Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Research a news story regarding a lottery winner that ended up losing everything after their big windfall. Summarize the story and include the link to

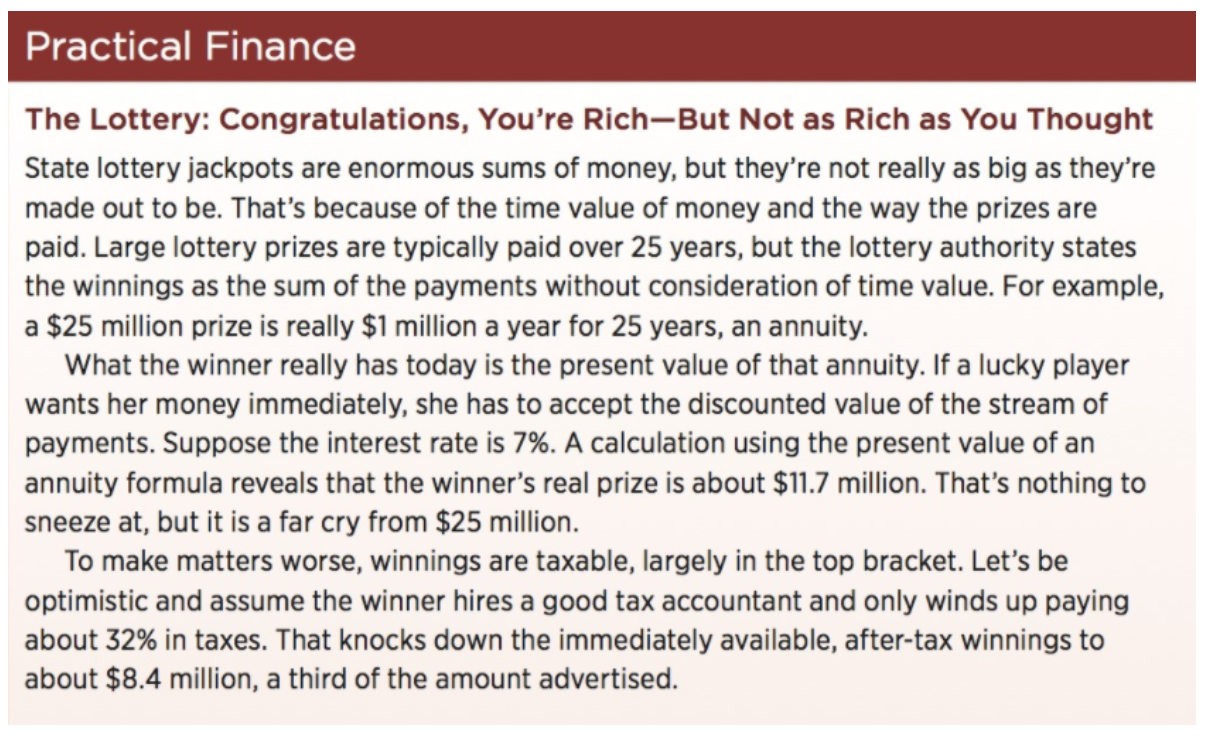

Research a news story regarding a lottery winner that ended up losing everything after their big windfall. Summarize the story and include the link to the news article. Also, address the following questions in your post:

- As the lottery winner's financial planner how would you have consulted the client regarding how the time value of money and taxes can impact their winnings?

- Using your knowledge from this course how would you advise your client to spend their winnings Two paragraph minimum (5-6 sentences for each paragraph)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started