Answered step by step

Verified Expert Solution

Question

1 Approved Answer

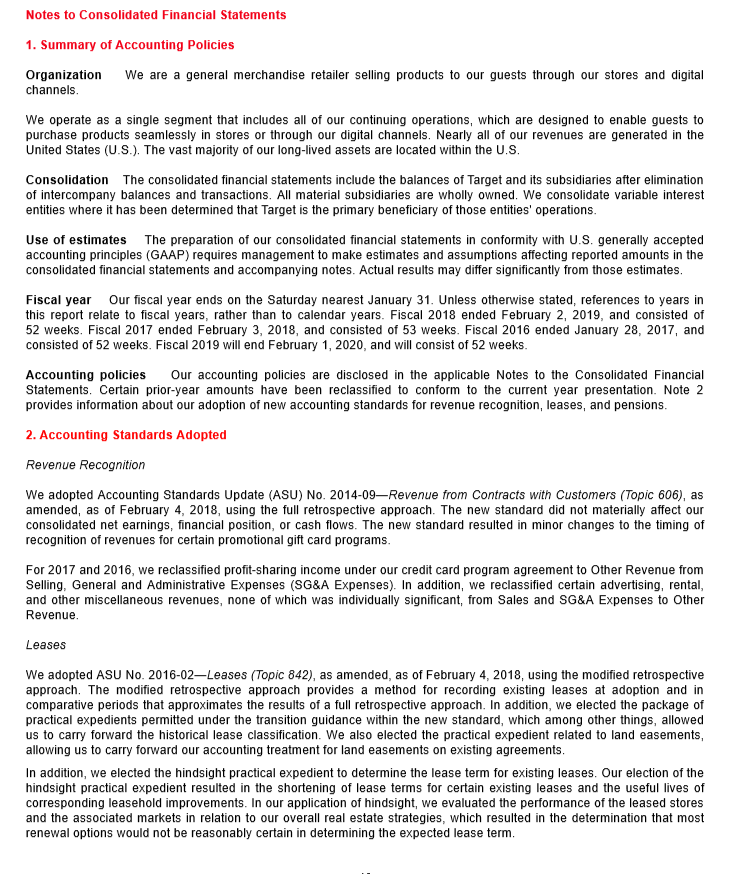

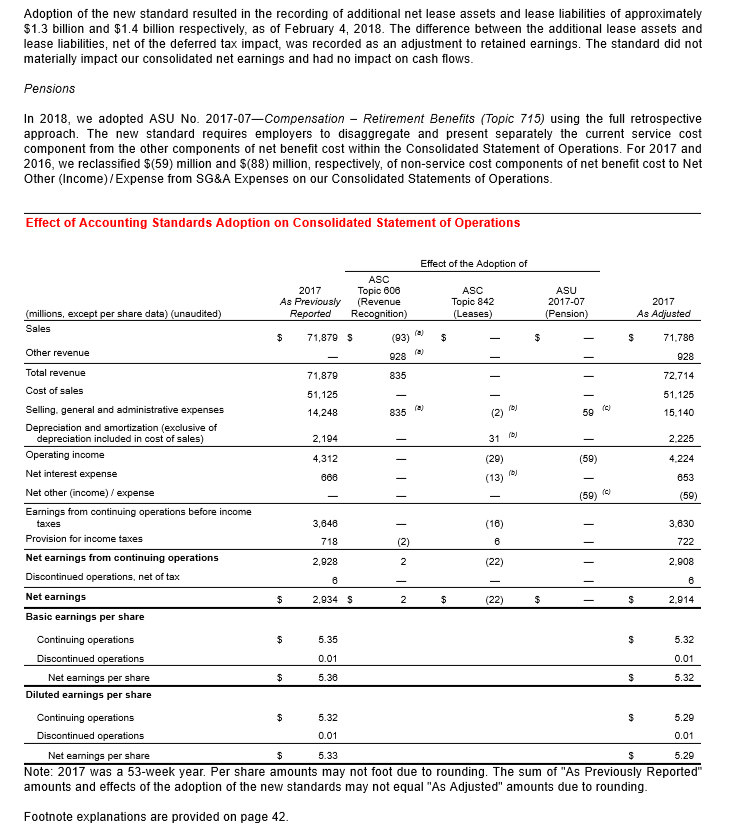

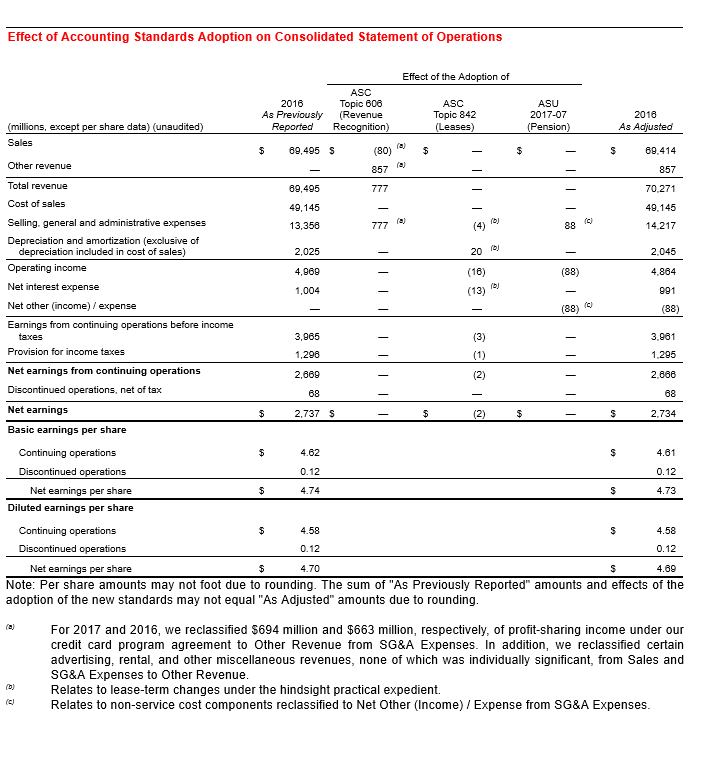

Research Target corporation. Access the corporation's annual report for the most recent year available and review the financial statements and related notes. Using APA format

- Research Target corporation. Access the corporation's annual report for the most recent year available and review the financial statements and related notes. Using APA format (no abstract necessary), write an 800- to 1,200-word essay in Microsoft Word answering the questions below.

- The essay must include an introduction, body, and conclusion, and address all parts of the question. Please note that originality is the expectation - your own words with reference support. Overuse of direct quotes and copy and paste are not acceptable and may be considered as plagiarism. (See your Syllabus for details.)

- Make sure to cite any references you use.?At a minimum, you must cite the annual report, the textbook, and 1 (one) peer reviewed article.

- All references must be cited in APA format as noted in the Lesson 0 instruction. Please refer to the grading matrix as shown in the Syllabus for essay assignments.

