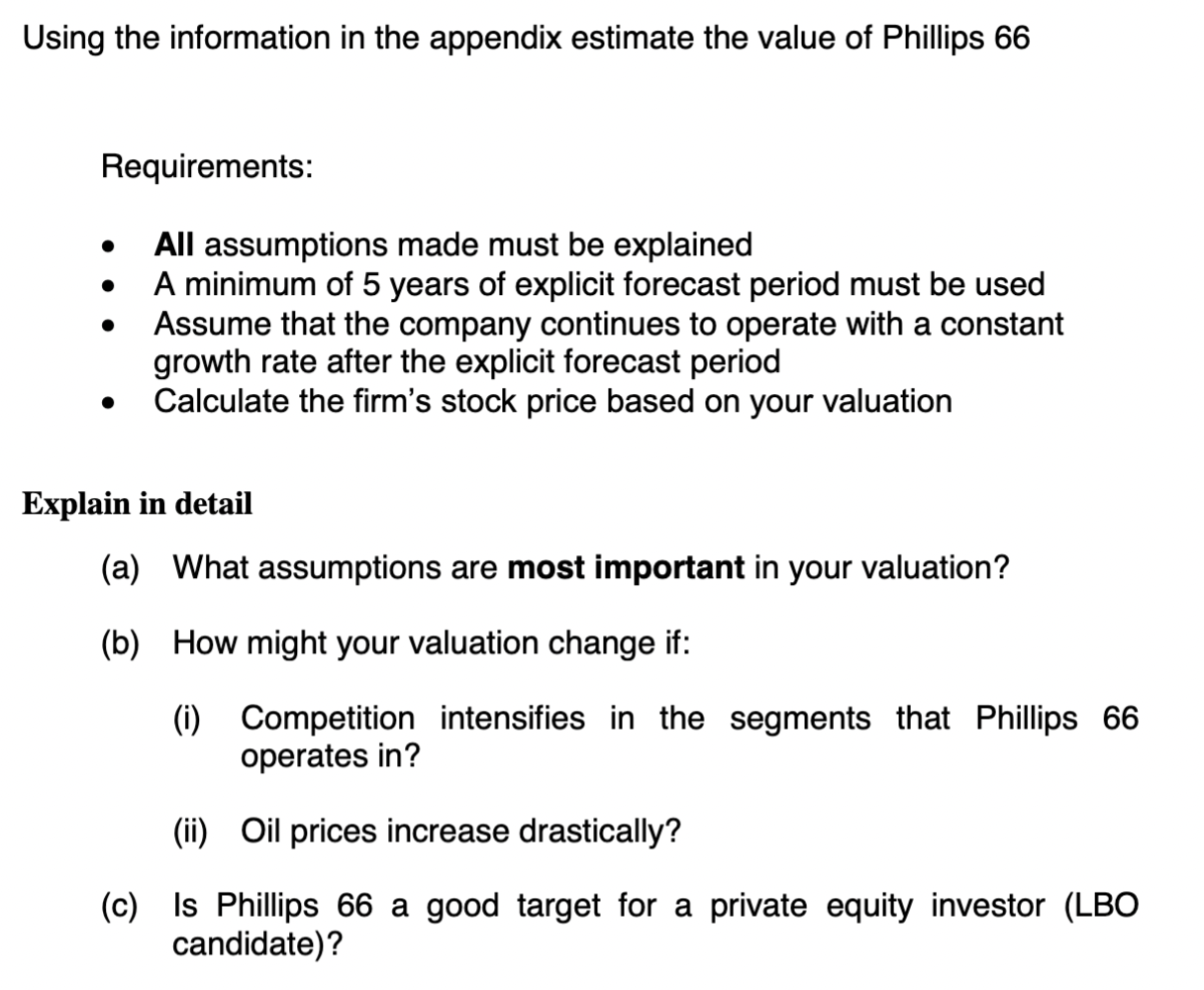

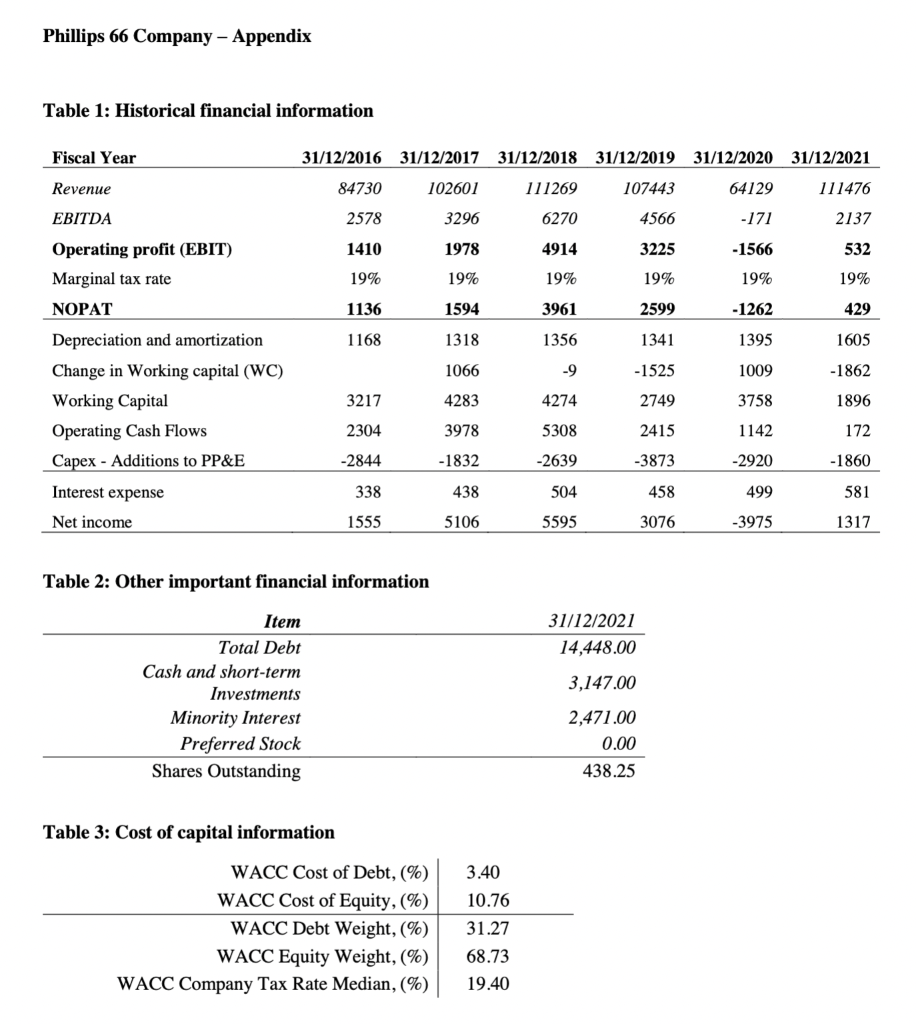

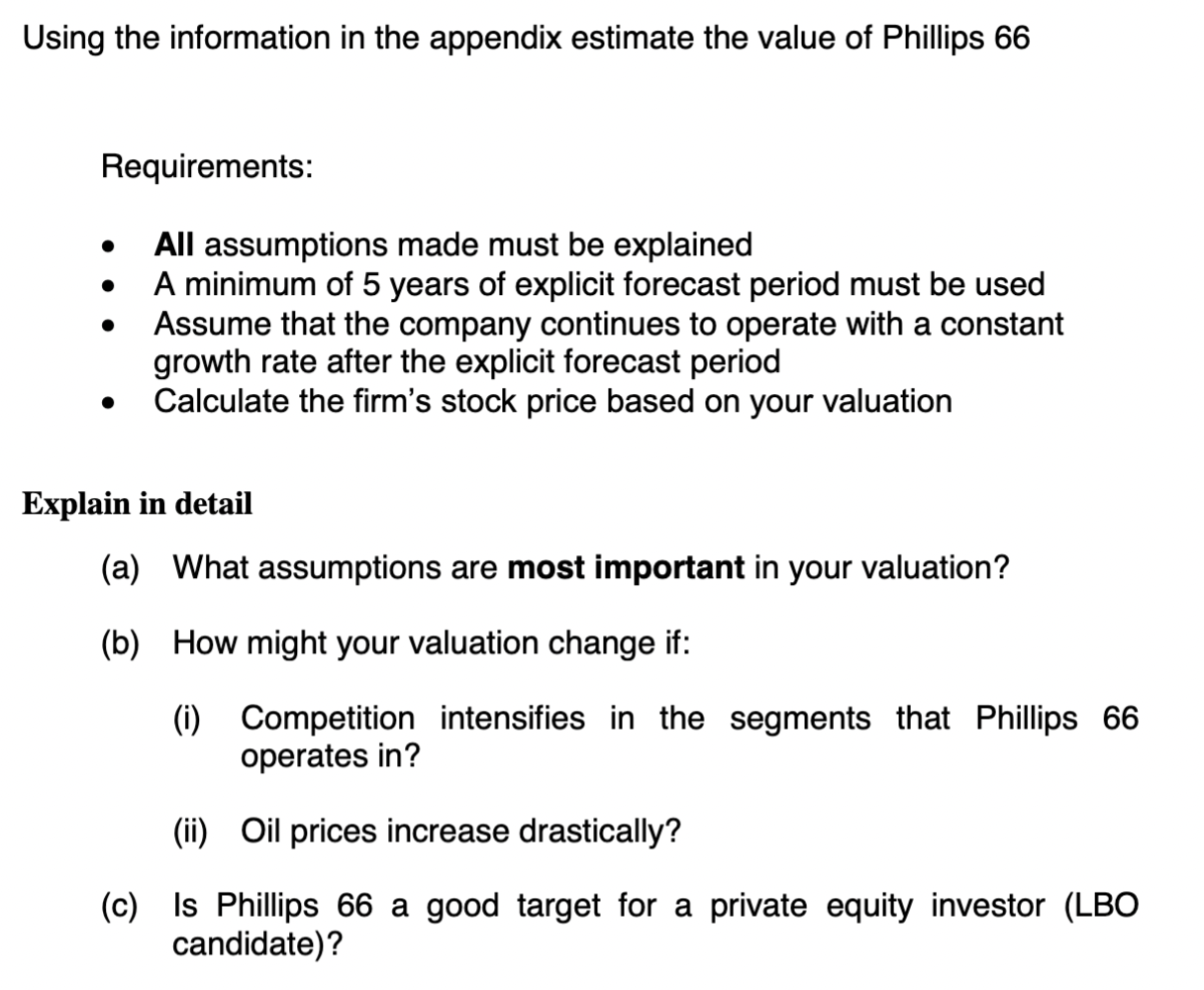

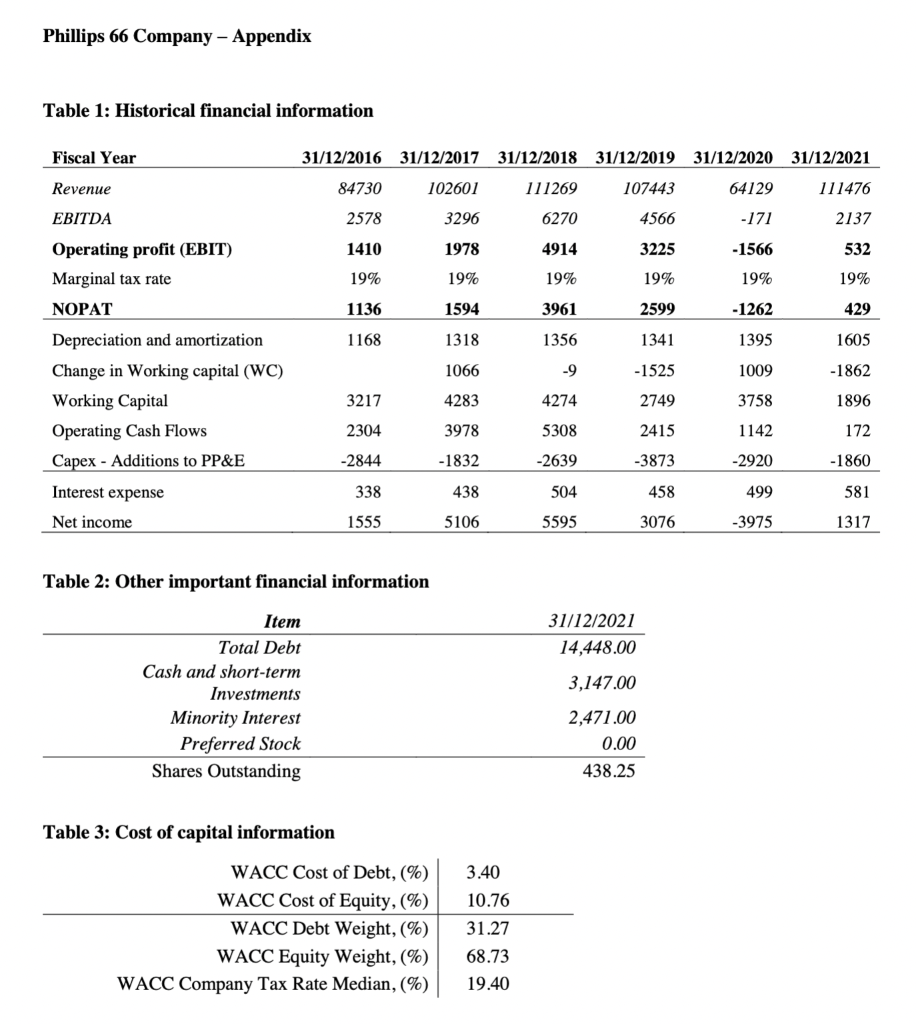

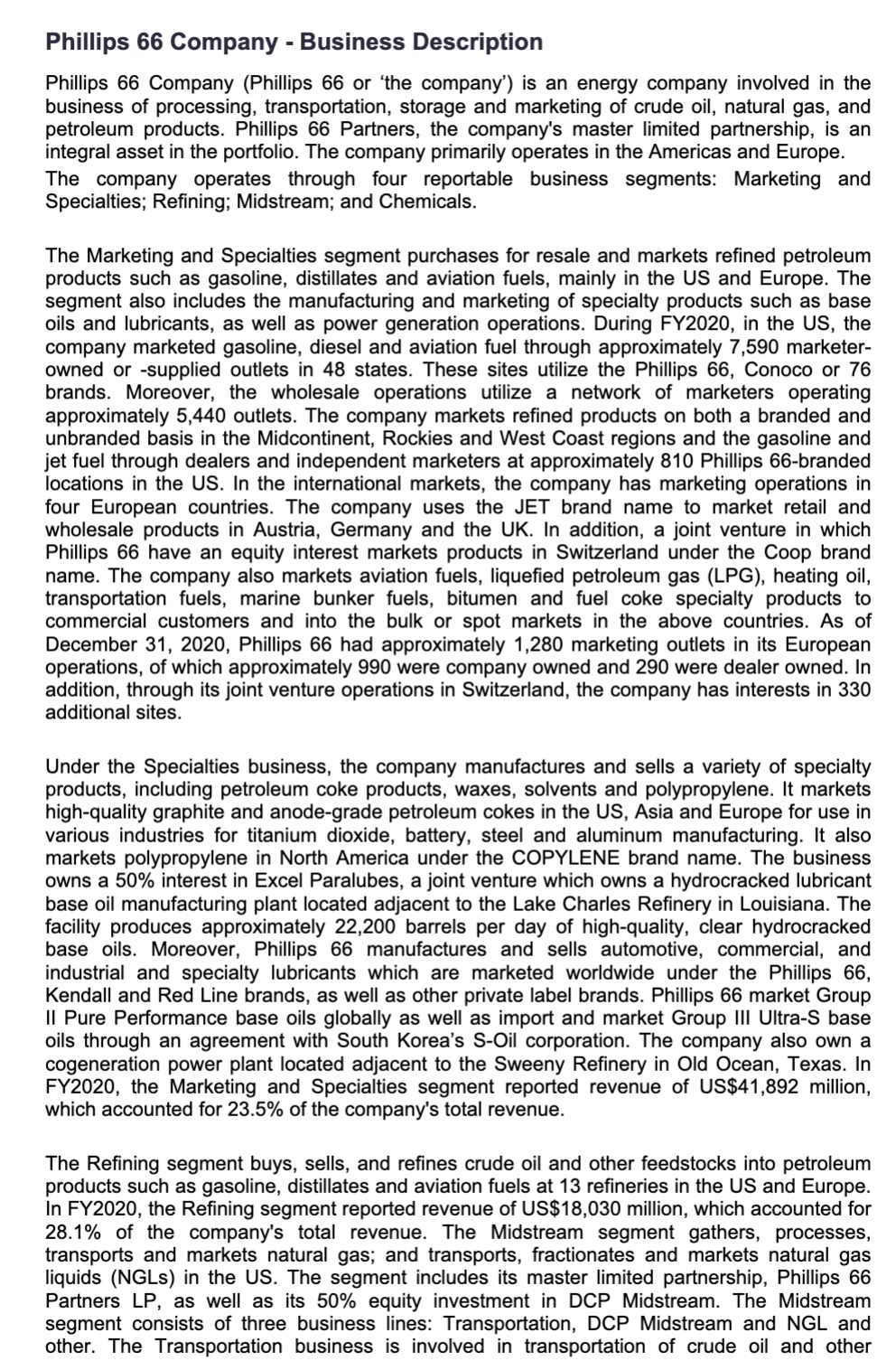

Requirements: - All assumptions made must be explained - A minimum of 5 years of explicit forecast period must be used - Assume that the company continues to operate with a constant growth rate after the explicit forecast period - Calculate the firm's stock price based on your valuation Explain in detail (a) What assumptions are most important in your valuation? (b) How might your valuation change if: (i) Competition intensifies in the segments that Phillips 66 operates in? (ii) Oil prices increase drastically? (c) Is Phillips 66 a good target for a private equity investor (LBO candidate)? Phillips 66 Company - Appendix Table 1: Historical financial information Table 2: Other important financial information Phillips 66 Company - Business Description Phillips 66 Company (Phillips 66 or 'the company') is an energy company involved in the business of processing, transportation, storage and marketing of crude oil, natural gas, and petroleum products. Phillips 66 Partners, the company's master limited partnership, is an integral asset in the portfolio. The company primarily operates in the Americas and Europe. The company operates through four reportable business segments: Marketing and Specialties; Refining; Midstream; and Chemicals. The Marketing and Specialties segment purchases for resale and markets refined petroleum products such as gasoline, distillates and aviation fuels, mainly in the US and Europe. The segment also includes the manufacturing and marketing of specialty products such as base oils and lubricants, as well as power generation operations. During FY2020, in the US, the company marketed gasoline, diesel and aviation fuel through approximately 7,590 marketerowned or -supplied outlets in 48 states. These sites utilize the Phillips 66 , Conoco or 76 brands. Moreover, the wholesale operations utilize a network of marketers operating approximately 5,440 outlets. The company markets refined products on both a branded and unbranded basis in the Midcontinent, Rockies and West Coast regions and the gasoline and jet fuel through dealers and independent marketers at approximately 810 Phillips 66-branded locations in the US. In the international markets, the company has marketing operations in four