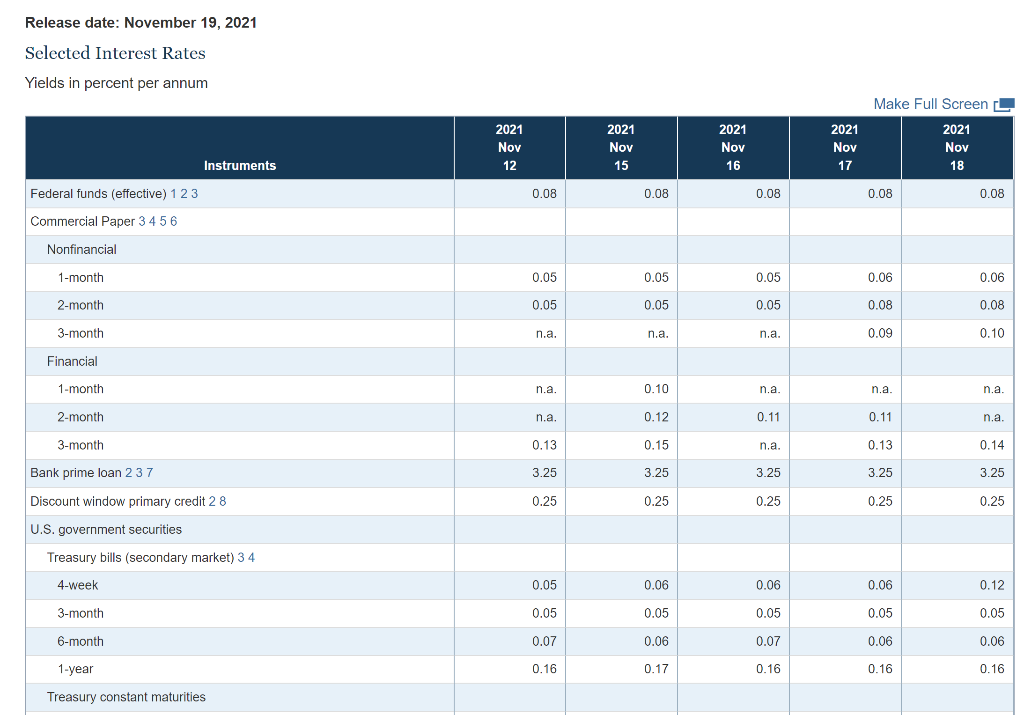

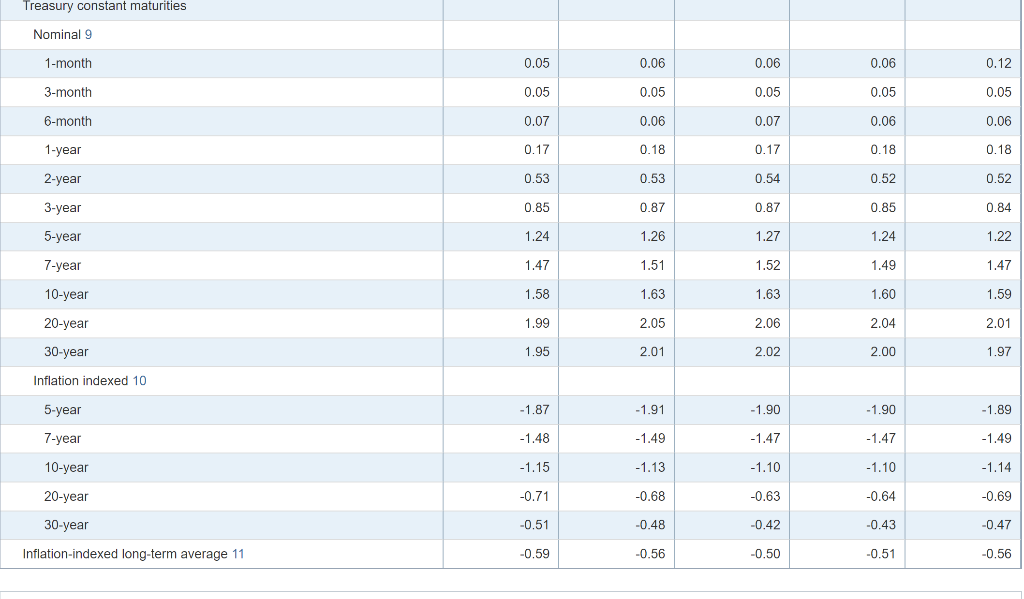

RESEARCH PROJECT on Class Inequality. While many of us confront credit card interest rates over 20%, another advantage for banks is their outrageously low borrowing costs. Approximately, what is the most recent effective Federal Funds Rate?

