Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirements: a) Prepare the liquidity ratio analysis of the company? (Any one financial year) b) Prepare the activity ratio analysis of the company? (Any one

Requirements: a) Prepare the liquidity ratio analysis of the company? (Any one financial year) b) Prepare the activity ratio analysis of the company? (Any one financial year) c) Prepare the profitability ratio analysis of the company? (Any one financial year)

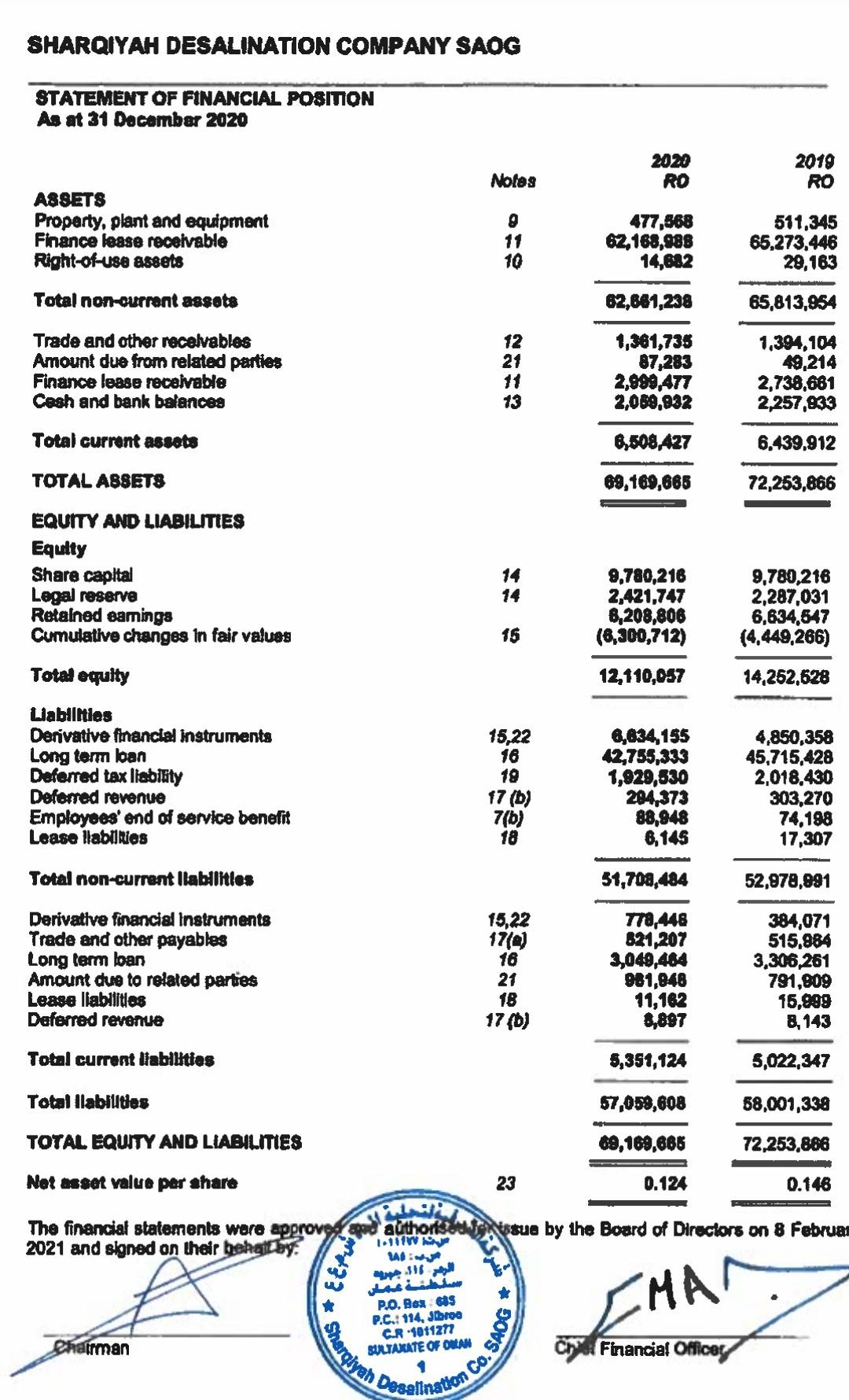

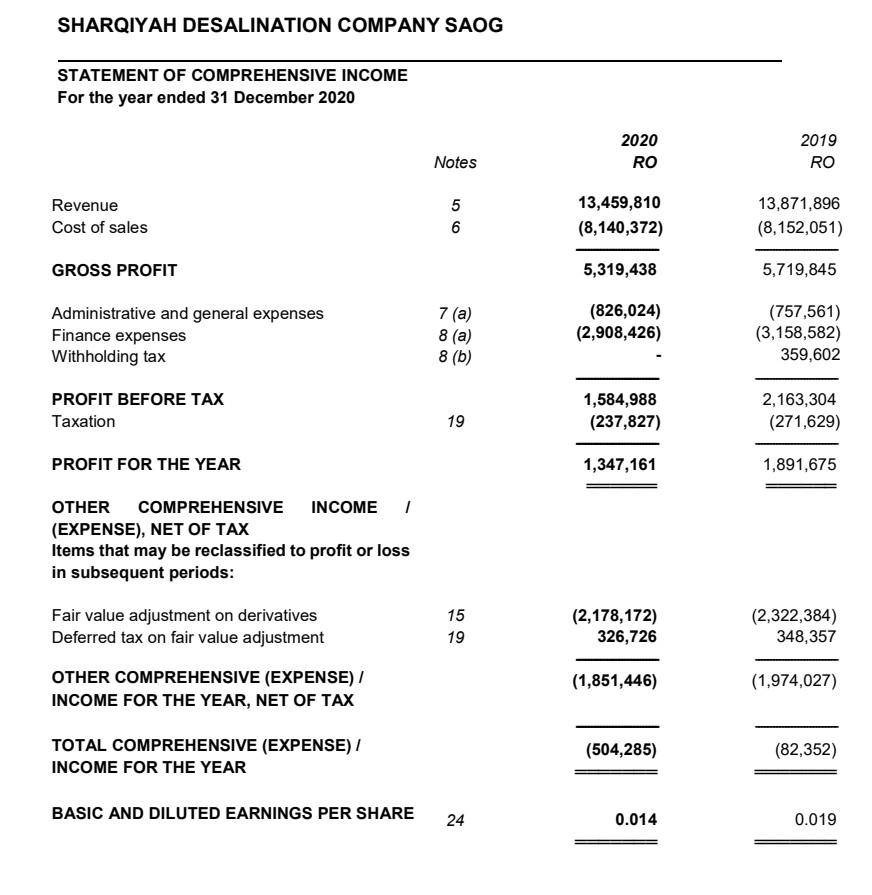

SHARQIYAH DESALINATION COMPANY SAOG STATEMENT OF FINANCIAL POSITION As at 31 December 2020 2020 RO 2019 RO Notag ASSETS Property, plant and equipment Finance lease receivable Right-of-use assets 9 11 10 477,868 62,168,988 14,682 511,345 65,273,446 29,163 Total non-currant assets 62,681,238 65,813,854 Trade and other receivables Amount due from related parties Finance lease receivable Cash and bank balances 12 21 1,361,735 87,283 2,999,477 2,089,832 1,394,104 49,214 2,738,681 2,257,833 13 Total current assets 8,608,427 6.439,912 TOTAL ASSETS 89,169,868 72,253,866 EQUITY AND LIABILITIES Equity Share capital Lagal reserve Retained earnings Cumulative changes in fair values 14 9.780,216 2,421,747 8,208,806 (6,300,712) 9,780,216 2,287,031 6,634,547 (4,449,266) 16 Total equlty 12,110,057 14,252,628 Liabilnias Derivative financial instruments Long term loan Deferred tax liability Defomed revenue Employees' end of service benefit Lease llabies 15,22 16 19 17 (b) 7(b) 18 6,834,155 42,755,333 1,929,530 204,373 88,948 6,145 4,850,358 45,715,428 2,018.430 303,270 74.198 17,307 Total non-current Ilabilitles 51,708,484 52,978,891 Derivative