European countries. The company uses the JET brand name to market retail and wholesale products in Austria, Germany and the UK. In addition, a joint venture in which Phillips 66 have an equity interest markets products in Switzerland under the Coop brand name. The company also markets aviation fuels, liquefied petroleum gas (LPG), heating oil, transportation fuels, marine bunker fuels, bitumen and fuel coke specialty products to commercial customers and into the bulk or spot markets in the above countries. As of December 31,2020 , Phillips 66 had approximately 1,280 marketing outlets in its European operations, of which approximately 990 were company owned and 290 were dealer owned. In addition, through its joint venture operations in Switzerland, the company has interests in 330 additional sites. Under the Specialties business, the company manufactures and sells a variety of specialty products, including petroleum coke products, waxes, solvents and polypropylene. It markets high-quality graphite and anode-grade petroleum cokes in the US, Asia and Europe for use in various industries for titanium dioxide, battery, steel and aluminum manufacturing. It also markets polypropylene in North America under the COPYLENE brand name. The business owns a 50% interest in Excel Paralubes, a joint venture which owns a hydrocracked lubricant base oil manufacturing plant located adjacent to the Lake Charles Refinery in Louisiana. The facility produces approximately 22,200 barrels per day of high-quality, clear hydrocracked base oils. Moreover, Phillips 66 manufactures and sells automotive, commercial, and industrial and specialty lubricants which are marketed worldwide under the Phillips 66, Kendall and Red Line brands, as well as other private label brands. Phillips 66 market Group II Pure Performance base oils globally as well as import and market Group III Ultra-S base oils through an agreement with South Korea's S-Oil corporation. The company also own a cogeneration power plant located adjacent to the Sweeny Refinery in Old Ocean, Texas. In FY2020, the Marketing and Specialties segment reported revenue of US $41,892 million, which accounted for 23.5% of the company's total revenue. The Refining segment buys, sells, and refines crude oil and other feedstocks into petroleum products such as gasoline, distillates and aviation fuels at 13 refineries in the US and Europe. In FY2020, the Refining segment reported revenue of