Answered step by step

Verified Expert Solution

Question

1 Approved Answer

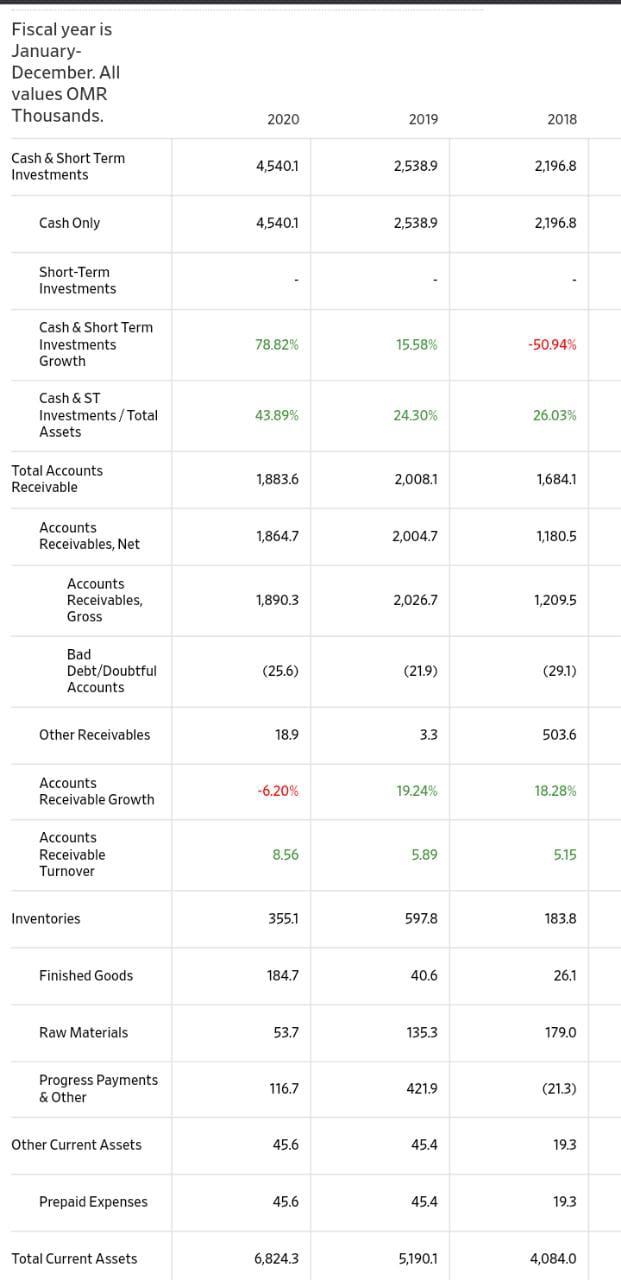

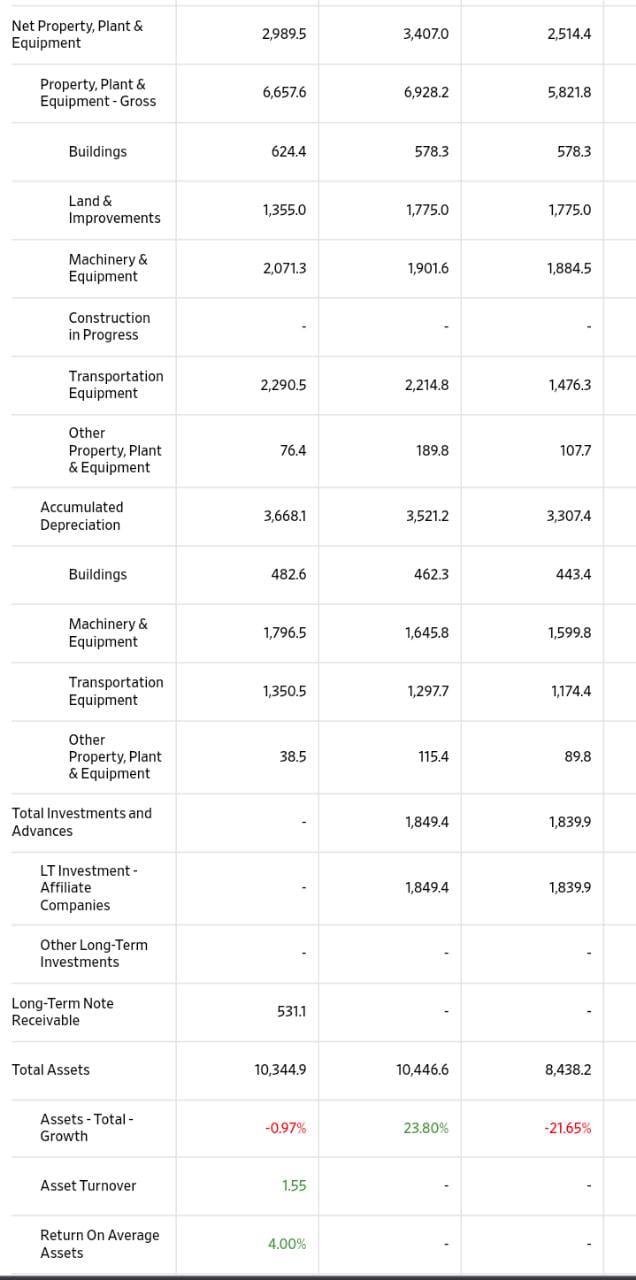

Requirment 1. Vertical Analysis of Balance sheet 2. Horizontal Analysis of Balance sheet PLEASE ANSWER IN DETAIL Net Property, Plant & Equipment 2,989.5 3,407.0 2.514.4

Requirment

1. Vertical Analysis of Balance sheet

2. Horizontal Analysis of Balance sheet

PLEASE ANSWER IN DETAIL

Net Property, Plant & Equipment 2,989.5 3,407.0 2.514.4 Property, Plant & Equipment - Gross 6,657.6 6,928.2 5,821.8 Buildings 624.4 578.3 578.3 Land & Improvements 1,355.0 1,775.0 1,775.0 Machinery & Equipment 2,071.3 1.901.6 1,884.5 Construction in Progress Transportation Equipment 2,290.5 2,214.8 1,476.3 Other Property, Plant & Equipment 76.4 189.8 107.7 Accumulated Depreciation 3,668.1 3,521.2 3,307.4 Buildings 482.6 462.3 443.4 Machinery & Equipment 1.796.5 1,645.8 1,599.8 Transportation Equipment 1,350.5 1,297.7 1,174.4 Other Property, Plant & Equipment 38.5 115.4 89.8 Total Investments and Advances 1,849.4 1,839.9 LT Investment Affiliate Companies 1,849.4 1,839.9 