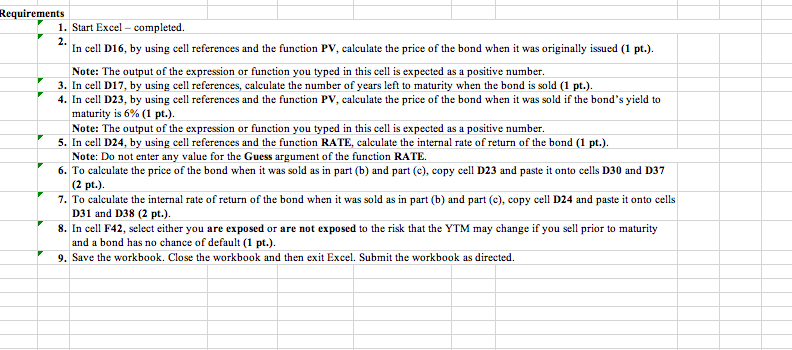

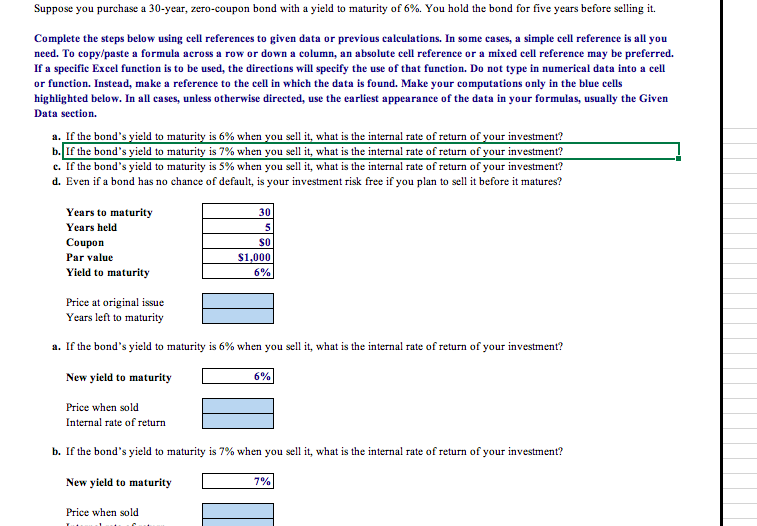

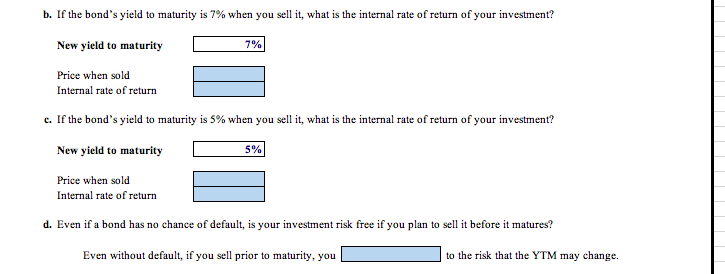

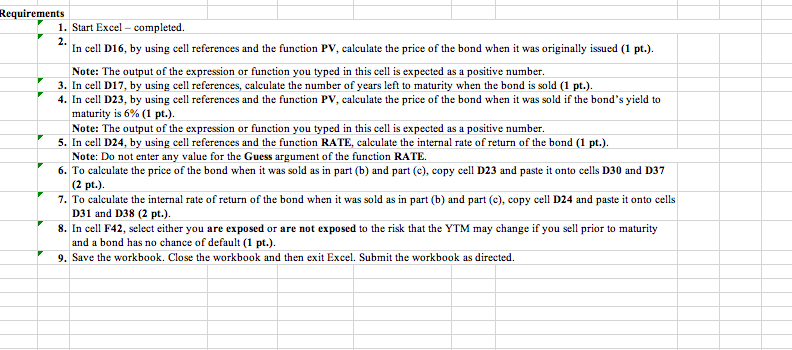

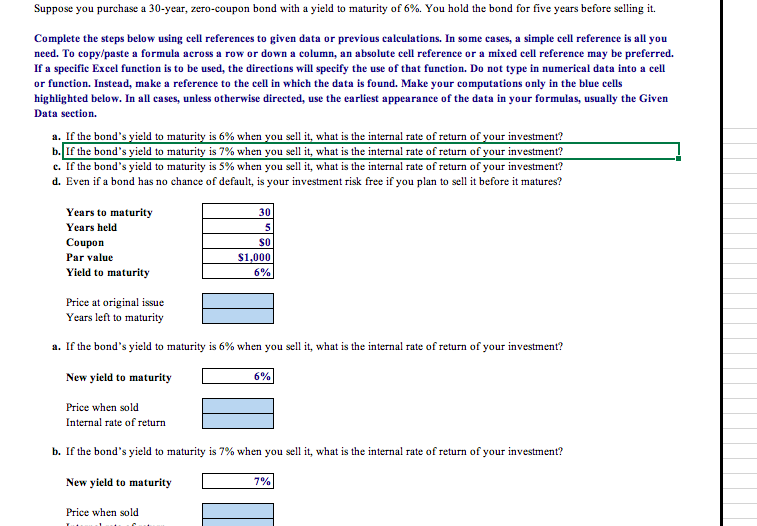

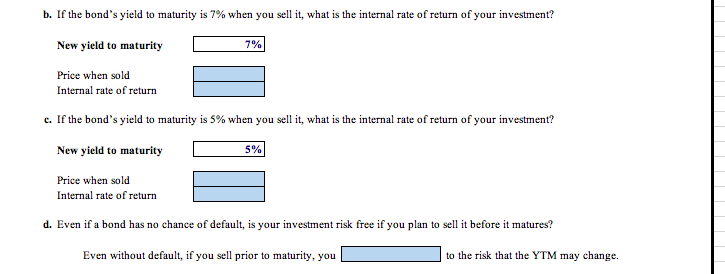

Requirements 1. Start Excel - completed. 2. In cell D16, by using cell references and the function PV, calculate the price of the bond when it was originally issued (1 pt.). Note: The output of the expression or function you typed in this cell is expected as a positive number. 3. In cell D17, by using cell references, calculate the number of years left to maturity when the bond is sold (1 pt.). 4. In cell D23, by using cell references and the function PV, calculate the price of the bond when it was sold if the bond's yield to maturity is 6% (1 pt.). Note: The output of the expression or function you typed in this cell is expected as a positive number. 5. In cell D24, by using cell references and the function RATE, calculate the internal rate of return of the bond (1 pt.). Note: Do not enter any value for the Guess argument of the function RATE. 6. To calculate the price of the bond when it was sold as in part (b) and part (C), copy cell D23 and paste it onto cells D30 and 137 (2 pt.). 7. To calculate the internal rate of return of the bond when it was sold as in part (b) and part (e), copy cell D24 and paste it onto cells D31 and D38 (2 pt.). 8. In cell F42, select either you are exposed or are not exposed to the risk that the YTM may change if you sell prior to maturity and a bond has no chance of default (1 pt.). 9. