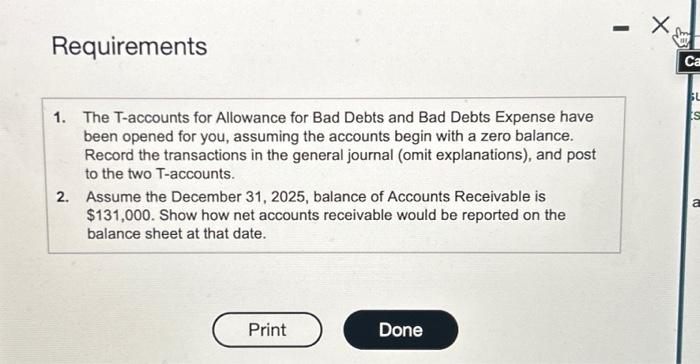

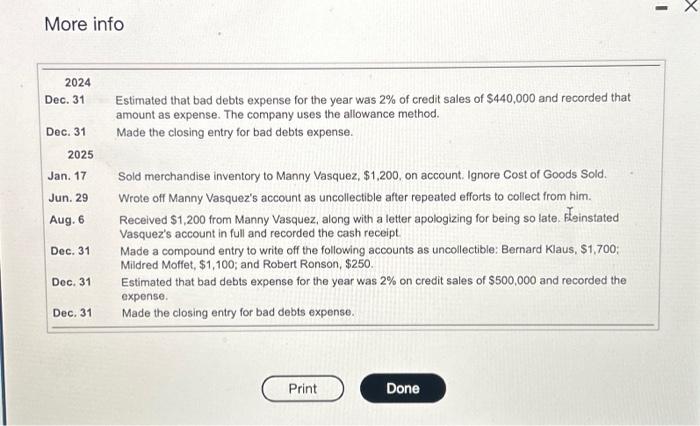

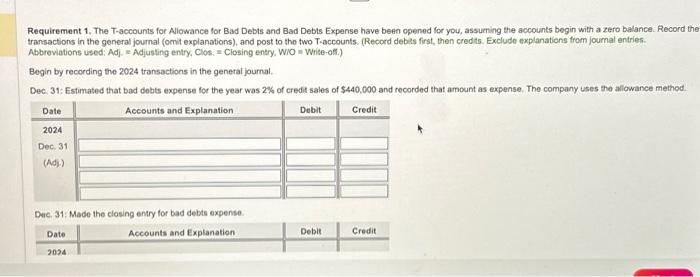

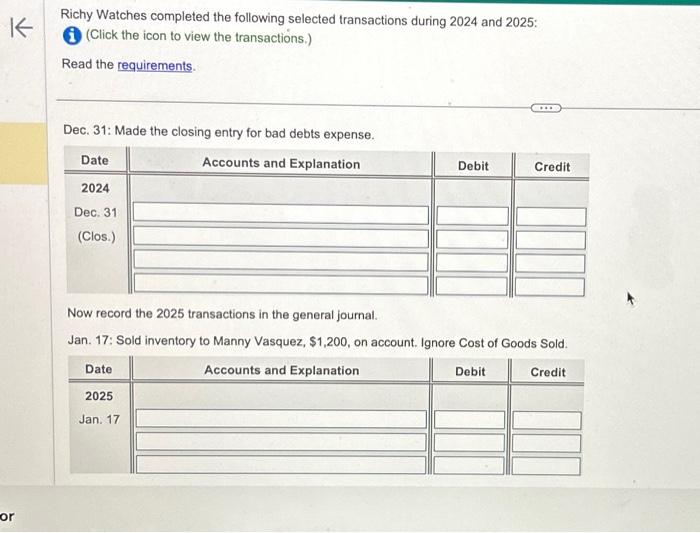

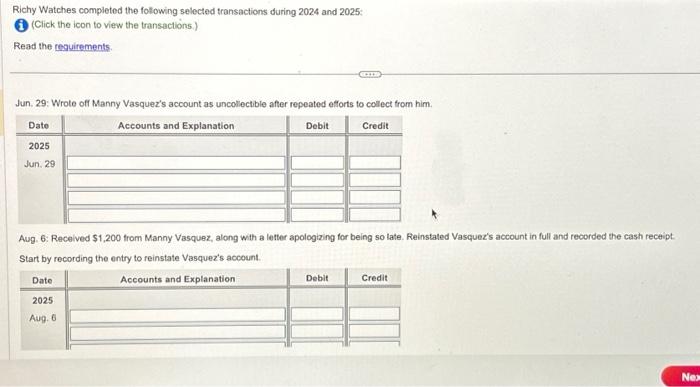

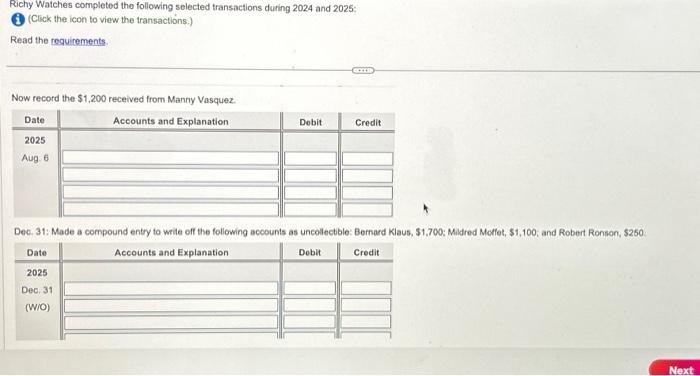

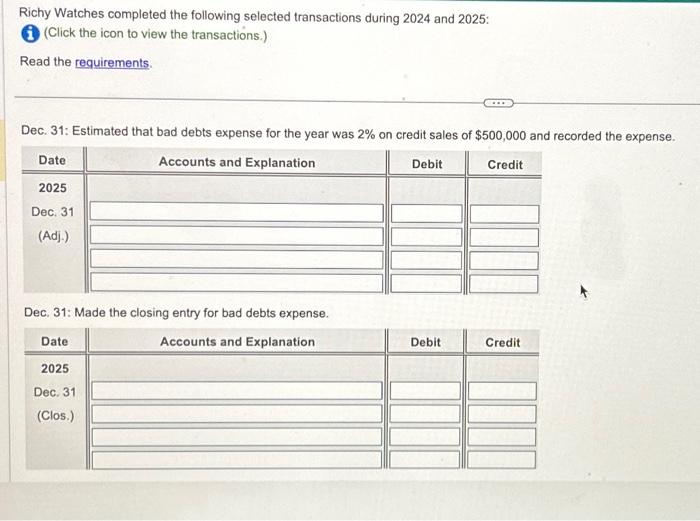

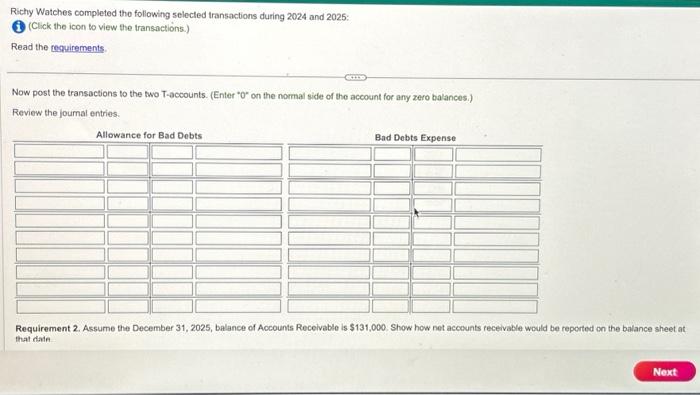

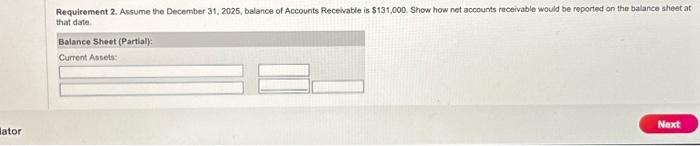

Requirements 1. The T-accounts for Allowance for Bad Debts and Bad Debts Expense have been opened for you, assuming the accounts begin with a zero balance. Record the transactions in the general journal (omit explanations), and post to the two T-accounts. 2. Assume the December 31,2025 , balance of Accounts Receivable is $131,000. Show how net accounts receivable would be reported on the balance sheet at that date. Requirement 1, The T-accounts for Allowance for Bad Debts and Bad Debts Expense have been opened for you, assurning the accounts begin with a zero balance. Record the transactions in the general journal (ornit explanations), and post to the two T-accounts. (Record debis first, then credits. Exclude explanations from journal entries. Abbreviations used: Adj. = Adjusting entry, Clos, = Closing entry, WiO = Write-off.) Begin by recording the 2024 transactions in the general journal. Dec. 31: Estimated that bad dobts expense for the year was 2% of credit sales of $440,000 and recorded that amount as expense. The company uses the allowance method. Denc. 31: Made the closing entry for bad debts expense. Richy Watches completed the following selected transactions during 2024 and 2025 : (1) (Click the icon to view the transactions.) Read the requirements. Dec. 31: Made the closing entry for bad debts expense. Now record the 2025 transactions in the general journal. Jan. 17: Sold inventory to Manny Vasquez, $1,200, on account. Ignore Cost of Goods Sold. Richy Watches completed the following selected transactions during 2024 and 2025: (1) (Click the icon to view the transactions.) Read the requirements. Now record the $1,200 received from Manny Vasquez. Richy Watches completed the following selected transactions during 2024 and 2025: (Click the icon to view the transactions.) Read the requirements. Dec. 31: Estimated that bad debts expense for the year was 2% on credit sales of $500,000 and recorded the expense. Dec. 31: Made the closing entry for bad debts expense. Richy Watches completed the following selected transactions during 2024 and 2025 : (Click the icon to vlew the transactions.) Read the teguirements: Now post the transactions to the two T-accounts. (Enter " 0 on the normal side of the account for any zero balances.) Review the joumal entries. Requirement 2. Assume the December 31, 2025, balance of Accounts Receivable is $131,000. Show how net accounts receivable would be reported on the balance sheet at that dath lator