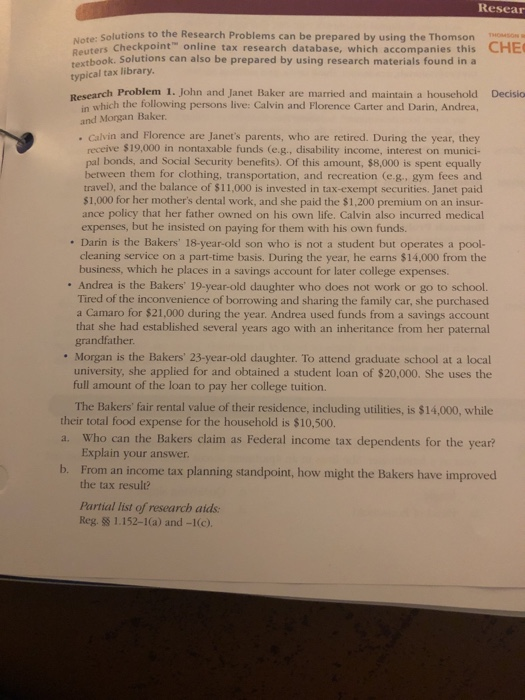

Resear Note: Solutions to the Research Problems can be prepared by using the Thomson TOASON uters Checkpoint online tax research database, which accompanies this CHE Reuters textbook. Solutions can also be prepared by using research materials found in a typical tax library Research Problem 1. John and Janet Baker are married and maintain a household Decisio in which the following persons live: Calvin and Florence Carter and Darin, Andrea, and Morgan Baker . Calvin and Florence are Janet's parents, who are retired. During the year, they receive $19,000 in nontaxable funds (e.g., disability income, interest on munici- pal bonds, and Social Security benefits). Of this amount, $8,000 is spent equally between them for clothing, transportation, and recreation (e.g., gym fees and travelD, and the balance of $11,000 is invested in tax-exempt securities. Janet paid $1,000 for her mother's dental work, and she paid the $1,200 premium on an insur- ance policy that her father owned on his own life. Calvin also incurred medical expenses, but he insisted on paying for them with his own funds. . Darin is the Bakers' 18-year-old son who is not a student but operates a pool- cleaning service on a part-time basis. During the year, he earns $14,000 from the business, which he places in a savings account for later college expenses. . Andrea is the Bakers' 19-year-old daughter who does not work or go to school. Tired of the inconvenience of borrowing and sharing the family car, she purchased a Camaro for $21,000 during the year. Andrea used funds from a savings account that she had established several years ago with an inheritance from her paternal grandfather. . Morgan is the Bakers 23-year-old daughter. To attend graduate school at a local university, she applied for and obtained a student loan of $20,000. She uses the full amount of the loan to pay her college tuition. The Bakers fair rental value of their residence, including utilities, is $14,000, while their total food expense for the household is $10,500. a. Who can the Bakers claim as Federal income tax dependents for the year? Explain your answer From an income tax planning standpoint, how might the Bakers have improved the tax result? b. Partial list of research aids Reg. s 1.152-1(a) and -I(c)