Release date: November 19, 2021 Selected Interest Rates Yields in percent per annum 2021 Nov 12 2021 Nov 15 2021 Nov 16 2021 Nov 17 Make Full Screen 2021 Nov 18 Instruments Federal funds (effective) 1 2 3 0.08 0.08 0.08 0.08 0.08 Commercial Paper 3456 Nonfinancial 1-month 0.05 0.05 0.05 0.06 0.06 2-month 0.05 0.05 0.05 0.08 0.08 3-month n.a. na. n.a. 0.09 0.10 Financial 1-month 1- n.a. 0.10 n.a n.a n.a. 2-month n.a. 0.12 0.11 0.11 n.a. 3-month 0.13 0.15 n.a. 0.13 0.14 Bank prime loan 2 37 3.25 3.25 3.25 3.25 3.25 Discount window primary credit 2 8 0.25 0.25 0.25 0.25 0.25 U.S. government securities Treasury bills (secondary market) 3 4 4-week 0.05 0.06 0.06 0.06 0.12 3-month 0.05 0.05 0.05 0.05 0.05 6-month 0.07 0.06 0.07 0.06 0.06 1-year 0.16 0.17 0.16 0.16 0.16 Treasury constant maturities Treasury constant maturities Nominal 9 1-month 0.05 0.06 0.06 0.06 0.12 3-month 0.05 0.05 0.05 0.05 0.05 6-month 0.07 0.06 0.07 0.06 0.06 1-year 0.17 0.18 0.17 0.18 0.18 2-year 0.53 0.53 0.54 0.52 0.52 3-year 0.85 0.87 0.87 0.85 0.84 5-year 1.24 1.26 1.27 1.24 1.22 7-year 1.47 1.51 1.52 1.49 1.47 10-year 1.58 1.63 1.63 1.60 1.59 20-year 1.99 2.05 2.06 2.04 2.01 30-year 1.95 2.01 2.02 2.00 1.97 Inflation indexed 10 5-year -1.87 -1.91 -1.90 -1.90 -1.89 7-year -1.48 -1.49 -1.47 -1.47 -1.49 10-year -1.15 -1.13 -1.10 -1.10 -1.14 20-year -0.71 -0.68 -0.63 -0.64 -0.69 30-year -0.51 -0.48 -0.42 -0.43 -0.47 Inflation-indexed long-term average 11 -0.59 -0.56 -0.50 -0.51 -0.56 Release date: November 19, 2021 Selected Interest Rates Yields in percent per annum 2021 Nov 12 2021 Nov 15 2021 Nov 16 2021 Nov 17 Make Full Screen 2021 Nov 18 Instruments Federal funds (effective) 1 2 3 0.08 0.08 0.08 0.08 0.08 Commercial Paper 3456 Nonfinancial 1-month 0.05 0.05 0.05 0.06 0.06 2-month 0.05 0.05 0.05 0.08 0.08 3-month n.a. na. n.a. 0.09 0.10 Financial 1-month 1- n.a. 0.10 n.a n.a n.a. 2-month n.a. 0.12 0.11 0.11 n.a. 3-month 0.13 0.15 n.a. 0.13 0.14 Bank prime loan 2 37 3.25 3.25 3.25 3.25 3.25 Discount window primary credit 2 8 0.25 0.25 0.25 0.25 0.25 U.S. government securities Treasury bills (secondary market) 3 4 4-week 0.05 0.06 0.06 0.06 0.12 3-month 0.05 0.05 0.05 0.05 0.05 6-month 0.07 0.06 0.07 0.06 0.06 1-year 0.16 0.17 0.16 0.16 0.16 Treasury constant maturities Treasury constant maturities Nominal 9 1-month 0.05 0.06 0.06 0.06 0.12 3-month 0.05 0.05 0.05 0.05 0.05 6-month 0.07 0.06 0.07 0.06 0.06 1-year 0.17 0.18 0.17 0.18 0.18 2-year 0.53 0.53 0.54 0.52 0.52 3-year 0.85 0.87 0.87 0.85 0.84 5-year 1.24 1.26 1.27 1.24 1.22 7-year 1.47 1.51 1.52 1.49 1.47 10-year 1.58 1.63 1.63 1.60 1.59 20-year 1.99 2.05 2.06 2.04 2.01 30-year 1.95 2.01 2.02 2.00 1.97 Inflation indexed 10 5-year -1.87 -1.91 -1.90 -1.90 -1.89 7-year -1.48 -1.49 -1.47 -1.47 -1.49 10-year -1.15 -1.13 -1.10 -1.10 -1.14 20-year -0.71 -0.68 -0.63 -0.64 -0.69 30-year -0.51 -0.48 -0.42 -0.43 -0.47 Inflation-indexed long-term average 11 -0.59 -0.56 -0.50 -0.51 -0.56