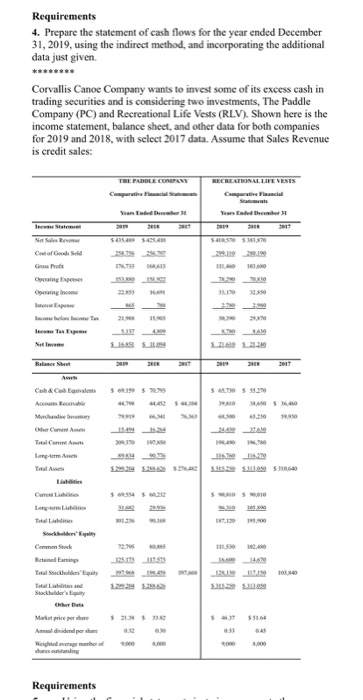

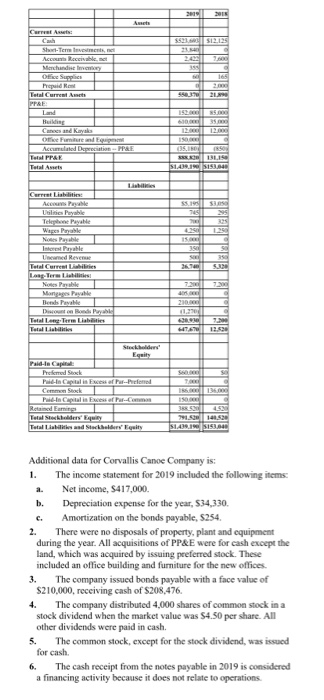

Requirements 4. Prepare the statement of cash flows for the year ended December 31, 2019, using the indirect method, and incorporating the additional data just given Corvallis Canoe Company wants to invest some of its excess cash in trading securities and is considering two investments, The Paddle Company (PC) and Recreational Life Vests (RLV). Shown here is the income statement, balance sheet, and other data for both companies for 2019 and 2018, with select 2017 data. Assume that Sales Revenue is credit sales: THE PADDLE COMPANY RECREATIONAL LIFE VESTS Yanded December IS 2017 SORTS Colof Gadi. 15131 Operating S2162 3.11.2 Balance Sheet Cash & Co Equivalents 5 65.930 559.270 6.10 Ohe Current Laeplerm Auch Totale S320 330 3310 Cure 32, ISO 2,400 Common Sauk Retained Earnings 128.139 117.89 Total Liabilities and Market price per here 21.30 Annual dividend perhe 050 45 000 anestanding Requirements 2016 $12.135 Carret A C Short-Terme, Acco Merchandise Of Sales Prepaid Total Current PAF 38 w 200 2.0 152. 85.000 Building C and Kayaks Office Furniture and Equipment Accumulated Derection - PPE TPPAE TA STI SINIS 51439.115.00 S. Curt List Ace Uits Payable Tele Payable Wasse Nos Payable Info Uneared Revenue Total Current Lilities 225 1150 1. 350 38 S. 36.00 Nos Payable 23 Bends Pavalle Discount on Bonds Payable Tual LaTerm Liabilities 1. . HITA Stockholders Equity Paid in Capital S To Puid-In Capital in Excess of Par--Preferred Comm Stock Paldin Capital in Excess of P--Comma Retainedoming Total Studiery quity Total Liabilities and Stockholders Equity 791.58141.520 SINIS c. Additional data for Corvallis Canoe Company is: 1. The income statement for 2019 included the following items: a. Net income, S417,000 b. Depreciation expense for the year, 534,330. Amortization on the bonds payable, $254. 2. There were no disposals of property, plant and equipment during the year. All acquisitions of PP&E were for cash except the land, which was acquired by issuing preferred stock. These included an office building and furniture for the new offices. The company issued bonds payable with a face value of S210,000, receiving cash of S208,476. The company distributed 4,000 shares of common stock in a stock dividend when the market value was $4.50 per share. All other dividends were paid in cash. 5. The common stock, except for the stock dividend, was issued for cash 6. The cash receipt from the notes payable in 2019 is considered a financing activity because it does not relate to operations. Requirements 4. Prepare the statement of cash flows for the year ended December 31, 2019, using the indirect method, and incorporating the additional data just given Corvallis Canoe Company wants to invest some of its excess cash in trading securities and is considering two investments, The Paddle Company (PC) and Recreational Life Vests (RLV). Shown here is the income statement, balance sheet, and other data for both companies for 2019 and 2018, with select 2017 data. Assume that Sales Revenue is credit sales: THE PADDLE COMPANY RECREATIONAL LIFE VESTS Yanded December IS 2017 SORTS Colof Gadi. 15131 Operating S2162 3.11.2 Balance Sheet Cash & Co Equivalents 5 65.930 559.270 6.10 Ohe Current Laeplerm Auch Totale S320 330 3310 Cure 32, ISO 2,400 Common Sauk Retained Earnings 128.139 117.89 Total Liabilities and Market price per here 21.30 Annual dividend perhe 050 45 000 anestanding Requirements 2016 $12.135 Carret A C Short-Terme, Acco Merchandise Of Sales Prepaid Total Current PAF 38 w 200 2.0 152. 85.000 Building C and Kayaks Office Furniture and Equipment Accumulated Derection - PPE TPPAE TA STI SINIS 51439.115.00 S. Curt List Ace Uits Payable Tele Payable Wasse Nos Payable Info Uneared Revenue Total Current Lilities 225 1150 1. 350 38 S. 36.00 Nos Payable 23 Bends Pavalle Discount on Bonds Payable Tual LaTerm Liabilities 1. . HITA Stockholders Equity Paid in Capital S To Puid-In Capital in Excess of Par--Preferred Comm Stock Paldin Capital in Excess of P--Comma Retainedoming Total Studiery quity Total Liabilities and Stockholders Equity 791.58141.520 SINIS c. Additional data for Corvallis Canoe Company is: 1. The income statement for 2019 included the following items: a. Net income, S417,000 b. Depreciation expense for the year, 534,330. Amortization on the bonds payable, $254. 2. There were no disposals of property, plant and equipment during the year. All acquisitions of PP&E were for cash except the land, which was acquired by issuing preferred stock. These included an office building and furniture for the new offices. The company issued bonds payable with a face value of S210,000, receiving cash of S208,476. The company distributed 4,000 shares of common stock in a stock dividend when the market value was $4.50 per share. All other dividends were paid in cash. 5. The common stock, except for the stock dividend, was issued for cash 6. The cash receipt from the notes payable in 2019 is considered a financing activity because it does not relate to operations