Requirements: *All assumptions made must be explained

*A minimum of 5 years of explicit forecast period must be used

* Assume that the company continues to operate with a constant growth rate after the explicit forecast period

* Calculate the firms stock price based on your valuation Explain in detail

(a) What assumptions are most important in your valuation?

(b) How might your valuation change if: (i) Competition intensifies in the segments that the company operates in?

(ii) Oil prices increase drastically?

(c) Is the company a good target for a private equity investor (LBO candidate)?

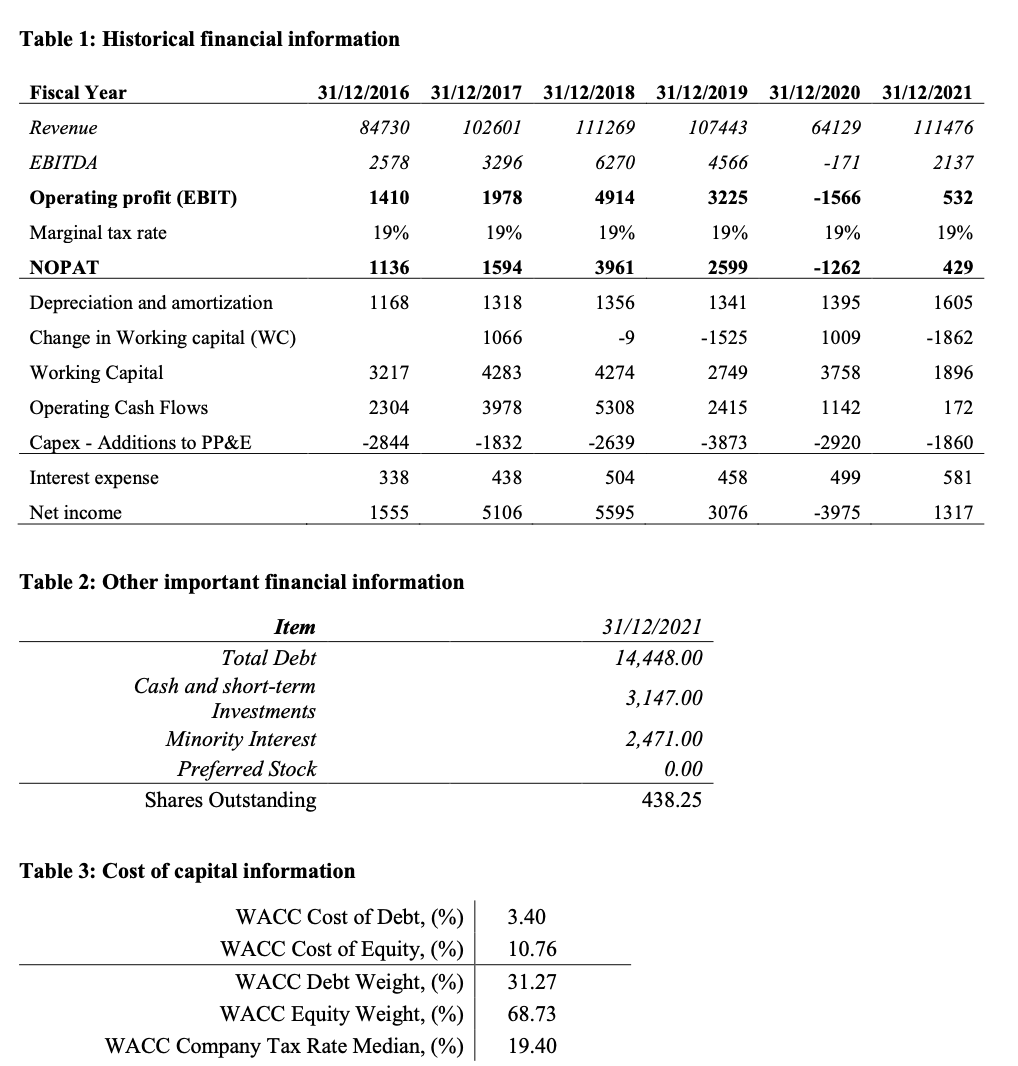

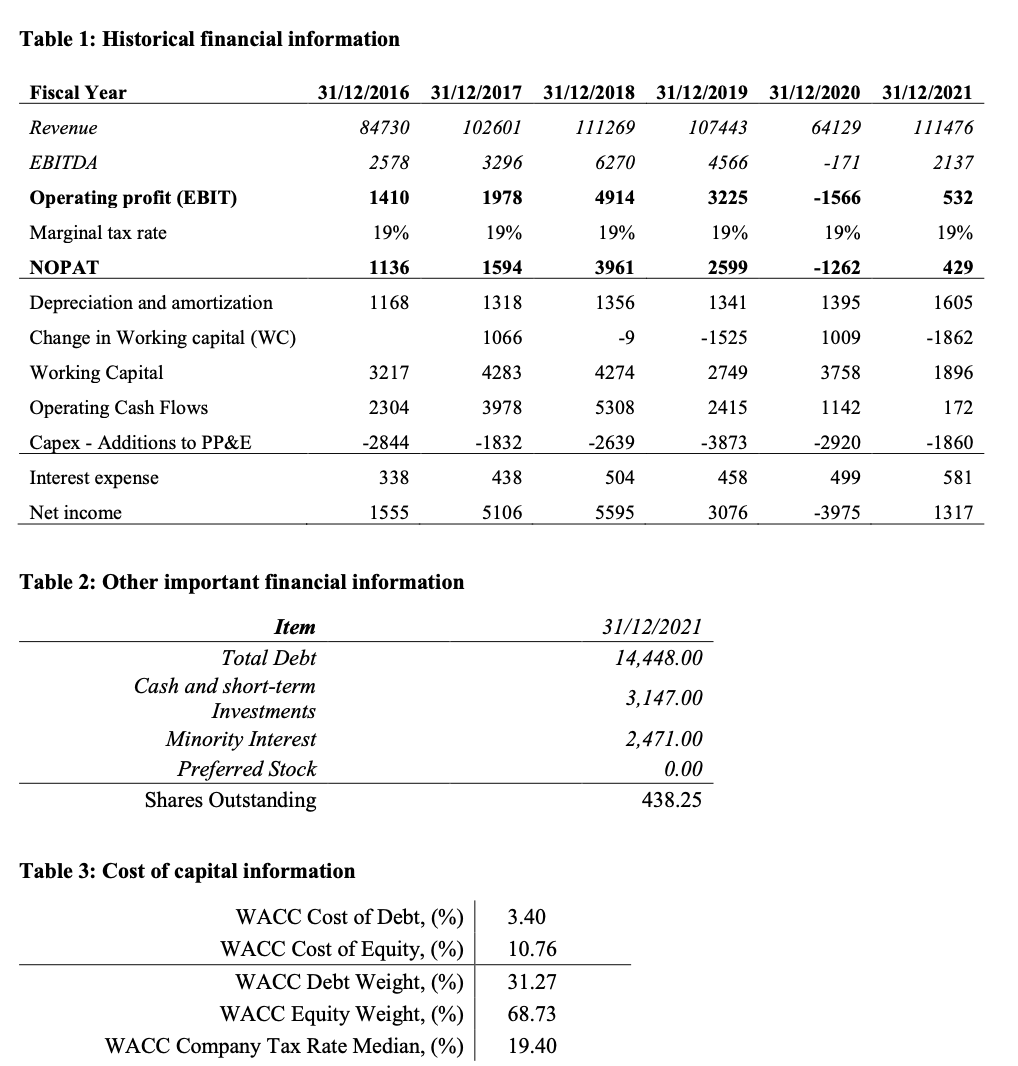

Table 1: Historical financial information Fiscal Year 31/12/2016 31/12/2017 31/12/2018 31/12/2019 31/12/2020 31/12/2021 Revenue 84730 102601 111269 107443 64129 111476 EBITDA 2578 3296 6270 4566 -171 2137 1410 1978 4914 3225 -1566 532 Operating profit (EBIT) Marginal tax rate 19% 19% 19% 19% 19% 19% NOPAT 1136 1594 3961 2599 -1262 429 1168 1318 1356 1341 1395 1605 1066 -9 - 1525 1009 -1862 Depreciation and amortization Change in Working capital (WC) Working Capital Operating Cash Flows Capex - Additions to PP&E 3217 4283 4274 2749 3758 1896 2304 3978 5308 2415 1142 172 -2844 -1832 -2639 -3873 -2920 -1860 Interest expense 338 438 504 458 499 581 Net income 1555 5106 5595 3076 -3975 1317 Table 2: Other important financial information 