Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Research the topic of annuities and retirement funds. In light of your new financial management knowledge, you have decided to invest $5000 at the

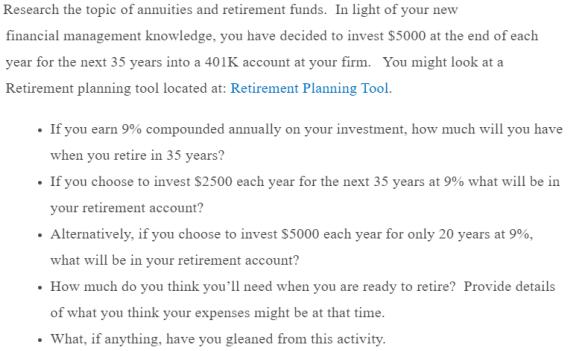

Research the topic of annuities and retirement funds. In light of your new financial management knowledge, you have decided to invest $5000 at the end of each year for the next 35 years into a 401K account at your firm. You might look at a Retirement planning tool located at: Retirement Planning Tool. If you earn 9% compounded annually on your investment, how much will you have when you retire in 35 years? If you choose to invest $2500 each year for the next 35 years at 9% what will be in your retirement account? Alternatively, if you choose to invest $5000 each year for only 20 years at 9%, what will be in your retirement account? How much do you think you'll need when you are ready to retire? Provide details of what you think your expenses might be at that time. What, if anything, have you gleaned from this activity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 st case Here the principal amount P 5000 Time n 35 years Rate r 9 per annum compounded annually Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started