values: Land, P200,000; Building, P800,000. 4 Issued a one-year, 10% note payable for P100,000 for office fixtures. The principal and interest are due October 1, 2023. 5 Paid the renewal of annual store insurance premium of P120,000 6 Paid interest due on the 8% note payable issued last July 1, 2022. 7 Purchased merchandise inventory on account for P1,250,000, terms n/30. 8 Paid P400,000 of accounts payable 9 Collected 80% of accounts receivables. 10 Paid P16,000 for utilities 11 Paid all liabilities associated with the September 30 payroll. 12 Received a cash dividend of P1.60 per share from Lagoon Company. 13 Recorded cash sales for the month of P560,000 and credit sales of P1,290,000. The cost of the goods sold was P1,100,000 and estimated warranty payable was 8%. 14 Recorded October payroll and paid employees 15 Accrued employer additional payroll contributions for October. 3 Paid interest due on the 8% note payable issued last July 1, 2022. 4 Paid suppliers for merchandise inventory purchased on October 3. 1 Paid the first mortgage payment. 2 Purchased 6,000 ordinary shares at P110 per share of Jack Source Co. as a long-term investment, representing 4% ownership.SmallSpoon irrevocably designate this investment at fair value through other comprehensive income. 5 Purchased merchandise inventory on account for P1,500,000, terms n/30 6 Collected 80% of accounts receivable. October 2022 12 Received a cash dividend of P6.6 per share on the Jack investment. 13 Paid the cash dividends declared on November 17. 7 Purchased 50,000 ordinary shares as treasury for P16 per share. These shares were originally issued for P14 per share. 8 Paid all liabilities associated with the October 31 payroll. 9 Paid P60,000 to satisfy warranty claims. 10 Declared cash dividends of P2 per outstanding share to ordinary shareholders and the preference dividends at the preference rate. 11 Paid P24,500 for utilities November 2022 14 Recorded cash sales for the month of P420,000 and credit sales of P980,000 The cost of the goods sold was P840,000 and estimated warranty payable was 8%. 15 Recorded November payroll and paid employees. 16 Accrued employer additional payroll contributions for November. 1 Paid the second mortgage payment. 2 Paid interest due on the 8% note payable issued last July 1, 2022. 3 Received a cash dividend of P4.80 per share from Horizon Company. 4 Paid suppliers for merchandise inventory purchased on November 10. 5 Collected 80% of accounts receivable. 6 Paid P100,000 to satisfy warranty claims. 7 Sold 30,000 shares f treasury share for P15 per share. 8 Paid all liabilities associated with the November 30 payroll. 9 Paid the principal and interests of the note payable issued last June 15, 2022. 10 Declared a 10% share dividend to all outstanding ordinary shares to be distributed on December 30, 2022 to shareholders of record December 24, 2022. The market value of the shares as of declaration date is P16 per share. 11 Paid P22,000 for utilities 12 Purchased merchandise inventory on account for P900,000, terms n/30. 13 Distribute the share dividends. 14 Recorded cash sales for the month of P630,000 and credit sales of P1,470,000 The cost of the goods sold was P1,260,000 and estimated warranty payable was 8%. 15 Recorded December payroll and paid employees. 16 Accrued employer additional payroll contributions for December. 17 Paid the first series of the 10% P1,200,000 bonds and the annual interest. Investment in Market Value Lagoon Company P 40 per share Horizon Company P 62 per share Manda Company 99% of face amo Jack Source Comp P 112 per share December 2022 18 8 A physical inventory count conducted revealed total cost of P1,000,000. The entity also determined that the net realizable value of inventory was P1,100,000. 19 The bank statement as of December 31, 2022 showed a balance of P5,973,670.00. Upon comparing the statement with the cash records, the following facts were determined: a. The bank debited service charges for December of P10,000. b. Receipts for December 31, 2022 for P500,000 were not recorded by bank until January 2, 2023. c. Checks outstanding on December 31, 2022 totaled P685,000 d. Amount erroneously credited by bank to SmallSpoon's account, P150,000 Net Income (Loss) P 2,000,000 3,000,000.00 -1,500,000.00 6,000,000.00 20 Appropriated retained earnings equal to the cost of treasury shares. 21 Management decided to cancel the appropriation for contingencies because the possibility of such contingency occurring has now become very remote. 22 The following year-end market values are determined for all of SmallSpoon's investments as well as their reported earnings: 196 197 198 199 1. Investment properties are measured using cost mode 200 2. A full year depreciation is taken in the year of acquisition and no depreciation is taken in the year of disposition 201 3. The accounting policy is to report inventory at lower of cost and net realizable value applied to total inventory. Cost is determined under the first-in, first-out method. The entity used the direct write-off method of recording inventory write-down. Any inventory loss will be charged directly to cost of goods sold account. 202 203 4. In estimating allowance for doubtful accounts, the entity used percentage of accounts receivables. The policy is to maintain an allowance for doubtful accounts equal to 10% of the outstanding accounts receivable. 204 5. The entity opted to use the straight line method of depreciation for all property, plant and equipment. Residual values are ignored because they are considered immaterial. 205 The following are the estimated useful life of the properties: 206 a. Office building 20 years 207 b. Office Furnitue and Fixtures 5 years c. Store Building 20 years d. Store Equipment 6 years THE FOLLOWING ARE THE ACCOUNTING POLICIES OF SMALLSPOON COMPANY:

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Journal entries for the transactions that occurred during the last quarter of 2022 Date Account Debi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started