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed. Suppose you purchase a 30-year, zero-coupon bond with a yield to maturity of 6%. You hold the bond for five years before selling it. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. a. If the bond's yield to maturity is 6% when you sell it, what is the internal rate of return of your investment? b. If the bond's yield to maturity is 7% when you sell it, what is the internal rate of return of your investment? c. If the bond's yield to maturity is 5% when you sell it, what is the internal rate of return of your investment? d. Even if a bond has no chance of default, is your investment risk free if you plan to sell it before it matures? Years to maturity Years held Coupon Par value Yield to maturity 30 5 SO $1,000 6% Price at original issue Years left to maturity a. If the bond's yield to maturity is 6% when you sell it, what is the internal rate of return of your investment? New yield to maturity 6% Price when sold Internal rate of return b. If the bond's yield to maturity is 7% when you sell it, what is the internal rate of return of your investment? New yield to maturity 7% Price when sold b. If the bond's yield to maturity is 7% when you sell it, what is the internal rate of return of your investment? New yield to maturity 7% Price when sold Internal rate of return c. If the bond's yield to maturity is 5% when you sell it, what is the internal rate of return of your investment? New yield to maturity 5% Price when sold Internal rate of return d. Even if a bond has no chance of default, is your investment risk free if you plan to sell it before it matures? Even without default, if you sell prior to maturity, you to the risk that the YTM may change