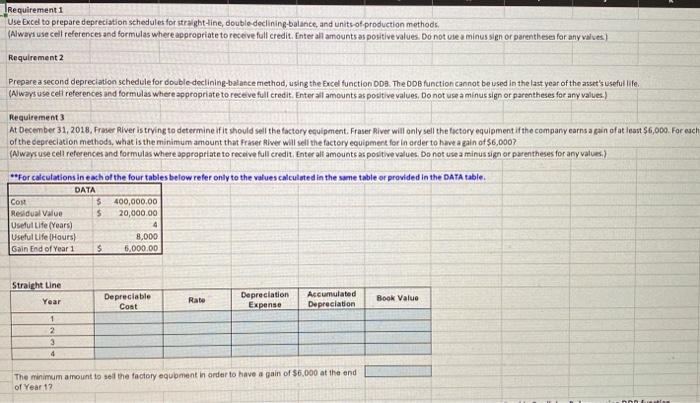

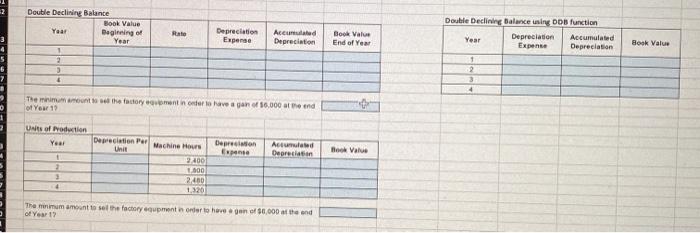

Requirement1 Use Excel to prepare depreciation schedules for straight-line, double declining-balance, and units of production methods. (Always use cell references and formulas where appropriate to receive full credit. Enter all amounts as positive values. Do not leaminus sien or parentheses for any valves Requirement 2 Prepare a second depreciation schedule for double declining-balance method, using the Excel function DD8. The DDB function cannot be used in the last year of the asset's useful life (Always use ceti references and formulas where appropriate to receive full credit. Enter all amounts as positive values. Do not use a minus sign or parentheses for any values.) Requirement 3 At December 31, 2018. Fraser River is trying to determine if it should sell the factory equipment. Fraser River will only sell the factory equipment if the company earns a pain of at least $6,000. For each of the depreciation methods, what is the minimum amount that Fraser River will sell the factory equipment for in order to have a gain of $6,000? (Always use cell references and formulas where appropriate to receive full credit Enter all amounts as positive values. Do not use a minus sign or parentheses for any values.) **For calculations in each of the four tables below refer only to the values calculated in the same table or provided in the DATA table. DATA Cont $ 400,000.00 Residual Value $ 20,000.00 Useful Life (Years) 4 Useful Life (Hours) 8,000 Gain End of Year 1 $ 5.000.00 Straight Line Year Depreciable Cost Rate Depreciation Expense Accumulated Depreciation Book Value 1 2 3 4 The minimum amount to sell the factory equipment in order to have a gain of $6.000 at the end of Year 1% no 2 Rate Double Declining Balance Book Value Year Degingo Year 1 2 3 & Depreciation Expense Accumulated Depreciation Book Value End of Year 3 4 5 6 Book Value Double Declining Balance using DDB function Year Depreciation Accumulated Expense Depreciation 1 2 3 4 The minimum to the factory woment inter to have a fan of 56.000 the end of You 19 Uits of Production Year Depreciation Per Unit Depresion Acumulated Depresin Value 2 Machine Hours 9400 1.000 2.400 1,320 4 The minimum amount to sell the factory oupant in order to have an of 50.000 at the end of Yeart