US\$18,030 million, which accounted for 28.1% of the company's total revenue. The Midstream segment gathers, processes, transports and markets natural gas; and transports, fractionates and markets natural gas liquids (NGLs) in the US. The segment includes its master limited partnership, Phillips 66 Partners LP, as well as its 50% equity investment in DCP Midstream. The Midstream segment consists of three business lines: Transportation, DCP Midstream and NGL and other. The Transportation business is involved in transportation of crude oil and other feedstocks to its refineries and other locations, delivers refined and specialty products to market, and provides terminaling and storage services for crude oil and petroleum products. DCP Midstream business gathers, processes, transports and markets natural gas and transports, fractionates and markets NGL. NGL business transports, fractionates and markets natural gas liquids. The segment's Transportation business owns or leases various assets and is engaged in terminaling and storage of crude oil, refined products, natural gas and NGL. These assets include pipeline systems; petroleum product, crude oil and liquefied petroleum gas (LPG) terminals; a petroleum coke handling facility; marine vessels; and railcars and trucks. During FY2020, the company's transportation business managed over 22,000 miles of crude oil, natural gas, NGL and petroleum products pipeline systems in the US, including those partially owned or operated by affiliates. The company owned or operated 39 refined petroleum product terminals, five NGL terminals, 20 crude oil terminals and one petroleum coke exporting facility. As of December 31, 2020, DCP Midstream owned or operated 39 natural gas processing facilities, with a net processing capacity of approximately 6.0 billion cubic feet per day (Bcfd). DCP Midstream's owned or operated natural gas pipeline systems included gathering services for these facilities, as well as natural gas transmission, and totaled approximately 59,000 miles of pipeline. DCP Midstream also owned or operated nine NGL fractionation plants, along with natural gas and NGL storage facilities, a propane wholesale marketing business and NGL pipeline assets. NGL and other business included a US Gulf Coast NGL market hub comprising the Freeport LPG Export Terminal and Phillips 66 Partners' 36,000 barrels-per-day (bpd) Sweeny Fractionator. These assets are supported by Phillips 