requirment is in the first picture at the bottom of the page!

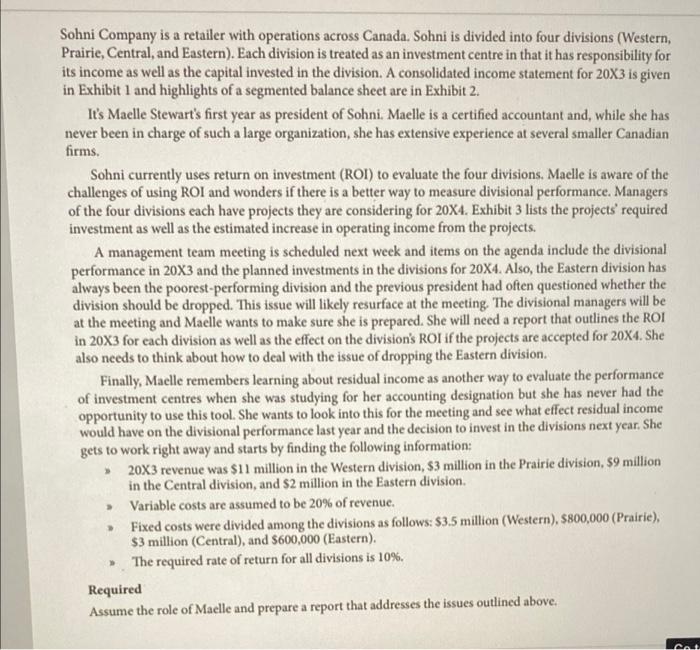

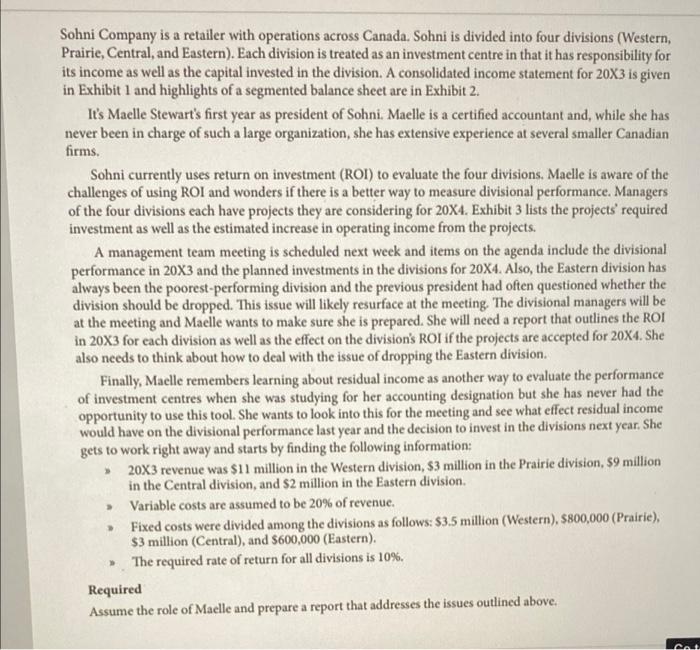

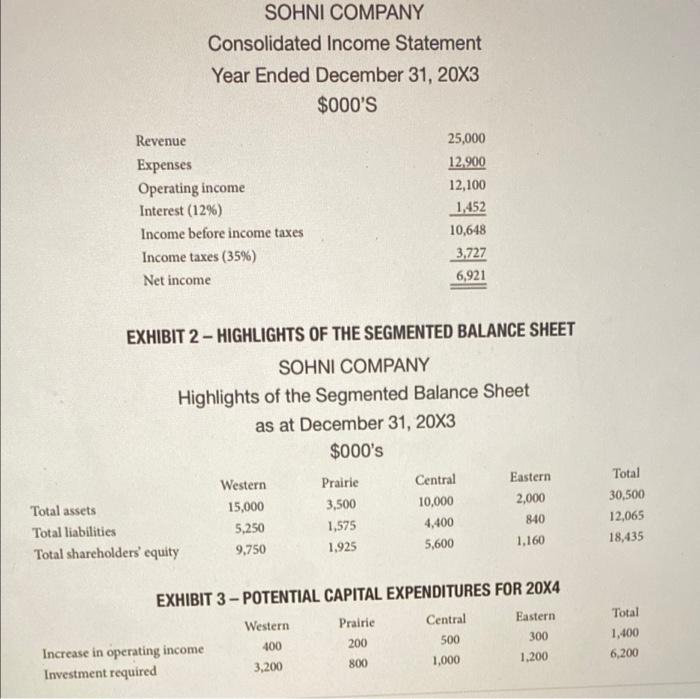

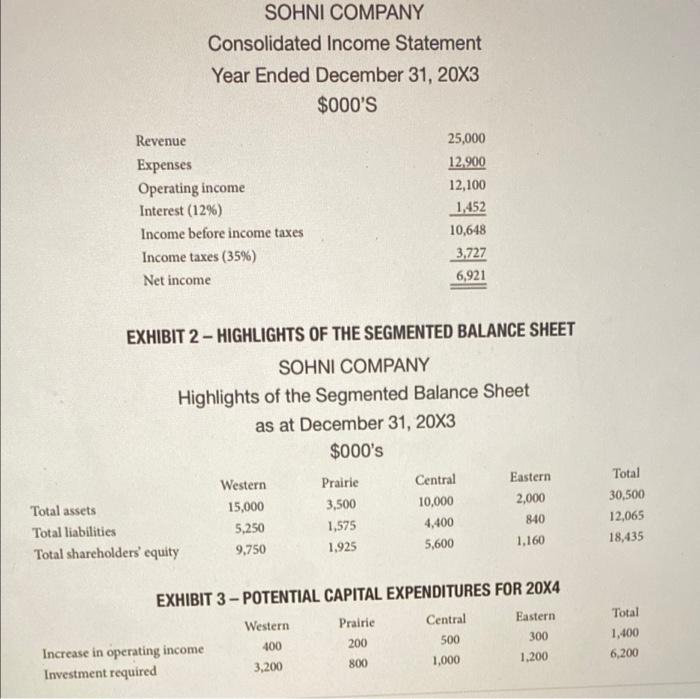

Sohni Company is a retailer with operations across Canada. Sohni is divided into four divisions (Western, Prairie, Central, and Eastern). Each division is treated as an investment centre in that it has responsibility for its income as well as the capital invested in the division. A consolidated income statement for 20X3 is given in Exhibit 1 and highlights of a segmented balance sheet are in Exhibit 2. It's Maelle Stewart's first year as president of Sohni. Maelle is a certified accountant and, while she has never been in charge of such a large organization, she has extensive experience at several smaller Canadian firms. Sohni currently uses return on investment (ROI) to evaluate the four divisions. Maelle is aware of the challenges of using ROI and wonders if there is a better way to measure divisional performance Managers of the four divisions each have projects they are considering for 20X4. Exhibit 3 lists the projects' required investment as well as the estimated increase in operating income from the projects. A management team meeting is scheduled next week and items on the agenda include the divisional performance in 20x3 and the planned investments in the divisions for 20X4. Also, the Eastern division has always been the poorest-performing division and the previous president had often questioned whether the division should be dropped. This issue will likely resurface at the meeting. The divisional managers will be at the meeting and Maelle wants to make sure she is prepared. She will need a report that outlines the ROI in 20X3 for each division as well as the effect on the division's ROI if the projects are