Answered step by step

Verified Expert Solution

Question

1 Approved Answer

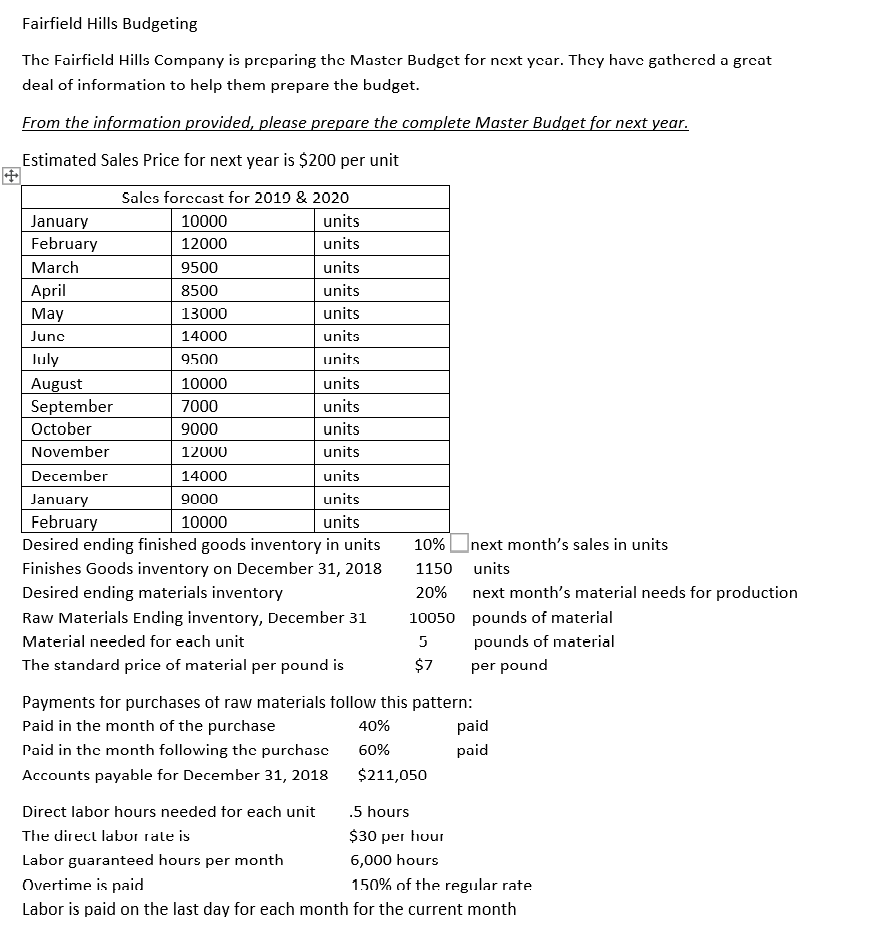

Requirements: A. From the information provided, please prepare the complete master budget for next year Fairfield Hills Budgeting The Fairfield Hills Company is preparing the

Requirements:

A. From the information provided, please prepare the complete master budget for next year

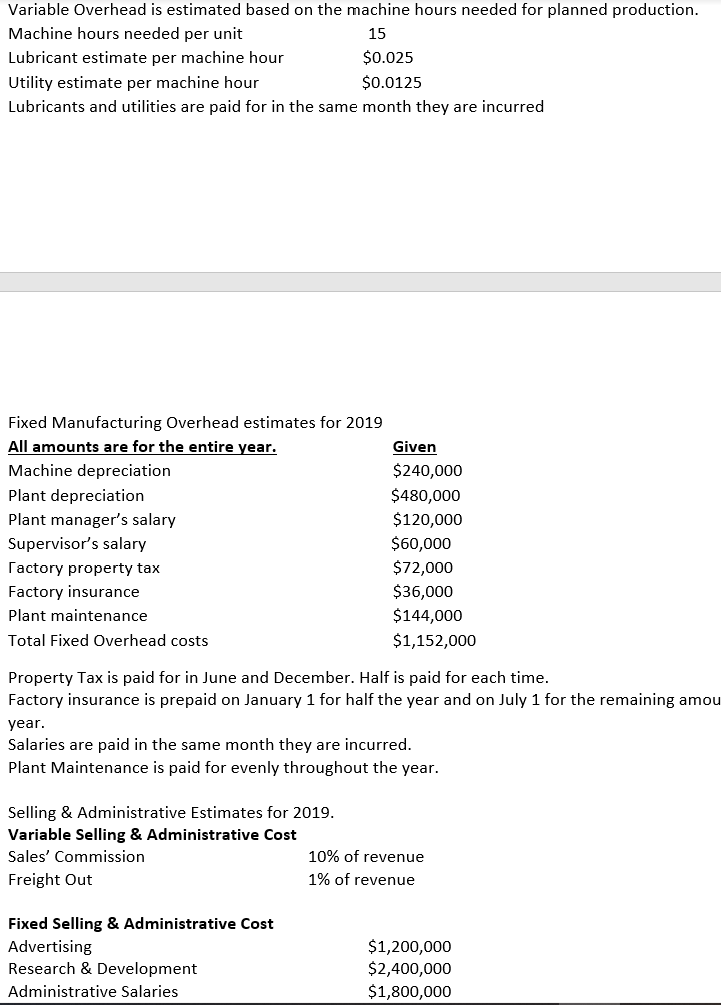

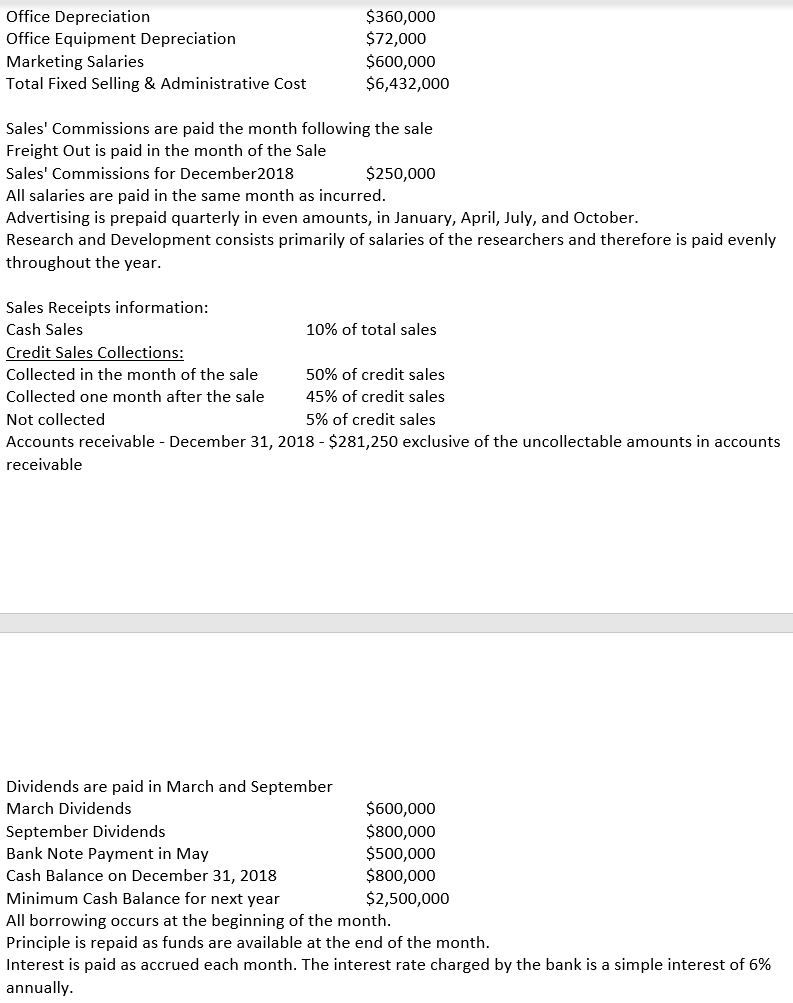

Fairfield Hills Budgeting The Fairfield Hills Company is preparing the Master Budget for next ycar. They have gathered a great deal of information to help them prepare the budget. From the information provided, please prepare the complete Master Budget for next year. Estimated Sales Price for next year is $200 per unit Salcs forccast for 2019 & 2020 January 10000 units February 12000 units March 9500 units April 8500 units May 13000 units Junc 14000 units July 9500 units August 10000 units September 7000 units October 9000 units November 12000 units December 14000 units January 9000 units February 10000 units Desired ending finished goods inventory in units 10% next month's sales in units Finishes Goods inventory on December 31, 2018 1150 units Desired ending materials inventory 20% next month's material needs for production Raw Materials Ending inventory, December 31 10050 pounds of material Material needed for each unit 5 pounds of material The standard price of material per pound is per pound Payments for purchases of raw materials follow this pattern: Paid in the month of the purchase 40% Paid in the month following the purchase 60% paid Accounts payable for December 31, 2018 $211,050 $7 paid Direct labor hours needed for each unit .5 hours The direct labor rale is $30 per hour Labor guaranteed hours per month 6,000 hours Overtime is paid 150% of the regular rate Labor is paid on the last day for each month for the current month Variable Overhead is estimated based on the machine hours needed for planned production. Machine hours needed per unit 15 Lubricant estimate per machine hour $0.025 Utility estimate per machine hour $0.0125 Lubricants and utilities are paid for in the same month they are incurred Fixed Manufacturing Overhead estimates for 2019 All amounts are for the entire year. Given Machine depreciation $240,000 Plant depreciation $480,000 Plant manager's salary $120,000 Supervisor's salary $60,000 Factory property tax $72,000 Factory insurance $36,000 Plant maintenance $144,000 Total Fixed Overhead costs $1,152,000 Property Tax is paid for in June and December. Half is paid for each time. Factory insurance is prepaid on January 1 for half the year and on July 1 for the remaining amou year. Salaries are paid in the same month they are incurred. Plant Maintenance is paid for evenly throughout the year. Selling & Administrative Estimates for 2019. Variable Selling & Administrative Cost Sales' Commission 10% of revenue Freight Out 1% of revenue Fixed Selling & Administrative Cost Advertising Research & Development Administrative Salaries $1,200,000 $2,400,000 $1,800,000 Office Depreciation Office Equipment Depreciation Marketing Salaries Total Fixed Selling & Administrative Cost $360,000 $72,000 $600,000 $6,432,000 Sales' Commissions are paid the month following the sale Freight Out is paid in the month of the Sale Sales' Commissions for December 2018 $250,000 All salaries are paid in the same month as incurred. Advertising is prepaid quarterly in even amounts, in January, April, July, and October. Research and Development consists primarily of salaries of the researchers and therefore is paid evenly throughout the year. Sales Receipts information: Cash Sales 10% of total sales Credit Sales Collections: Collected in the month of the sale 50% of credit sales Collected one month after the sale 45% of credit sales Not collected 5% of credit sales Accounts receivable - December 31, 2018 - $281,250 exclusive of the uncollectable amounts in accounts receivable Dividends are paid in March and September March Dividends $600,000 September Dividends $800,000 Bank Note Payment in May $500,000 Cash Balance on December 31, 2018 $800,000 Minimum Cash Balance for next year $2,500,000 All borrowing occurs at the beginning of the month. Principle is repaid as funds are available at the end of the month. Interest is paid as accrued each month. The interest rate