66 Partners' 9 MMBbls Clemens storage facility. The business also had 22.5% equity interest in Gulf Coast Fractionators, which owns an NGL fractionation plant in Mont Belvieu, Texas. The company's net share of capacity in this plant totaled 32,625bpd. The business also had a 12.5% equity interest in a fractionation plant in Mont Belvieu, Texas with a net share of its capacity of 30,250bpd. Moreover, the NGL business also has a 40% interest in a fractionation plant in Conway, Kansas with a net share of its capacity of 43,200 bpd. Also, Phillips 66 Partners owns an NGL logistics system in southeast Louisiana comprising approximately 500 miles of pipelines and a storage cavern connecting multiple fractionation facilities, refineries and a petrochemical facility. Further, Phillips 66 Partners owns a direct one-third interest in both Sand Hills and Southern Hills pipelines, which connect Eagle Ford, Permian and Midcontinent production to the Mont Belvieu, Texas market. In FY2020, the Midstream segment reported revenue of US\$4,174 million, which accounted for 6.5% of the company's total revenue. Under the Chemicals segment, the company manufactures and markets petrochemicals and plastics on a worldwide basis. The chemicals segment consists of the 50% equity investment in Chevron Phillips Chemical Company (CPChem). As of December 31, 2020, CPChem owned or had joint-venture interests in 28 manufacturing facilities in Qatar, Belgium, Saudi Arabia, Colombia, the US and Singapore and two research and development centers in the US. Moreover, CPChem has two primary business divisions: Olefins and Polyolefins (O\&P) and Specialties, Aromatics and Styrenics (SA\&S). The O\&P business division produces and markets ethylene and other olefin products. The ethylene produced is primarily consumed within CPChem for the production of polyethylene, normal alpha olefins and polyethylene pipe. The SA\&S business division manufactures and markets aromatics and styrenics products, including benzene, styrene, cyclohexane, and polystyrene. SA\&S also manufactures and markets a variety of specialty chemical products, such as organosulfur chemicals, solvents, chemicals and catalysts used in drilling and mining. In FY2020, the Chemicals segment reported revenue of US\$3 million. Geographically, the company classifies its operations into four segments, namely US, UK, Germany, Other foreign countries. In FY2020, US accounted for 76% of