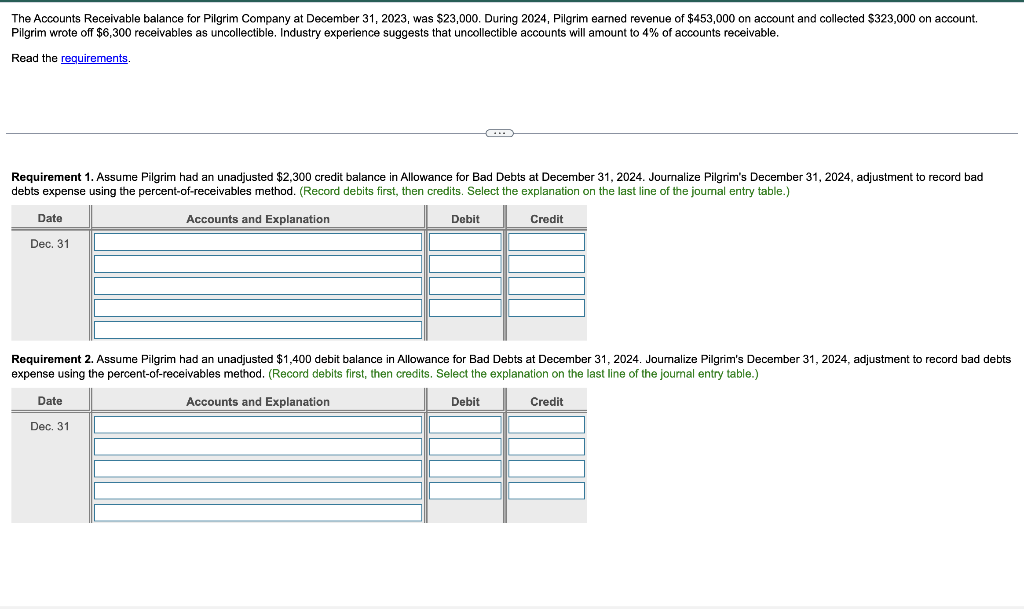

Requirements 1. Assume Pilgrim had an unadjusted $2,300 credit balance in Allowance for Bad Debts at December 31, 2024. Journalize Pilgrim's December 31, 2024, adjustment to record bad debts expense using the percent-of-receivables method. 2. Assume Pilgrim had an unadjusted $1,400 debit balance in Allowance for Bad Debts at December 31, 2024. Journalize Pilgrim's December 31, 2024, adjustment to record bad debts expense using the percent-of-receivables method. The Accounts Receivable balance for Pilgrim Company at December 31,2023 , was $23,000. During 2024, Pilgrim earned revenue of $453,000 on account and collected $323,000 on account. Pilgrim wrote off $6,300 receivables as uncollectible. Industry experience suggests that uncollectible accounts will amount to 4% of accounts receivable. Read the Requirement 1. Assume Pilgrim had an unadjusted $2,300 credit balance in Allowance for Bad Debts at December 31, 2024. Journalize Pilgrim's December 31, 2024, adjustment to record bad debts expense using the percent-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) Requirement 2. Assume Pilgrim had an unadjusted $1,400 debit balance in Allowance for Bad Debts at December 31, 2024. Joumalize Pilgrim's December 31, 2024, adjustment to record bad debts expense using the percent-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Requirements 1. Assume Pilgrim had an unadjusted $2,300 credit balance in Allowance for Bad Debts at December 31, 2024. Journalize Pilgrim's December 31, 2024, adjustment to record bad debts expense using the percent-of-receivables method. 2. Assume Pilgrim had an unadjusted $1,400 debit balance in Allowance for Bad Debts at December 31, 2024. Journalize Pilgrim's December 31, 2024, adjustment to record bad debts expense using the percent-of-receivables method. The Accounts Receivable balance for Pilgrim Company at December 31,2023 , was $23,000. During 2024, Pilgrim earned revenue of $453,000 on account and collected $323,000 on account. Pilgrim wrote off $6,300 receivables as uncollectible. Industry experience suggests that uncollectible accounts will amount to 4% of accounts receivable. Read the Requirement 1. Assume Pilgrim had an unadjusted $2,300 credit balance in Allowance for Bad Debts at December 31, 2024. Journalize Pilgrim's December 31, 2024, adjustment to record bad debts expense using the percent-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the joumal entry table.) Requirement 2. Assume Pilgrim had an unadjusted $1,400 debit balance in Allowance for Bad Debts at December 31, 2024. Joumalize Pilgrim's December 31, 2024, adjustment to record bad debts expense using the percent-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)