Question

Requirements: Create adjusting journal entries AND a trial Balance to confirm adjustments. Prepare the required adjusting journal entries for each situation as of December 3

Requirements:

Create adjusting journal entries AND a trial Balance to confirm adjustments.

Prepare the required adjusting journal entries for each situation as of December of the current year.

Information:

A Deanna's received a $ shipment of supplies in September of the current year. When counting the supplies on December of the current year, Deanna's found only $ worth of supplies on hand.

b Deanna's had paid $ for six months of rent on November of the current year. As of December, of the current year, two months November & December of prepaid rent have expired.

c Deanna's had paid $ for one year's insurance on August of the current year. Debit and credit the accounts affected.

d The company acquired equipment costing $ on January of the current year. Suppose that the depreciation on this equipment was calculated to be $ for the current year.

e On December of the current year, the company sold $ in gift certificates for decorating services to a customer. On December of the current year, the accountant received an envelope containing $ worth of redeemed gift certificates, not yet recorded in the company's books.

f Investments owned by the company earned $ in additional interest revenue for the year; the cash will be received in January.

g The company borrowed using a note payable from the bank for $ on January of the current year, due with all interest on June of the following year. The note payable requires interest.

h The company calculated its income taxes as $ for the current year ended December

i On December of the current year, the company declared a $ dividend, payable on January of the following year.

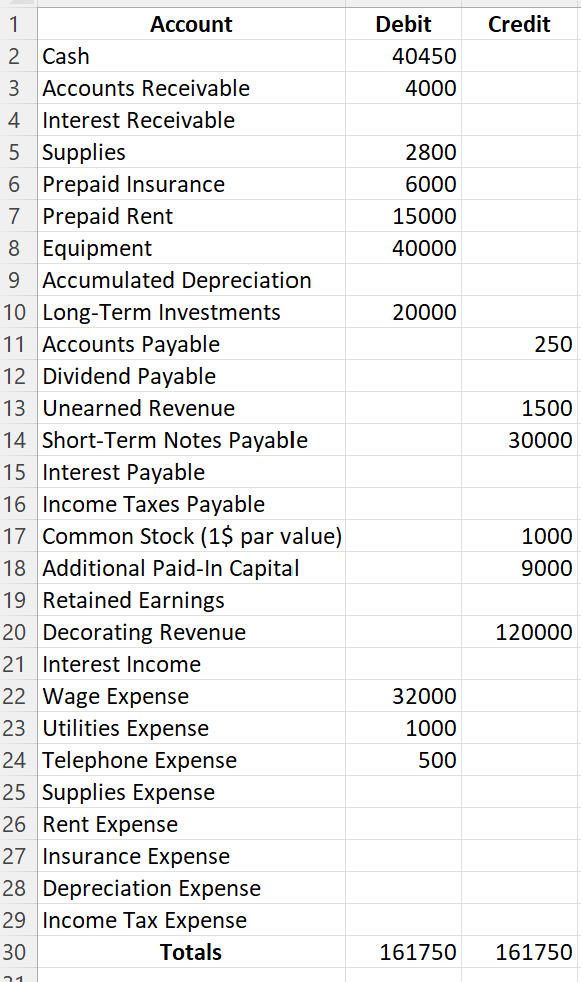

Starting Balances of the comapny provided below:

1 2 Cash 3 Accounts Receivable Account Debit Credit 40450 4000 4 Interest Receivable 5 Supplies 2800 6 Prepaid Insurance 6000 7 Prepaid Rent 15000 8 Equipment 40000 9 Accumulated Depreciation 10 Long-Term Investments 20000 11 Accounts Payable 250 12 Dividend Payable 13 Unearned Revenue 14 Short-Term Notes Payable 1500 30000 15 Interest Payable 16 Income Taxes Payable 17 Common Stock (1$ par value) 1000 18 Additional Paid-In Capital 9000 19 Retained Earnings 20 Decorating Revenue 120000 21 Interest Income 22 Wage Expense 32000 23 Utilities Expense 1000 24 Telephone Expense 500 25 Supplies Expense 26 Rent Expense 27 Insurance Expense 28 Depreciation Expense 29 Income Tax Expense 30 Totals 161750 161750

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the adjusting journal entries for Deannas company as of December 31 of the current year w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started