the company's total revenue, followed by UK (11\%), Germany (4.7\%), and Other foreign countries (8.3\%). Requirements: - All assumptions made must be explained - A minimum of 5 years of explicit forecast period must be used - Assume that the company continues to operate with a constant growth rate after the explicit forecast period - Calculate the firm's stock price based on your valuation Explain in detail (a) What assumptions are most important in your valuation? (b) How might your valuation change if: (i) Competition intensifies in the segments that Phillips 66 operates in? (ii) Oil prices increase drastically? (c) Is Phillips 66 a good target for a private equity investor (LBO candidate)? Phillips 66 Company - Appendix Table 1: Historical financial information Table 2: Other important financial information Phillips 66 Company - Business Description Phillips 66 Company (Phillips 66 or 'the company') is an energy company involved in the business of processing, transportation, storage and marketing of crude oil, natural gas, and petroleum products. Phillips 66 Partners, the company's master limited partnership, is an integral asset in the portfolio. The company primarily operates in the Americas and Europe. The company operates through four reportable business segments: Marketing and Specialties; Refining; Midstream; and Chemicals. The Marketing and Specialties segment purchases for resale and markets refined petroleum products such as gasoline, distillates and aviation fuels, mainly in the US and Europe. The segment also includes the manufacturing and marketing of specialty products such as base oils and lubricants, as well as power generation operations. During FY2020, in the US, the company marketed gasoline, diesel and aviation fuel through approximately 7,590 marketerowned or -supplied outlets in 48 states. These sites utilize the Phillips 66 , Conoco or 76 brands. Moreover, the wholesale operations utilize a network of marketers operating approximately 5,440 outlets. The company markets refined products on both a branded and unbranded basis in the Midcontinent, Rockies and West Coast regions and the gasoline and jet fuel through dealers and independent marketers at approximately 810 Phillips 66-branded locations in the US. In the international markets, the company has marketing operations in four European countries. The company uses the JET brand name to market retail and wholesale products in