Question

REQUIREMENTS Part 1. A . Write the adjusting journal entry [in proper journal entry form] for book tax expense & tax liability AND prepare financial

REQUIREMENTS

Part 1. A. Write the adjusting journal entry [in proper journal entry form] for book tax expense & tax liability AND prepare financial statements, specifically, a [book basis] balance sheet, income statement and retained earnings statement. Your tax expense adjusting entry should include a debit to book tax expense, a credit to tax prepayments and a debit or credit to deferred tax and a credit to tax liability (if any). Note: as per (3) above, the company has made timely estimated tax payments. Do you see these on the companys trial balance?

Part 1. B. Prepare a schedule (as we have done in class) showing the book to tax differences. Your schedule that you hand in should begin with book Net Income (after tax) and end with Taxable Income.

INFORMATION

1.Analysis of the Allowance for Doubtful Accounts shows:

| Beginning of year balance | $45,496 |

| Provision for the year | 19,567 |

| Write-offs in the year | (22,957) |

| End of year balance on 12/31 | $42,106 |

2.All charitable contributions were made in cash to qualified organizations.

3.Four estimated federal income tax payments of $60,000 were made timely.

4.Entertainment expenses consist only of reimbursements for business meals & entertainment incurred by the company's officers & sales force.

5.$2,560 of the interest income was earned on investments in tax-exempt state bonds. The rest of the interest income was earned from investments in taxable corporate bonds. Dividend income is from shares of Microsoft Corporation. The company owns much less that 1% of the outstanding shares.

6.The company owns several insurance policies on the lives of its officers and key employees. The company is the beneficiary of these policies. Premiums on these policies cost $24,670 this year.

7.MACRS depreciation for tax purposes is $239,000.

8.The company sold some shares of stock this year and realized a gain of $30,890. The shares were purchased in 2010. There were no other asset sales in the current year.

All appropriate financial reporting adjustments have been made to the trial balance except for the provision for income taxes. You will need to calculate and record an adjusting journal entry for the book income tax expense to complete the book basis trial balance in order to produce the GAAP basis financial statements

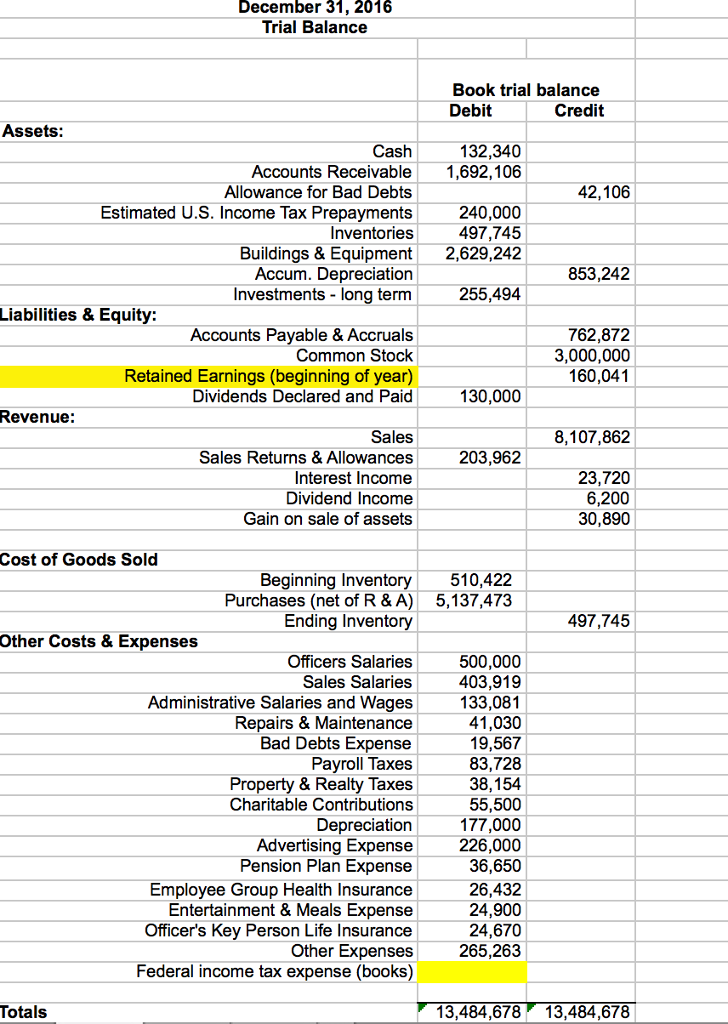

December 31, 2016 Trial Balance Book trial balance Debit Credit Assets: Cash 132,340 Accounts Receivable 1,692,106 Allowance for Bad Debts 42,106 Estimated U.S. Income Tax Prepayments 240,000 497,745 Inventories Buildings & Equipment 2,629,242 853,242 Accum. Depreciation 255,494 Investments long term Liabilities & Equity: Accounts Payable & Accruals 762,872 Common Stock 3,000,000 Retained Earnings (beginning of year) Dividends Declared and Paid Revenue: Sales 8,107,862 Sales Returns & Allowances 203,962 Interest Income 23,720 6,200 Dividend Income Gain on sale of assets 30,890 Cost of Goods Sold 510,422 Beginning Inventory Purchases (net of R & A) 5,137,473 497,745 Ending Inventory other Costs & Expenses Officers Salaries 500,000 Sales Salaries 403 Administrative Salaries and Wages 133,081 41,030 Repairs & Maintenance Bad Debts Expense 19,567 83,728 Payroll Taxes 38,154 Property & Realty Taxes 55,500 Charitable Contributions Depreciation 177,000 Advertising Expense 226,000 Pension Plan Expense 36,650 Employee Group Health Insurance 26,432 Entertainment & Meals Expense 24,900 Officer's Key Person Life Insurance 670 Other Expenses 265,263 Federal income tax expense (books) Totals 13,484,678 13,484,678

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started