31/12/2021 14,448.00 3,147.00 Item Total Debt Cash and short-term Investments Minority Interest Preferred Stock Shares Outstanding 2,471.00 0.00 438.25 Table 3: Cost of capital information 3.40 10.76 WACC Cost of Debt, (%) WACC Cost of Equity, (%) WACC Debt Weight, (%) WACC Equity Weight, (%) WACC Company Tax Rate Median, (%) 31.27 68.73 19.40 Table 1: Historical financial information Fiscal Year 31/12/2016 31/12/2017 31/12/2018 31/12/2019 31/12/2020 31/12/2021 Revenue 84730 102601 111269 107443 64129 111476 EBITDA 2578 3296 6270 4566 -171 2137 1410 1978 4914 3225 -1566 532 Operating profit (EBIT) Marginal tax rate 19% 19% 19% 19% 19% 19% NOPAT 1136 1594 3961 2599 -1262 429 1168 1318 1356 1341 1395 1605 1066 -9 - 1525 1009 -1862 Depreciation and amortization Change in Working capital (WC) Working Capital Operating Cash Flows Capex - Additions to PP&E 3217 4283 4274 2749 3758 1896 2304 3978 5308 2415 1142 172 -2844 -1832 -2639 -3873 -2920 -1860 Interest expense 338 438 504 458 499 581 Net income 1555 5106 5595 3076 -3975 1317 Table 2: Other important financial information 31/12/2021 14,448.00 3,147.00 Item Total Debt Cash and short-term Investments Minority Interest Preferred Stock Shares Outstanding 2,471.00 0.00 438.25 Table 3: Cost of capital information 3.40 10.76 WACC Cost of Debt, (%) WACC Cost of Equity, (%) WACC Debt Weight, (%) WACC Equity Weight, (%) WACC Company Tax Rate Median, (%) 31.27 68.73 19.40