Answered step by step

Verified Expert Solution

Question

1 Approved Answer

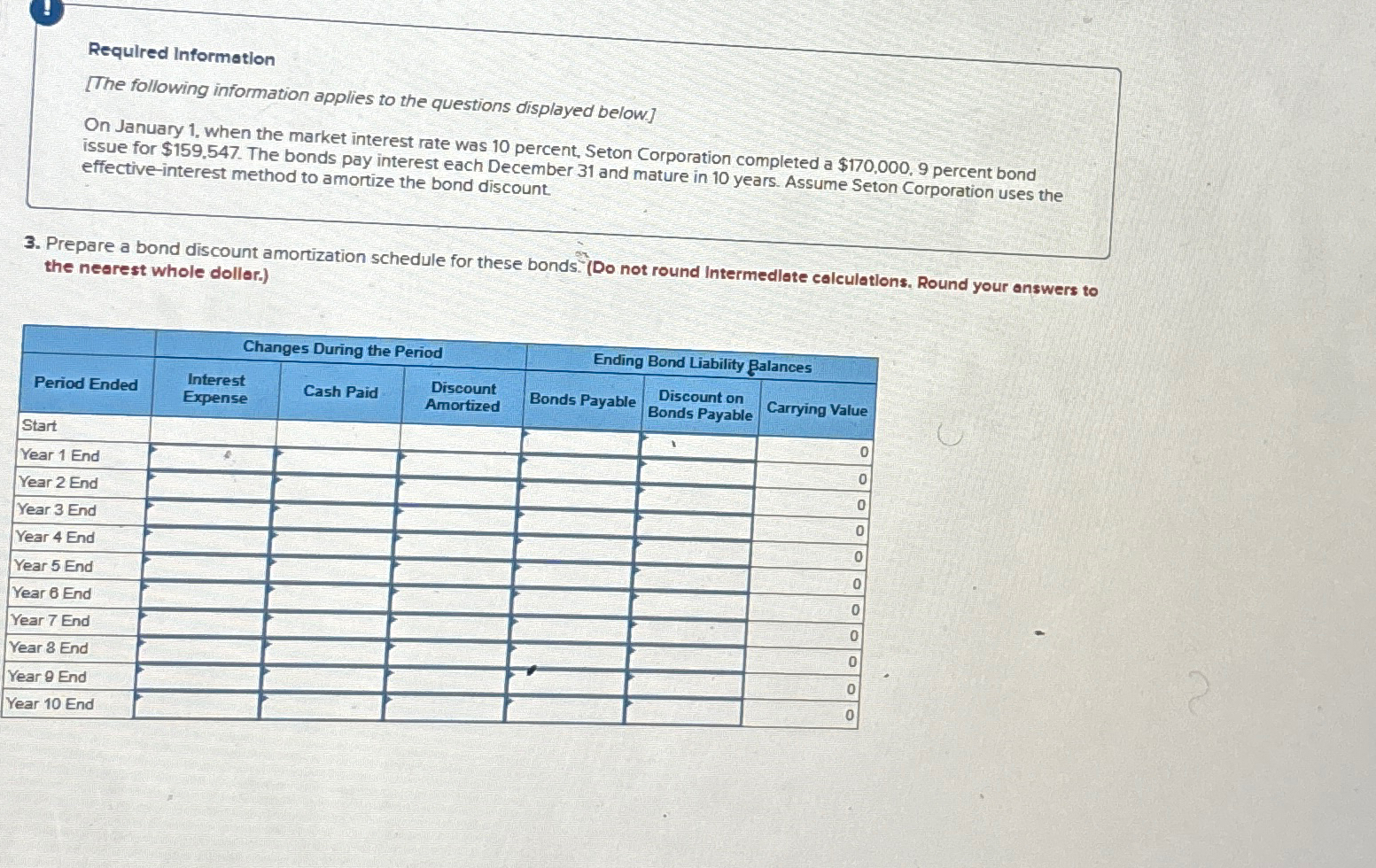

Requlred Information [ The following information applies to the questions displayed below ] On January 1 , when the market interest rate was 1 0

Requlred Information

The following information applies to the questions displayed below

On January when the market interest rate was percent, Seton Corporation completed a $ percent bond issue for $ The bonds pay interest each December and mature in years. Assume Seton Corporation uses the effectiveinterest method to amortize the bond discount.

Prepare a bond discount amortization schedule for these bonds." Do not round Intermedlate calculatlons. Round your answers to the nearest whole dollor.

tablePeriod Ended,Changes During the Period,Ending Bond Liability BalancestableInterestExpenseCash Paid,tableDiscountAmortizedBonds Payable,tableDiscount onBonds PayableCarrying ValueStartYear End,Year End,,,,,,Year End,,,,Year End,,,,Year End,,,,,,Year End,,,,rtableYear EndEYear End,,,,Year End,,,,,Year End,,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started