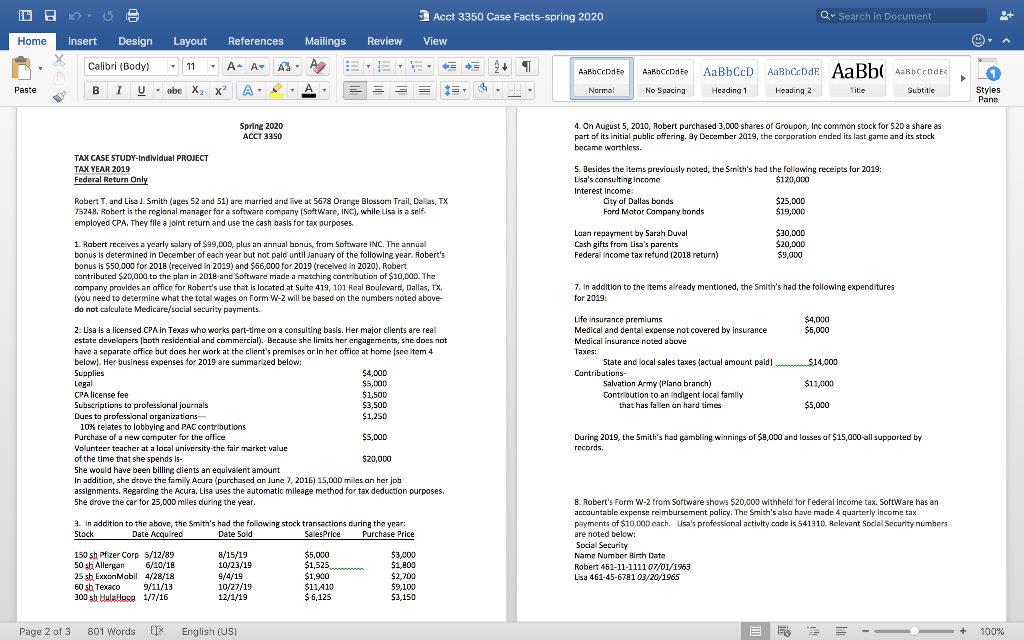

Question

REQUIREMENTS FOR TAX RETURN Prepare an income tax return (with appropriate schedules) for the Smiths for 2019. Make necessary assumptions for facts not stated in

REQUIREMENTS FOR TAX RETURN

Prepare an income tax return (with appropriate schedules) for the Smiths for 2019.

Make necessary assumptions for facts not stated in the problem.

Use the forms in the book or online- do NOT use software for this project. Handwritten forms is fine.

Prepare notes/comments on questions for return reviewer-critical part of the submission

This project is like an exam- and do not share your assumptions and/or answers with others. You will be asked to attest to that on the cover sheet-see comments below- that you must attach to your submission.

If a refund results, the taxpayers want it sent to them.

The Smiths do not wish to contribute to the PresidentialElection Campaign Fund. In the past several years, they have itemized their deductions from AGI (have not claimed the standard deduction option).

REQUIREMENTS FOR SUBMITTING THE PROJECT

Attach and sign the following:

I did not seek assistance of any other student, friend, and colleague or use the solution manual in the completion of this assignment.

