Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Requirements: 1. prepare journal entries with transaction no not date 2. reversing entries for applicable items (require date) 3. prepare entries that should be made

Requirements:

1. prepare journal entries with transaction no not date

2. reversing entries for applicable items (require date)

3. prepare entries that should be made when the related cash transactions occur.(require date)

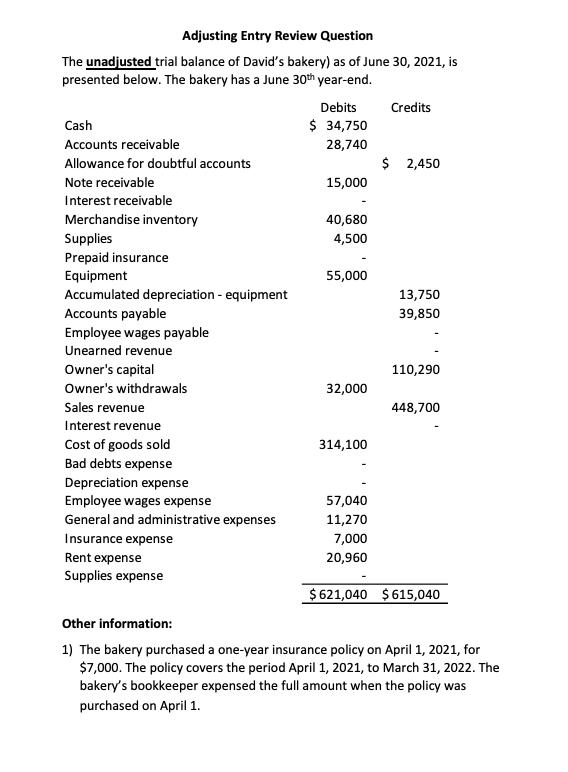

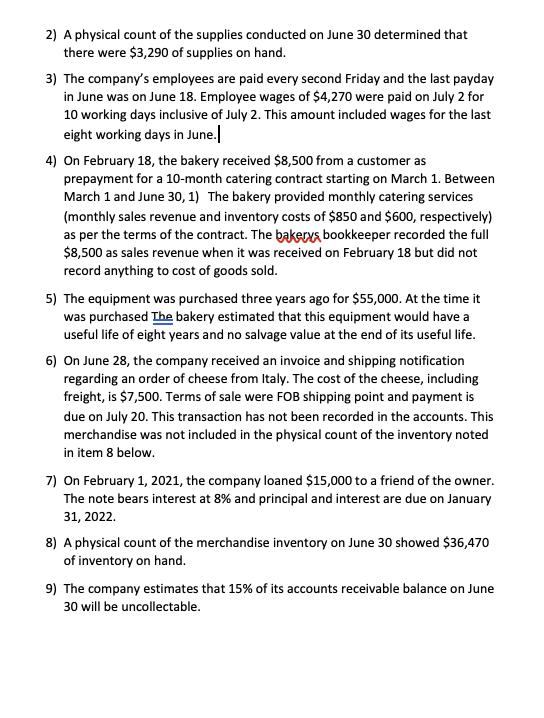

Adjusting Entry Review Question The unadjusted trial balance of David's bakery) as of June 30, 2021, is presented below. The bakery has a June 30th year-end. Cash Accounts receivable Allowance for doubtful accounts Note receivable Interest receivable Merchandise inventory Supplies Prepaid insurance Equipment Accumulated depreciation - equipment Accounts payable Employee wages payable Unearned revenue Owner's capital Owner's withdrawals Sales revenue Interest revenue Cost of goods sold Bad debts expense Depreciation expense Employee wages expense General and administrative expenses Insurance expense Rent expense Supplies expense Debits $ 34,750 28,740 15,000 40,680 4,500 55,000 32,000 314,100 57,040 11,270 7,000 20,960 Credits $ 2,450 13,750 39,850 110,290 448,700 $621,040 $615,040 Other information: 1) The bakery purchased a one-year insurance policy on April 1, 2021, for $7,000. The policy covers the period April 1, 2021, to March 31, 2022. The bakery's bookkeeper expensed the full amount when the policy was purchased on April 1.

Step by Step Solution

★★★★★

3.55 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Transaction No 1 Debit Prepaid Insurance 7000 Credit Cash 7000 Transaction No 2 Debit Supplies 3290 Credit Cash 3290 Transaction No 3 Debit Employee Wages Expense 4270 Credit Employee Wages Payable 42...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started