Other Long-Term Investments Long-Term Note Receivable 531.1 Total Assets 10,344.9 10,446.6 8,438.2 Assets - Total - Growth -0.97% 23.80% -21.65% Asset Turnover 1.55 Return On Average 4.00% Assets Net Property, Plant & Equipment 2,989.5 3,407.0 2.514.4 Property, Plant & Equipment - Gross 6,657.6 6,928.2 5,821.8 Buildings 624.4 578.3 578.3 Land & Improvements 1,355.0 1,775.0 1,775.0 Machinery & Equipment 2,071.3 1.901.6 1,884.5 Construction in Progress Transportation Equipment 2,290.5 2,214.8 1,476.3 Other Property, Plant & Equipment 76.4 189.8 107.7 Accumulated Depreciation 3,668.1 3,521.2 3,307.4 Buildings 482.6 462.3 443.4 Machinery & Equipment 1.796.5 1,645.8 1,599.8 Transportation Equipment 1,350.5 1,297.7 1,174.4 Other Property, Plant & Equipment 38.5 115.4 89.8 Total Investments and Advances 1,849.4 1,839.9 LT Investment Affiliate Companies 1,849.4 1,839.9 Other Long-Term Investments Long-Term Note Receivable 531.1 Total Assets 10,344.9 10,446.6 8,438.2 Assets - Total - Growth -0.97% 23.80% -21.65% Asset Turnover 1.55 Return On Average 4.00% AssetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started