Answered step by step

Verified Expert Solution

Question

1 Approved Answer

requirements 1-3 needed. thanks! A New York City dally newspaper called Manhattan Today sells annual subscriptions for a fee of $324. To attract more subscribers,

requirements 1-3 needed. thanks!

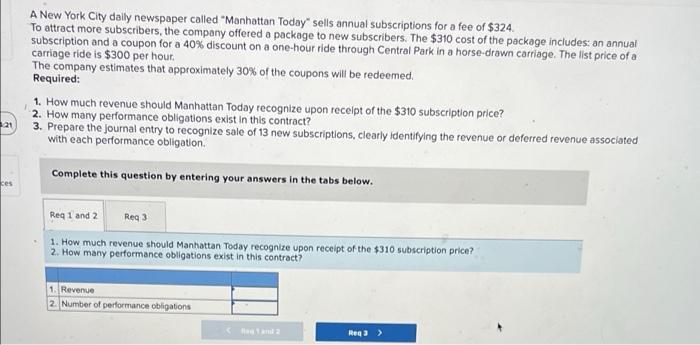

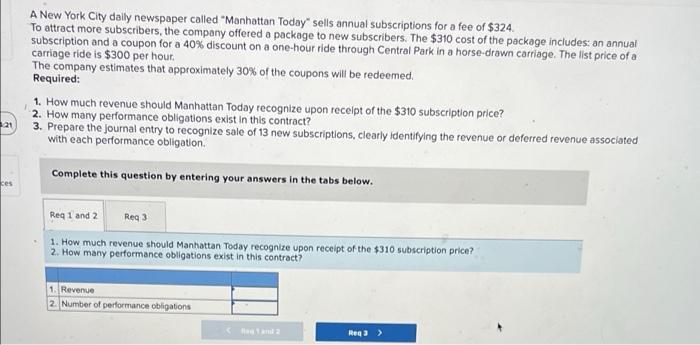

A New York City dally newspaper called "Manhattan Today" sells annual subscriptions for a fee of $324. To attract more subscribers, the company offered a package to new subscribers. The $310 cost of the package includes: an annual subscription and a coupon for a 40% discount on a one-hour ride through Central Park in a horse-drawn carriage. The list price of a carriage ride is $300 per hour. The company estimates that approximately 30% of the coupons will be redeemed. Required: 1. How much revenue should Manhattan Today recognize upon receipt of the $310 subscription price? 2. How many performance obligations exist in this contract? 3. Prepare the journal entry to recognize sale of 13 new subscriptions, clearly identifying the revenue or deferred revenue associated with each performance obligation 21 Complete this question by entering your answers in the tabs below. ces Req 1 and 2 Reg 3 1. How much revenue should Manhattan Today recognize upon receipt of the $310 subscription price? 2. How many performance obligations exist in this contract? 1. Revenue 2. Number of performance obligations Reg 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started