Answered step by step

Verified Expert Solution

Question

1 Approved Answer

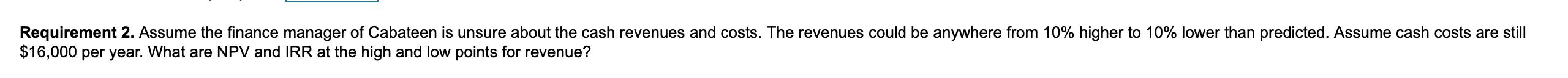

Requirements 1,2 please. Cabateen Natural Snacks is contemplating an expansion. The finance manager is looking at buying a second machine that would cost $80,000 and

Requirements 1,2 please.

Cabateen Natural Snacks is contemplating an expansion. The finance manager is looking at buying a second machine that would cost $80,000 and last for 10 years, with no disposal value at the end of that time. Cabateen expects the increase in cash revenues from the expansion at $28,500 per year, with additional annual cash costs of $16,000. Cabateen's cost of capital is 8%, and the company pays no taxes because of its location in a special economic zone.

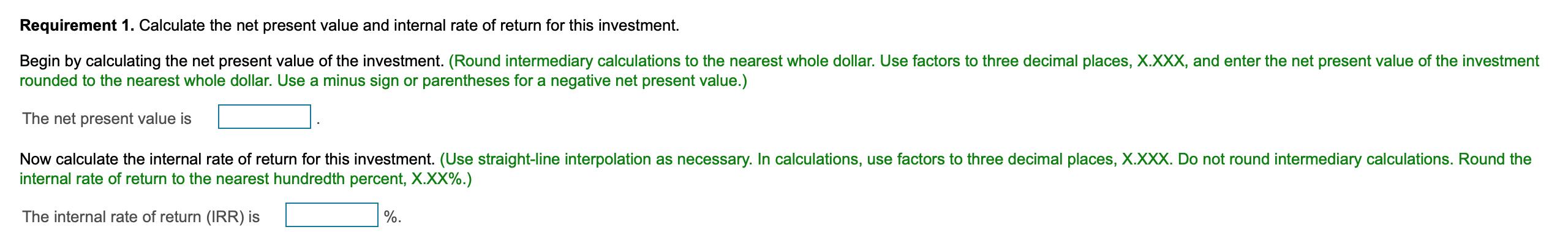

Requirement 1. Calculate the net present value and internal rate of return for this investment. Begin by calculating the net present value of the investment. (Round intermediary calculations to the nearest whole dollar. Use factors to three decimal places, X.XXX, and enter the net present value of the investment rounded to the nearest whole dollar. Use a minus sign or parentheses for a negative net present value.) The net present value is Now calculate the internal rate of return for this investment. (Use straight-line interpolation as necessary. In calculations, use factors to three decimal places, X.XXX. Do not round intermediary calculations. Round the internal rate of return to the nearest hundredth percent, X.XX%.) The internal rate of return (IRR) is %.

Step by Step Solution

★★★★★

3.43 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started