financial Instruments Trade and other payables Long term loan Amount due to related parties Lease liabilities Deferred revenue 15,22 17(e) 16 21 18 17(b) T78,448 821,207 3,049,464 981,048 11,162 8,897 384,071 515,984 3,306,261 791,809 16,999 8,143 Total current Habilities 5,391,124 5,022,347 Total llabludes 57,059,608 88,001,338 TOTAL EQUITY AND LIABILITIES 69,169,666 72,253.886 Not asset value per share 23 0.124 0.146 The financial statements werd approve 2021 and signed on their hengit by authorissue by the Board of Directors on 8 Februar Handel 1.11 Wiw SH / P.O. Per es P.C.: 114, stbroe C.R.10112717 SULTAXATE OF ONAN Charmon Ch Financial Offices Sharqiyah in CO. SAOG Desalination SHARQIYAH DESALINATION COMPANY SAOG STATEMENT OF COMPREHENSIVE INCOME For the year ended 31 December 2020 2020 RO 2019 RO Notes Revenue Cost of sales 5 6 13,459,810 (8,140,372) 13,871,896 (8,152,051) GROSS PROFIT 5,319,438 5,719,845 Administrative and general expenses Finance expenses Withholding tax 7 (a) 8 (a) 8 (b) (826,024) (2,908,426) (757,561) (3,158,582) 359,602 PROFIT BEFORE TAX Taxation 1,584,988 (237,827) 2,163,304 (271,629) 19 PROFIT FOR THE YEAR 1,347,161 1,891,675 OTHER COMPREHENSIVE INCOME 1 (EXPENSE), NET OF TAX Items that may be reclassified to profit or loss in subsequent periods: Fair value adjustment on derivatives Deferred tax on fair value adjustment 15 19 (2,178,172) 326,726 (2,322,384) 348,357 OTHER COMPREHENSIVE (EXPENSE) / INCOME FOR THE YEAR, NET OF TAX (1,851,446) (1,974,027) TOTAL COMPREHENSIVE (EXPENSE) / INCOME FOR THE YEAR (504,285) (82,352) BASIC AND DILUTED EARNINGS PER SHARE 24 0.014 0.019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started