Requirements: 1. Journalize and post normal monthly transactions to general ledger accounts in T-accounts. 2. Prepare a trial balance as at December 31, 2023. 3.

Requirements:

Requirements: - 1. Journalize and post normal monthly transactions to general ledger accounts in T-accounts.

- 2. Prepare a trial balance as at December 31, 2023.

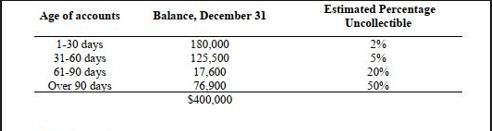

- 3. Journalize and post adjusting entries in the same T accounts as requirement #1 above.

- 4. Prepare an adjusted trial balance as at December 2023.

- 5. Generate income statement, statement of owner's equity, and classified balance sheet for the year ended December 31, 2023. (Note: November 30, 2023 Trial Balance represents the accumulated revenue and expenses of the first 11 months in 2023. Tax rate: 0% - There is no tax expense).

- 6. Journalize and post-closing entries in the same T accounts in requirement #1 above.

- 7. Prepare a post-closing trial balance as at December 2023.

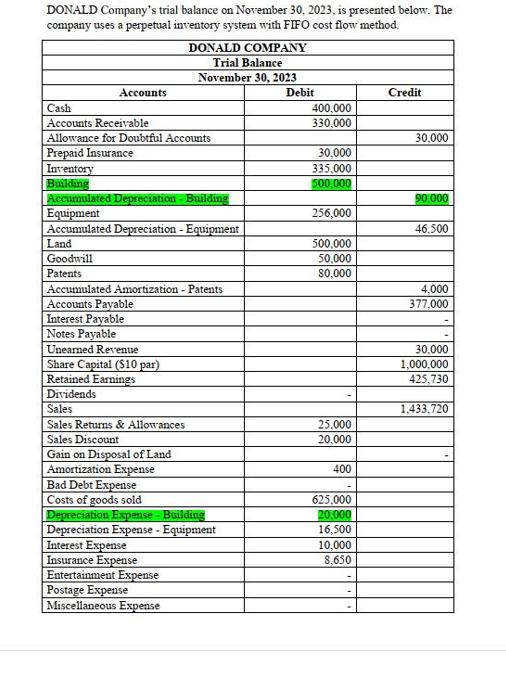

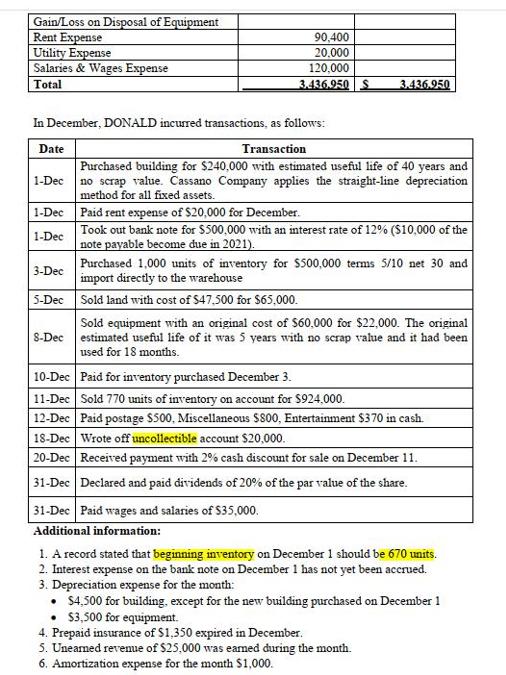

DONALD Company's trial balance on November 30, 2023, is presented below. The company uses a perpetual inventory system with FIFO cost flow method. Inventory Building Accounts Cash Accounts Receivable Allowance for Doubtful Accounts Prepaid Insurance Land Goodwill Patents Accumulated Depreciation - Building Equipment Accumulated Depreciation - Equipment DONALD COMPANY Trial Balance November 30, 2023 Accumulated Amortization - Patents Accounts Payable Interest Payable Notes Payable Unearned Revenue Share Capital ($10 par) Retained Earnings Dividends Sales Sales Returns & Allowances Sales Discount Gain on Disposal of Land Amortization Expense Bad Debt Expense Costs of goods sold Depreciation Expense - Building Depreciation Expense - Equipment Interest Expense Insurance Expense Entertainment Expense Postage Expense Miscellaneous Expense Debit 400,000 330,000 30,000 335,000 500,000 256,000 500,000 50,000 80,000 25,000 20,000 400 625,000 20,000 16,500 10,000 8,650 Credit 30,000 90,000 46,500 4,000 377,000 30,000 1,000,000 425,730 1,433,720

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Introduction A perpetual inventory system updates the inventory data continuously to reflect the most recent stock levels This technique for track inventory in realtime This system keeps track of inve...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started