accepted for 20X4. She also needs to think about how to deal with the issue of dropping the Eastern division. Finally, Maelle remembers learning about residual income as another way to evaluate the performance of investment centres when she was studying for her accounting designation but she has never had the opportunity to use this tool. She wants to look into this for the meeting and see what effect residual income would have on the divisional performance last year and the decision to invest in the divisions next year. She gets to work right away and starts by finding the following information: 20x3 revenue was $11 million in the Western division, $3 million in the Prairie division, $9 million in the Central division, and $2 million in the Eastern division. Variable costs are assumed to be 20% of revenue. Fixed costs were divided among the divisions as follows: 53.5 million (Western), $800,000 (Prairie), $3 million (Central), and $600,000 (Eastern). The required rate of return for all divisions is 10%. Required Assume the role of Maelle and prepare a report that addresses the issues outlined above. Cat SOHNI COMPANY Consolidated Income Statement Year Ended December 31, 20X3 $000'S Revenue Expenses Operating income Interest (12%) Income before income taxes Income taxes (35%) Net income 25,000 12.900 12,100 1,452 10,648 3,727 6,921 EXHIBIT 2 - HIGHLIGHTS OF THE SEGMENTED BALANCE SHEET SOHNI COMPANY Highlights of the Segmented Balance Sheet as at December 31, 20X3 $000's Western Prairie Central Eastern Total assets 15,000 3,500 10,000 2,000 Total liabilities 5,250 1,575 4,400 840 Total shareholders' equity 9,750 1.925 1,160 Total 30,500 12,065 18,435 5,600 EXHIBIT 3 - POTENTIAL CAPITAL EXPENDITURES FOR 20X4 Western Prairie Central Eastern Increase in operating income 400 200 500 300 Investment required 3,200 800 1,000 1,200 Total 1,400 6,200