Austria, Germany and the UK. In addition, a joint venture in which Phillips 66 have an equity interest markets products in Switzerland under the Coop brand name. The company also markets aviation fuels, liquefied petroleum gas (LPG), heating oil, transportation fuels, marine bunker fuels, bitumen and fuel coke specialty products to commercial customers and into the bulk or spot markets in the above countries. As of December 31,2020 , Phillips 66 had approximately 1,280 marketing outlets in its European operations, of which approximately 990 were company owned and 290 were dealer owned. In addition, through its joint venture operations in Switzerland, the company has interests in 330 additional sites. Under the Specialties business, the company manufactures and sells a variety of specialty products, including petroleum coke products, waxes, solvents and polypropylene. It markets high-quality graphite and anode-grade petroleum cokes in the US, Asia and Europe for use in various industries for titanium dioxide, battery, steel and aluminum manufacturing. It also markets polypropylene in North America under the COPYLENE brand name. The business owns a 50% interest in Excel Paralubes, a joint venture which owns a hydrocracked lubricant base oil manufacturing plant located adjacent to the Lake Charles Refinery in Louisiana. The facility produces approximately 22,200 barrels per day of high-quality, clear hydrocracked base oils. Moreover, Phillips 66 manufactures and sells automotive, commercial, and industrial and specialty lubricants which are marketed worldwide under the Phillips 66, Kendall and Red Line brands, as well as other private label brands. Phillips 66 market Group II Pure Performance base oils globally as well as import and market Group III Ultra-S base oils through an agreement with South Korea's S-Oil corporation. The company also own a cogeneration power plant located adjacent to the Sweeny Refinery in Old Ocean, Texas. In FY2020, the Marketing and Specialties segment reported revenue of US $41,892 million, which accounted for 23.5% of the company's total revenue. The Refining segment buys, sells, and refines crude oil and other feedstocks into petroleum products such as gasoline, distillates and aviation fuels at 13 refineries in the US and Europe. In FY2020, the Refining segment reported revenue of US\$18,030 million, which accounted for 28.1% of the company's total revenue. The Midstream segment