Answered step by step

Verified Expert Solution

Question

1 Approved Answer

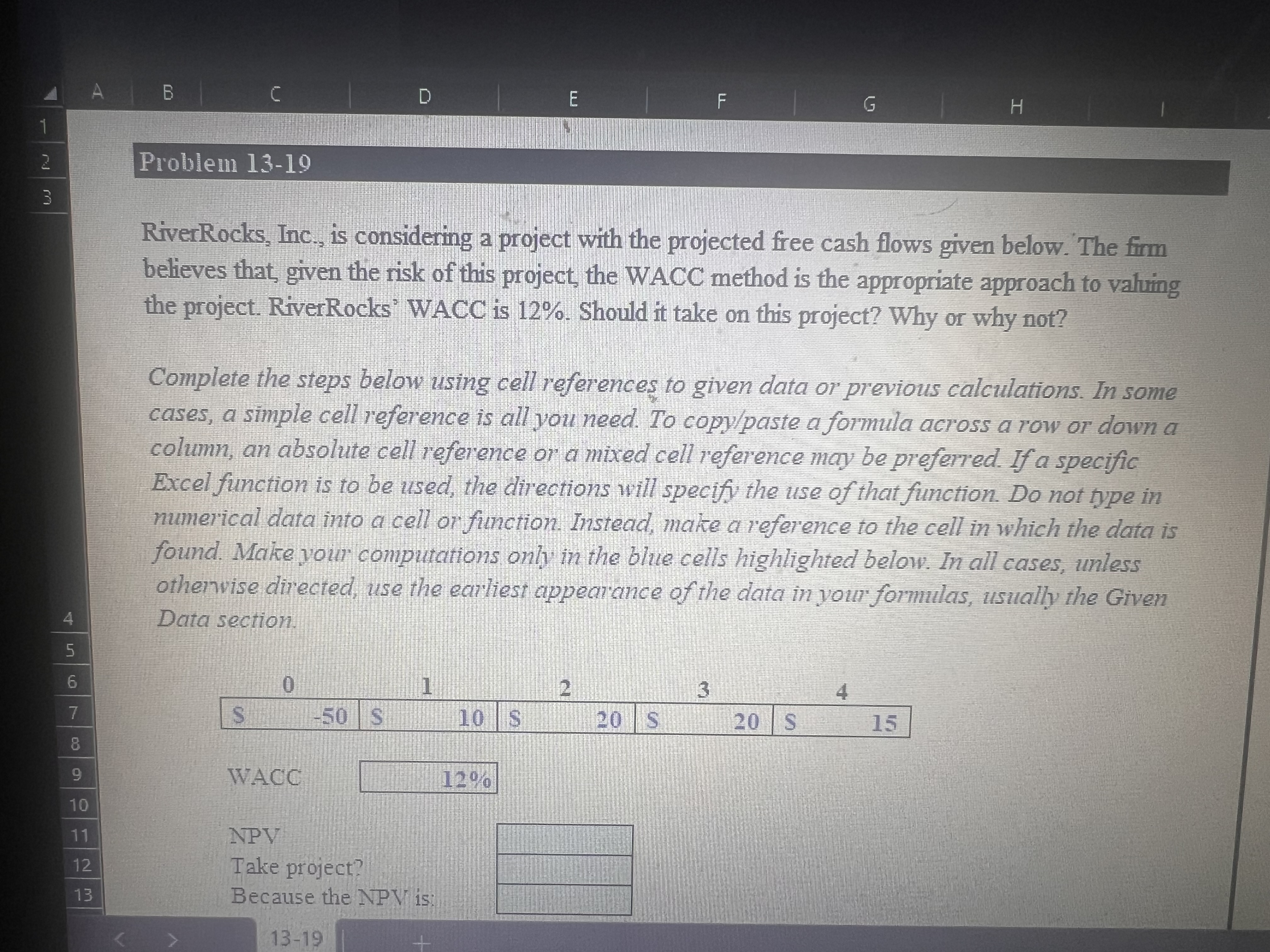

Requirements 1 In cell E 1 1 , by using the NPV function and cell references, calculate the net present value of the cash flows

Requirements

In cell E by using the NPV function and cell references, calculate the net present value of the cash flows pt

In cell E type either Yes or No depending on whether you would take on the project pt

In cell E type either Positive, Negative or Zero depending on the sign of the projects net present value ptProblem

RiverRocks, Inc., is considering a project with the projected free cash flows given below. The firm

behieves that, given the risk of this project, the WACC method is the appropriate approach to valuing

the project. RiverRocks' WACC is Should it take on this project? Why or why not?

Complete the steps below using cell references to given data or previous calculations. In some

cases, a simple cell reference is all you need. To copypaste a formula across a row or down a

column, an absolute cell reference or a mixed cell reference may be preferred. If a specific

Excel function is to be used, the directions will specify the use of that function. Do not type in

numerical data into a cell or function. Instead, make a reference to the cell in which the data is

found. Make your computations only in the blue cells highlighted below. In all cases, unless

othervise directed, use the earliest appearance of the data in your formulas, usually the Given

Data section.

WACC

NPV

Take project?

Because the NPY is:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started