Student signature not initials are required

19 Acct 3350 Case Facts-spring 2020 Q Search in Document Home Review View Insert Design Layout References Mailings Calibri (Body 11 . A- A - A- A : BIU U - obe X abe X, X A. = = A 11 Aabhcbd Fe AaBlaCcode AaBbCcD AaBCcDdf AaBb Aabecode Paste Normal No Spacing Heading 1 Heading 2 Title Subtitle Styles Pane Spring 2020 ACCT 3350 4. On August 5, 2010, Robert purchased 3,000 shares of Groupon, Inc common stock for $20 a share as part of its initial public offering. By December 2019, the corporation ended its last game and its stock became worthless. TAX CASE STUDY-Individual PROJECT TAX YEAR 2019 Federal Return Only 5. Besides the items previously noted, the Smith's had the following receipts for 2019: Lisa's consulting income $120,000 Interest income City of Dallas bonds $25,000 Ford Motor Company bonds $19,000 Robert T. and Lisa l. Sinith (ages 52 and 51) are married and live at 5678 Orange Blossom Trail, Dallas, TX 75248. Robert is the regional manager for a software company (SoftWare, INC), while Lisa is a self employed CPA. They file a joint return and use the cash basis for tax purposes. Loan repayment by Sarah Duval Cash gifts from Lisa's parents Federal income tax refund (2018 return) $30,000 $20,000 $9,000 7. In addition to the items already mentioned, the Smith's had the following expenditures for 2019 1. Robert receives a yearly salary of $99,000, plus an annual bonus, from Software INC. The annual bonus is determined in December of each year but not paid until January of the following year. Robert's bonus is $50,000 for 2018 (received in 2019) and $56,000 for 2019 (received in 2020). Robert contributed $20,000 to the plan in 2018 and Software made a matching contribution of $10,000. The company provides an office for Robert's use that is located at Suite 419, 101 Real Boulevard, Dallas, TX. you need to determine what the total wages on Form W-2 will be based on the numbers noted above do not calculate Medicare/social security payments. 2: Lisa is a licensed CPA in Texas who works part-time on a consulting basis. Her major clients are real estate developers (both residential and commercial). Because she limits her engagements, she does not have a separate affice but does her work at the client's premises ar in her office at home (see item 4 below). Her business expenses for 2019 are summarized below: Supplies $4,000 Legal $5,000 CPA license fee $1,500 Subscriptions to professional journals $3,500 Dues to professional organizations- $1,250 10% relates to lobbying and PAC contributions Purchase of a new computer for the office $5,000 Volunteer teacher at a local university the fair market value of the time that she spends is- $20,000 She would have been billing clients an equivalent amount In addition, she drove the family Acura (purchased on June 7, 2016) 15,000 miles on her job assignments. Regarding the Acura, Lisa uses the automatic mileage method for tax deduction purposes. . She drove the car for 25,000 miles during the year. Life insurance premiums $4,000 Medical and dental expense not covered by insurance $6,000 Medical insurance noted above Taxes: State and local sales taxes (actual amount paid $14,000 Contributions- Salvation Army (Plana branch) $11,000 Contribution to an indleent local family that has fallen en hard times $5,000 During 2019, the Sinith's had gambling winnings of $8,000 and losses of $15,000-all supported by , $ $ records. 3. In addition to the above, the Smith's had the following stock transactions during the year: Stock Date Acquired Date Sold Sales Price Purchase Price 150 sh Pfizer Corp 5/12/89 8/15/19 $5,000 $3,000 50 sh Allergan 6/10/16 10/23/19 $1,525 25 sh ExxonMabil 4/28/18 9/4/19 $1,900 $2,700 60 sh Texaco 9/11/13 10/27/19 $11A10 $9,100 300 sh. Hulallogg 1/7/16 12/1/19 $ 6,125 $3,150 8. Robert's Form W-2 from Software shows $20,000 withheld for Federal income tax. Software has an accountable expense reimbursement policy. The Smith's also have made 4 quarterly income tax payments of $10,000 each. Lisa's professional activity code is 541310. Relevant Social Security numbers are noted below: Social Security Name Number Birth Date Robert 451-11-1111 07/01/1963 Lisa 461-45-6781 03/20/1965 $1.000 Page 2 of 3 801 Words UTX English (US) ) SE 100% 19 Acct 