gathers, processes, transports and markets natural gas; and transports, fractionates and markets natural gas liquids (NGLs) in the US. The segment includes its master limited partnership, Phillips 66 Partners LP, as well as its 50% equity investment in DCP Midstream. The Midstream segment consists of three business lines: Transportation, DCP Midstream and NGL and other. The Transportation business is involved in transportation of crude oil and other feedstocks to its refineries and other locations, delivers refined and specialty products to market, and provides terminaling and storage services for crude oil and petroleum products. DCP Midstream business gathers, processes, transports and markets natural gas and transports, fractionates and markets NGL. NGL business transports, fractionates and markets natural gas liquids. The segment's Transportation business owns or leases various assets and is engaged in terminaling and storage of crude oil, refined products, natural gas and NGL. These assets include pipeline systems; petroleum product, crude oil and liquefied petroleum gas (LPG) terminals; a petroleum coke handling facility; marine vessels; and railcars and trucks. During FY2020, the company's transportation business managed over 22,000 miles of crude oil, natural gas, NGL and petroleum products pipeline systems in the US, including those partially owned or operated by affiliates. The company owned or operated 39 refined petroleum product terminals, five NGL terminals, 20 crude oil terminals and one petroleum coke exporting facility. As of December 31, 2020, DCP Midstream owned or operated 39 natural gas processing facilities, with a net processing capacity of approximately 6.0 billion cubic feet per day (Bcfd). DCP Midstream's owned or operated natural gas pipeline systems included gathering services for these facilities, as well as natural gas transmission, and totaled approximately 59,000 miles of pipeline. DCP Midstream also owned or operated nine NGL fractionation plants, along with natural gas and NGL storage facilities, a propane wholesale marketing business and NGL pipeline assets. NGL and other business included a US Gulf Coast NGL market hub comprising the Freeport LPG Export Terminal and Phillips 66 Partners' 36,000 barrels-per-day (bpd) Sweeny Fractionator. These assets are supported by Phillips 66 Partners' 9 MMBbls Clemens storage facility. The business also had 22.5% equity interest in Gulf