Answered step by step

Verified Expert Solution

Question

1 Approved Answer

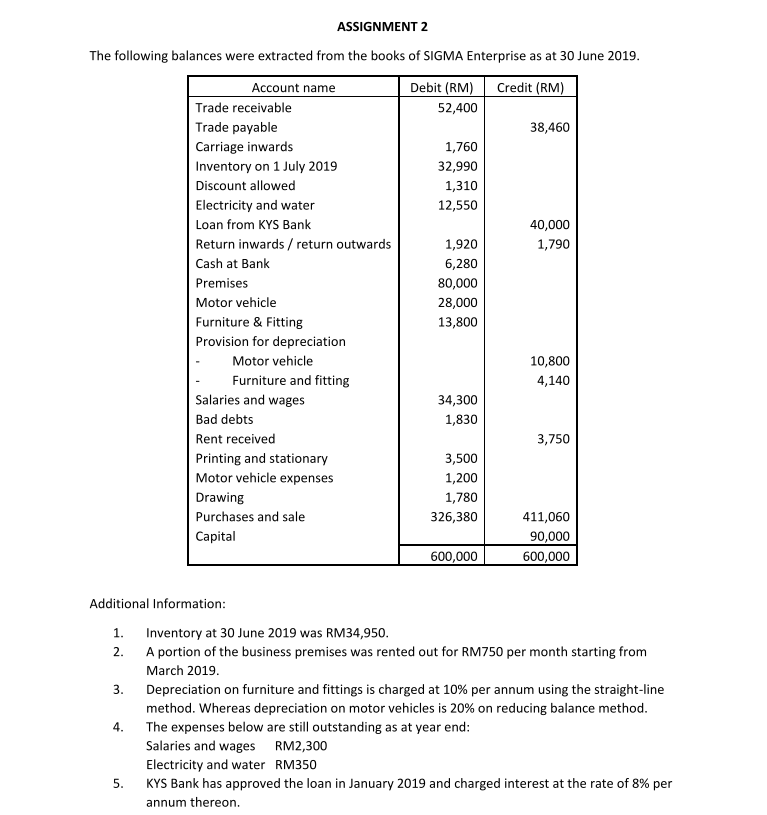

Requirements: Comprehensive income and financial position. ASSIGNMENT 2 The following balances were extracted from the books of SIGMA Enterprise as at 30 June 2019. Account

Requirements:

Comprehensive income and financial position.

ASSIGNMENT 2 The following balances were extracted from the books of SIGMA Enterprise as at 30 June 2019. Account name Debit (RM) Credit (RM) Trade receivable 52,400 Trade payable 38,460 Carriage inwards 1,760 Inventory on 1 July 2019 32,990 Discount allowed 1,310 Electricity and water 12,550 Loan from KYS Bank 40,000 Return inwards / return outwards 1,920 1,790 Cash at Bank 6,280 Premises 80,000 Motor vehicle 28,000 Furniture & Fitting 13,800 Provision for depreciation Motor vehicle 10,800 Furniture and fitting 4,140 Salaries and wages 34,300 Bad debts 1,830 Rent received 3,750 Printing and stationary 3,500 Motor vehicle expenses 1,200 Drawing 1,780 Purchases and sale 326,380 411,060 Capital 90,000 600,000 600,000 2. Additional Information: 1. Inventory at 30 June 2019 was RM34,950. A portion of the business premises was rented out for RM750 per month starting from March 2019. 3. Depreciation on furniture and fittings is charged at 10% per annum using the straight-line method. Whereas depreciation on motor vehicles is 20% on reducing balance method. The expenses below are still outstanding as at year end: Salaries and wages RM2,300 Electricity and water RM350 KYS Bank has approved the loan in January 2019 and charged interest at the rate of 8% per annum thereon. 4. 5Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started