3350 Case Facts-spring 2020 Q Search in Document Home Review View Insert Design Layout References Mailings Calibri (Body 11 . A- A - A- A : BIU U - obe X abe X, X A. = = A 11 Aabhcbd Fe AaBlaCcode AaBbCcD AaBCcDdf AaBb Aabecode Paste Normal No Spacing Heading 1 Heading 2 Title Subtitle Styles Pane Spring 2020 ACCT 3350 4. On August 5, 2010, Robert purchased 3,000 shares of Groupon, Inc common stock for $20 a share as part of its initial public offering. By December 2019, the corporation ended its last game and its stock became worthless. TAX CASE STUDY-Individual PROJECT TAX YEAR 2019 Federal Return Only 5. Besides the items previously noted, the Smith's had the following receipts for 2019: Lisa's consulting income $120,000 Interest income City of Dallas bonds $25,000 Ford Motor Company bonds $19,000 Robert T. and Lisa l. Sinith (ages 52 and 51) are married and live at 5678 Orange Blossom Trail, Dallas, TX 75248. Robert is the regional manager for a software company (SoftWare, INC), while Lisa is a self employed CPA. They file a joint return and use the cash basis for tax purposes. Loan repayment by Sarah Duval Cash gifts from Lisa's parents Federal income tax refund (2018 return) $30,000 $20,000 $9,000 7. In addition to the items already mentioned, the Smith's had the following expenditures for 2019 1. Robert receives a yearly salary of $99,000, plus an annual bonus, from Software INC. The annual bonus is determined in December of each year but not paid until January of the following year. Robert's bonus is $50,000 for 2018 (received in 2019) and $56,000 for 2019 (received in 2020). Robert contributed $20,000 to the plan in 2018 and Software made a matching contribution of $10,000. The company provides an office for Robert's use that is located at Suite 419, 101 Real Boulevard, Dallas, TX. you need to determine what the total wages on Form W-2 will be based on the numbers noted above do not calculate Medicare/social security payments. 2: Lisa is a licensed CPA in Texas who works part-time on a consulting basis. Her major clients are real estate developers (both residential and commercial). Because she limits her engagements, she does not have a separate affice but does her work at the client's premises ar in her office at home (see item 4 below). Her business expenses for 2019 are summarized below: Supplies $4,000 Legal $5,000 CPA license fee $1,500 Subscriptions to professional journals $3,500 Dues to professional organizations- $1,250 10% relates to lobbying and PAC contributions Purchase of a new computer for the office $5,000 Volunteer teacher at a local university the fair market value of the time that she spends is- $20,000 She would have been billing clients an equivalent amount In addition, she drove the family Acura (purchased on June 7, 2016) 15,000 miles on her job assignments. Regarding the Acura, Lisa uses the automatic mileage method for tax deduction purposes. . She drove the car for 25,000 miles during the year. Life insurance premiums $4,000 Medical and dental expense not covered by insurance $6,000 Medical insurance noted above Taxes: State and local sales taxes (actual amount paid $14,000 Contributions- Salvation Army (Plana branch) $11,000 Contribution to an indleent local family that has fallen en hard times $5,000 During 2019, the Sinith's had gambling winnings of $8,000 and losses of $15,000-all supported by , $ $ records. 3. In addition to the above, the Smith's had the following stock transactions during the year: Stock Date Acquired Date Sold Sales Price Purchase Price 150 sh Pfizer Corp 5/12/89 8/15/19 $5,000 $3,000 50 sh Allergan 6/10/16 10/23/19 $1,525 25 sh ExxonMabil 4/28/18 9/4/19 $1,900 $2,700 60 sh Texaco 9/11/13 10/27/19 $11A10 $9,100 300 sh. Hulallogg 1/7/16 12/1/19 $ 6,125 $3,150 8. Robert's Form W-2 from Software shows $20,000 withheld for Federal income tax. Software has an accountable expense reimbursement policy. The Smith's also have made 4 quarterly income tax payments of $10,000 each. Lisa's professional activity code is 541310. Relevant Social Security numbers are noted below: Social Security Name Number Birth Date Robert 451-11-1111 07/01/1963 Lisa 461-45-6781 03/20/1965 $1.000 Page 2 of 3 801 Words UTX English (US) ) SE 100%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started