Coast Fractionators, which owns an NGL fractionation plant in Mont Belvieu, Texas. The company's net share of capacity in this plant totaled 32,625bpd. The business also had a 12.5% equity interest in a fractionation plant in Mont Belvieu, Texas with a net share of its capacity of 30,250bpd. Moreover, the NGL business also has a 40% interest in a fractionation plant in Conway, Kansas with a net share of its capacity of 43,200 bpd. Also, Phillips 66 Partners owns an NGL logistics system in southeast Louisiana comprising approximately 500 miles of pipelines and a storage cavern connecting multiple fractionation facilities, refineries and a petrochemical facility. Further, Phillips 66 Partners owns a direct one-third interest in both Sand Hills and Southern Hills pipelines, which connect Eagle Ford, Permian and Midcontinent production to the Mont Belvieu, Texas market. In FY2020, the Midstream segment reported revenue of US\$4,174 million, which accounted for 6.5% of the company's total revenue. Under the Chemicals segment, the company manufactures and markets petrochemicals and plastics on a worldwide basis. The chemicals segment consists of the 50% equity investment in Chevron Phillips Chemical Company (CPChem). As of December 31, 2020, CPChem owned or had joint-venture interests in 28 manufacturing facilities in Qatar, Belgium, Saudi Arabia, Colombia, the US and Singapore and two research and development centers in the US. Moreover, CPChem has two primary business divisions: Olefins and Polyolefins (O\&P) and Specialties, Aromatics and Styrenics (SA\&S). The O\&P business division produces and markets ethylene and other olefin products. The ethylene produced is primarily consumed within CPChem for the production of polyethylene, normal alpha olefins and polyethylene pipe. The SA\&S business division manufactures and markets aromatics and styrenics products, including benzene, styrene, cyclohexane, and polystyrene. SA\&S also manufactures and markets a variety of specialty chemical products, such as organosulfur chemicals, solvents, chemicals and catalysts used in drilling and mining. In FY2020, the Chemicals segment reported revenue of US\$3 million. Geographically, the company classifies its operations into four segments, namely US, UK, Germany, Other foreign countries. In FY2020, US accounted for 76% of the company's total revenue, followed by UK (11\%), Germany (4.7\%), and Other foreign countries (8.3\%)