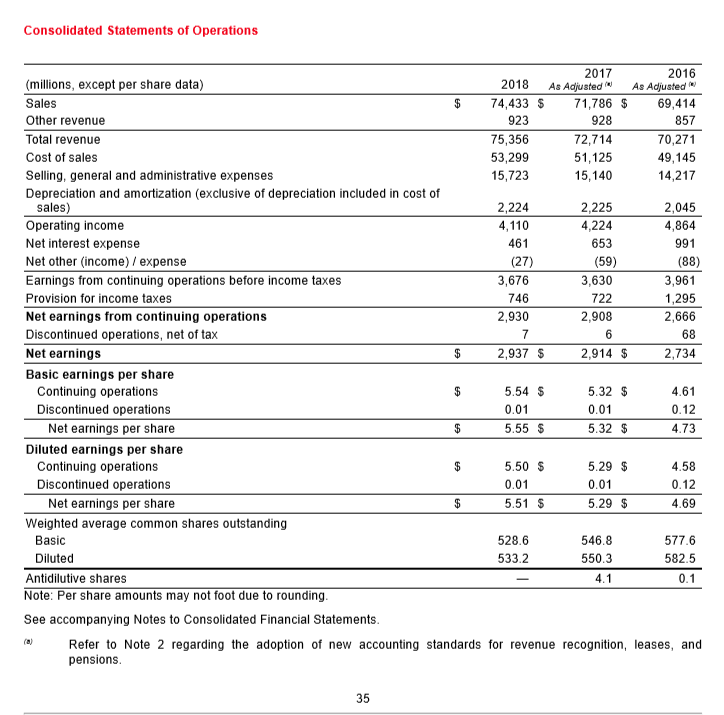

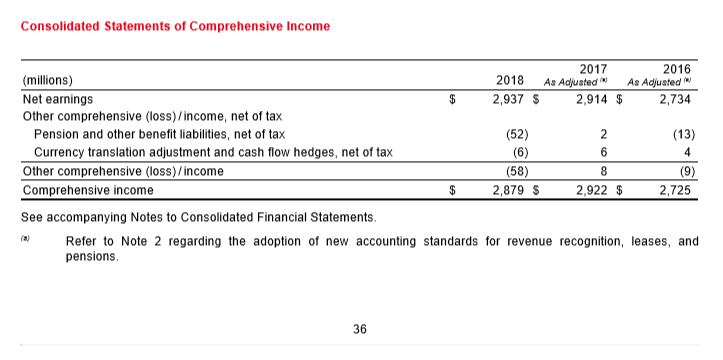

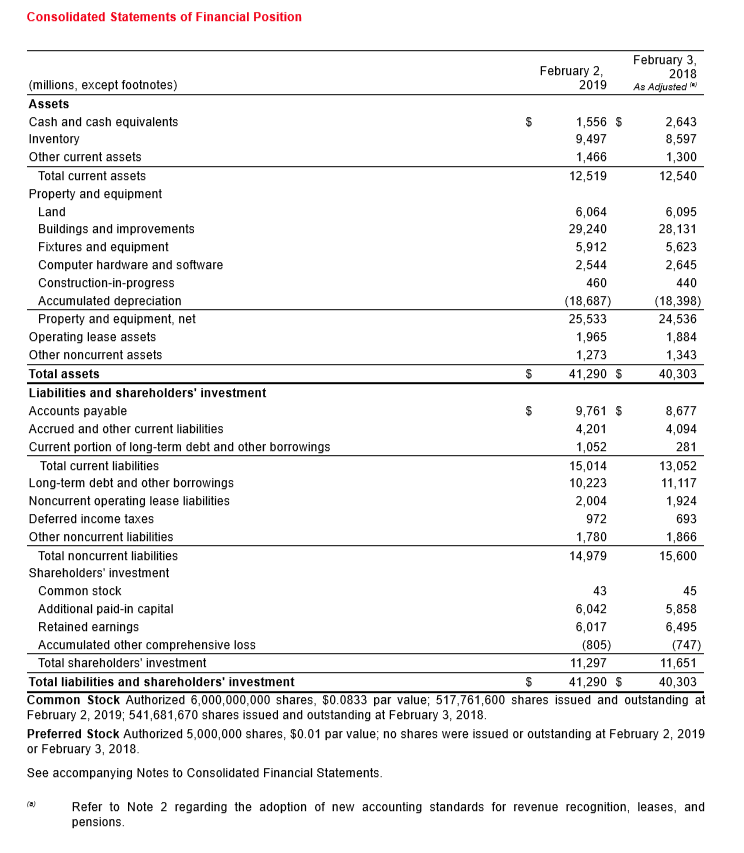

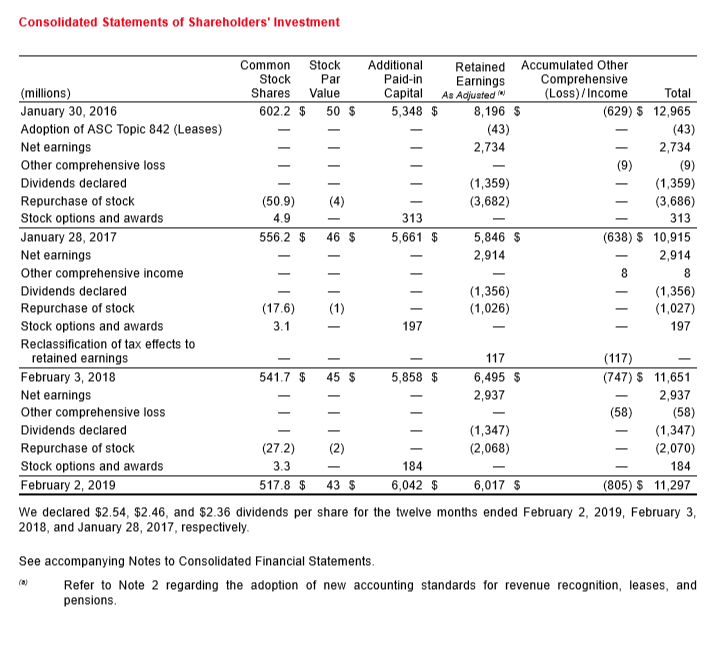

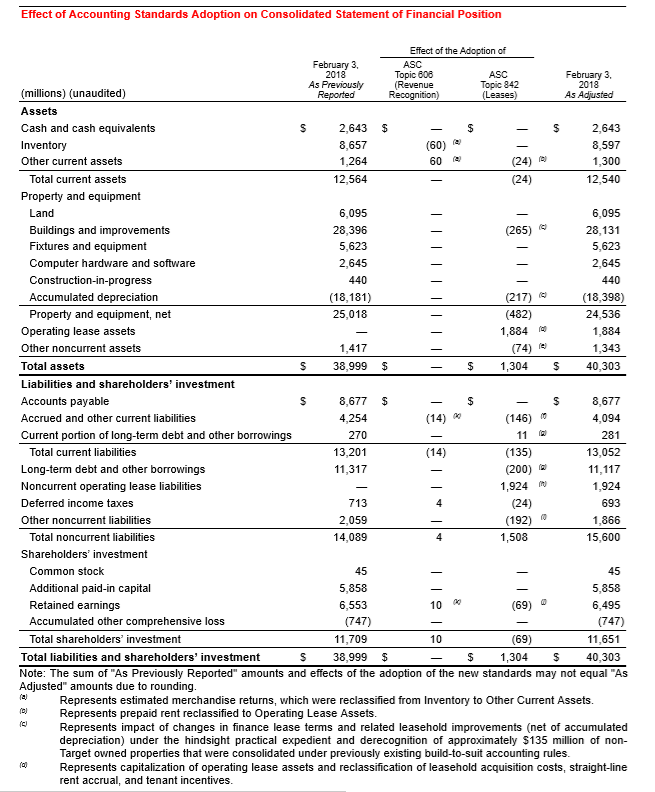

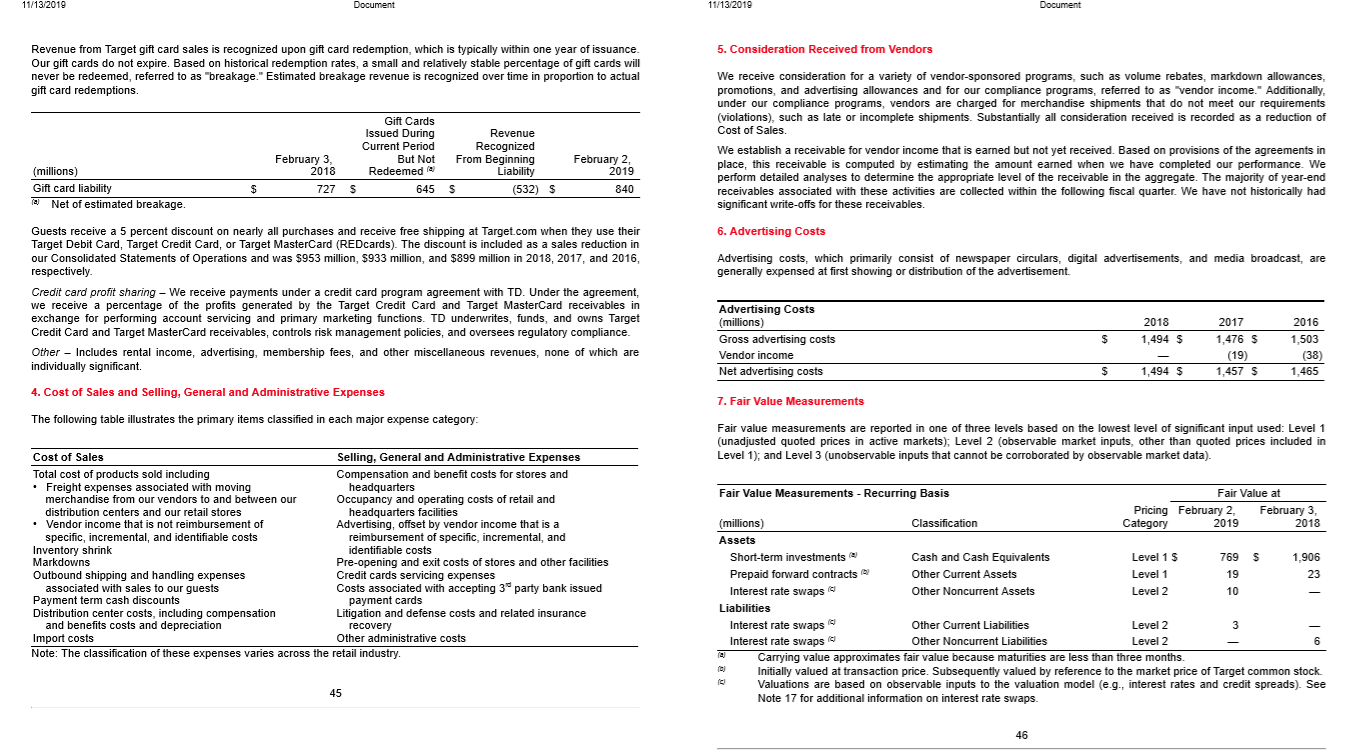

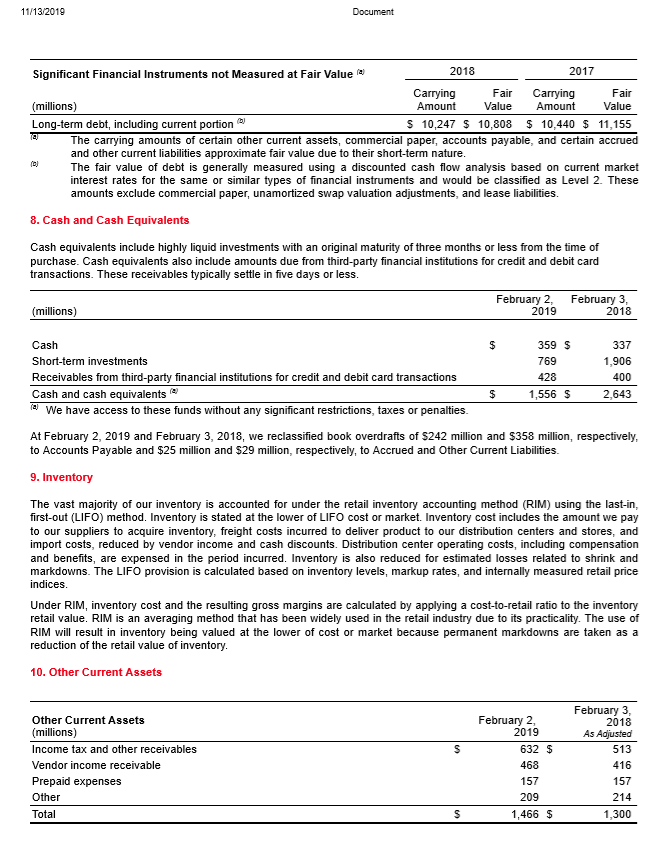

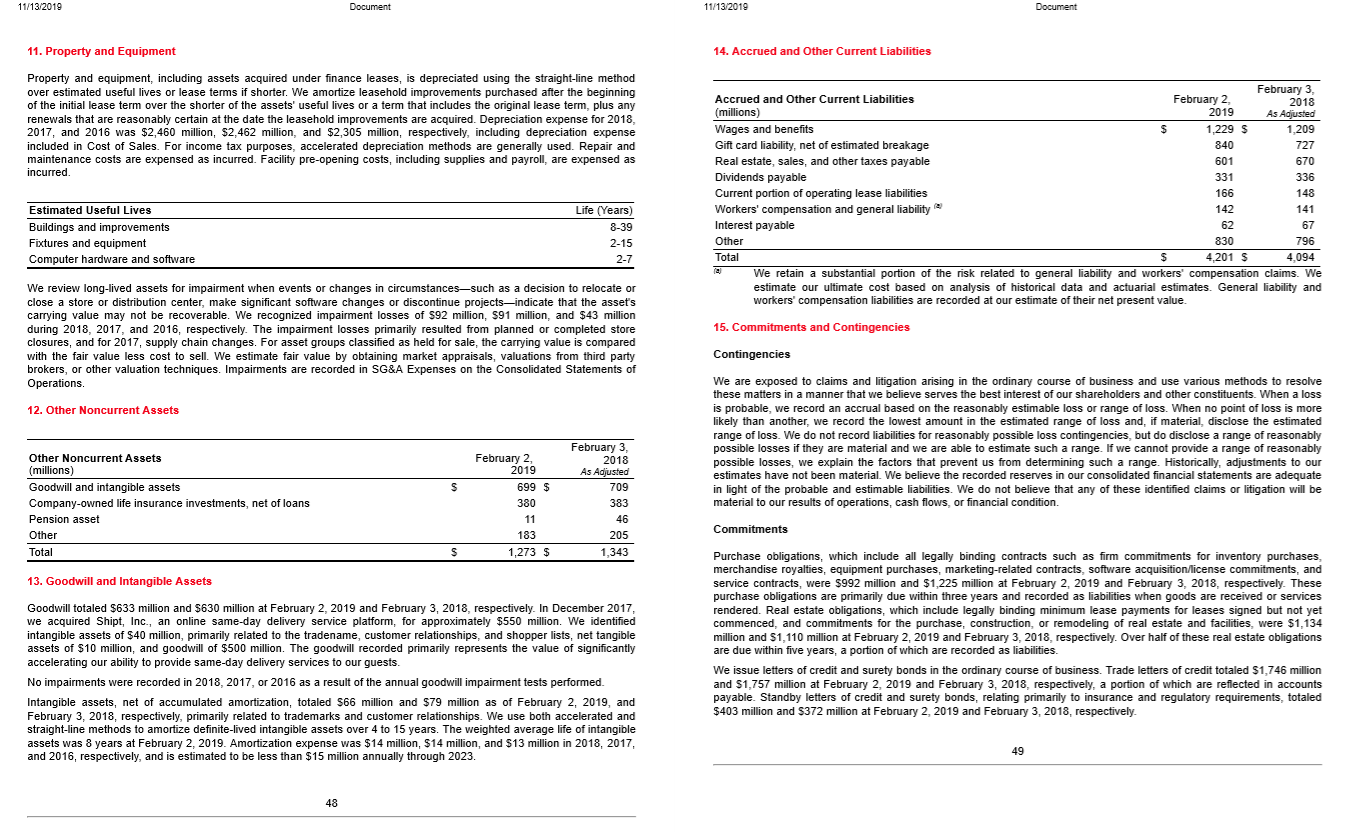

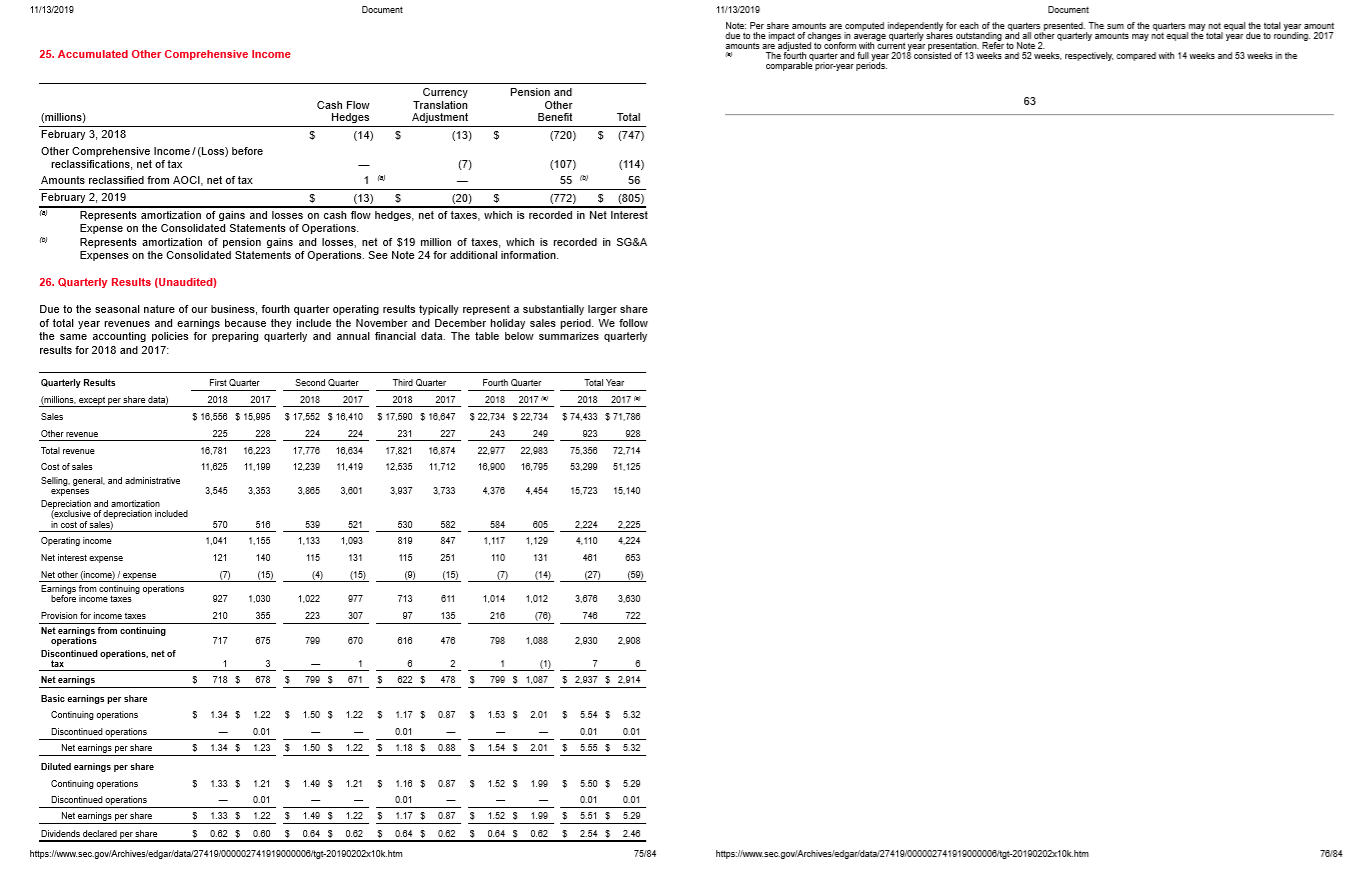