charged by the bank is a simple interest of 6% annually. Fairfield Hills Budgeting The Fairfield Hills Company is preparing the Master Budget for next ycar. They have gathered a great deal of information to help them prepare the budget. From the information provided, please prepare the complete Master Budget for next year. Estimated Sales Price for next year is $200 per unit Salcs forccast for 2019 & 2020 January 10000 units February 12000 units March 9500 units April 8500 units May 13000 units Junc 14000 units July 9500 units August 10000 units September 7000 units October 9000 units November 12000 units December 14000 units January 9000 units February 10000 units Desired ending finished goods inventory in units 10% next month's sales in units Finishes Goods inventory on December 31, 2018 1150 units Desired ending materials inventory 20% next month's material needs for production Raw Materials Ending inventory, December 31 10050 pounds of material Material needed for each unit 5 pounds of material The standard price of material per pound is per pound Payments for purchases of raw materials follow this pattern: Paid in the month of the purchase 40% Paid in the month following the purchase 60% paid Accounts payable for December 31, 2018 $211,050 $7 paid Direct labor hours needed for each unit .5 hours The direct labor rale is $30 per hour Labor guaranteed hours per month 6,000 hours Overtime is paid 150% of the regular rate Labor is paid on the last day for each month for the current month Variable Overhead is estimated based on the machine hours needed for planned production. Machine hours needed per unit 15 Lubricant estimate per machine hour $0.025 Utility estimate per machine hour $0.0125 Lubricants and utilities are paid for in the same month they are incurred Fixed Manufacturing Overhead estimates for 2019 All amounts are for the entire year. Given Machine depreciation $240,000 Plant depreciation $480,000 Plant manager's salary $120,000 Supervisor's salary $60,000 Factory property tax $72,000 Factory insurance $36,000 Plant maintenance $144,000 Total Fixed Overhead costs $1,152,000 Property Tax is paid for in June and December. Half is paid for each time. Factory insurance is prepaid on January 1 for half the year and on July 1 for the remaining amou year. Salaries are paid in the same month they are incurred. Plant Maintenance is paid for evenly throughout the year. Selling & Administrative Estimates for 2019. Variable Selling & Administrative Cost Sales' Commission 10% of revenue Freight Out 1% of revenue Fixed Selling & Administrative Cost Advertising Research & Development Administrative Salaries $1,200,000 $2,400,000 $1,800,000 Office Depreciation Office Equipment Depreciation Marketing Salaries Total Fixed Selling & Administrative Cost $360,000 $72,000 $600,000 $6,432,000 Sales' Commissions are paid the month following the sale Freight Out is paid in the month of the Sale Sales' Commissions for December 2018 $250,000 All salaries are paid in the same month as incurred. Advertising is prepaid quarterly in even amounts, in January, April, July, and October. Research and Development consists primarily of salaries of the researchers and therefore is paid evenly throughout the year. Sales Receipts information: Cash Sales 10% of total sales Credit Sales Collections: Collected in the month of the sale 50% of credit sales Collected one month after the sale 45% of credit sales Not collected 5% of credit sales Accounts receivable - December 31, 2018 - $281,250 exclusive of the uncollectable amounts in accounts receivable Dividends are paid in March and September March Dividends $600,000 September Dividends $800,000 Bank Note Payment in May $500,000 Cash Balance on December 31, 2018 $800,000 Minimum Cash Balance for next year $2,500,000 All borrowing occurs at the beginning of the month. Principle is repaid as funds are available at the end of the month. Interest is paid as accrued each month. The interest rate charged by the bank is a simple interest of 6% annuallyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started