- Briefly describe the company(corporation), product, and the industry within which it operates. When is the fiscal year end for this company? What are the company's total assets, liabilities, and equity, Income (loss) for the most recent year?

- Identify all three inventory methods including their advantages and disadvantages. Identify the inventory method used by your selected corporation. How does this corporation value its inventories? Why do you think the corporation selected this inventory method? Explain your answer.

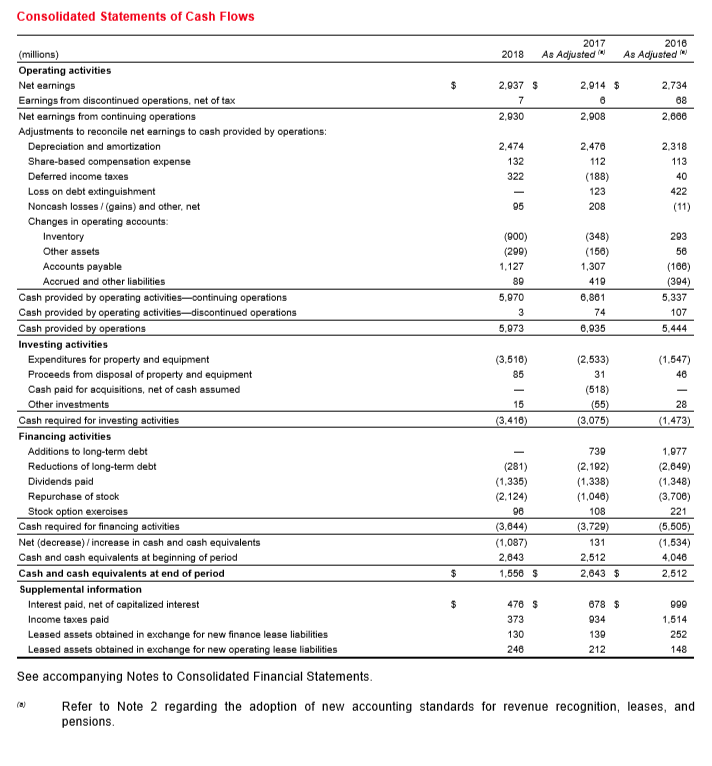

- Use the cost of goods sold formula to compute net purchases, which are not reported in the corporation's financial statements. Include your calculations.

- Analyze your selected corporation's strengths and weaknesses. Elaborate on why the strengths you identified are strengths. If you included any weaknesses, what would you suggest to your selected corporation to improve the weaknesses? Be specific. Support your assertion with research and cite your sources.

- Determine your selected corporation's inventory turnover and days' sales in inventory for the year ended. (Round each ratio to one decimal place.)

- Find your selected corporation's biggest competitor and access their annual report for the most recent year available. How do your selected corporation's inventory turnover and days' sales in inventory compare with their competitor's most recent annual report?

- Conclude the essay by answering the following questions: Do you consider this an optimal analysis for determining whether to invest in your selected corporation? Why or why not? The conclusion should be built on the information you provided in the body of the essay. Do not introduce new ideas in the conclusion.

Essay Questions

Report

?

?