Question

Researchers at Fredricks Feed and Farm have made a breakthrough. They believe that they can produce a new, environmentally friendly fertilizer at substantial cost savings

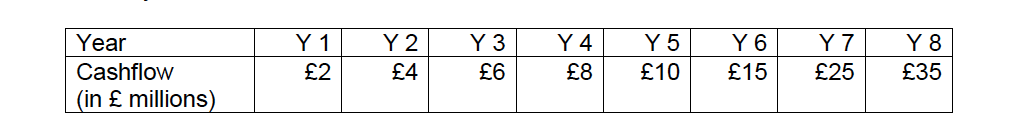

Researchers at Fredricks Feed and Farm have made a breakthrough. They believe that they can produce a new, environmentally friendly fertilizer at substantial cost savings over the companys existing line of fertilizer. The fertilizer will require a new plant that can be built immediately at a cost of 60 million. Financial managers estimate that the benefits of the new fertilizer will be 2 million at the end of the first year, followed by increasing benefits each year, as shown by the table below.

The financial managers responsible for this project estimate the cost of capital of 10% per year.

(a) Calculate the net present value (NPV) of the new fertilizer project.

(b) Calculate the internal rate of return (IRR) of the new fertilizer project

(c) Calculate the accounting rate of return (ARR) on the new fertilizer project. In calculating ARR you should assume that cash flows are equal to profit before depreciation and that the initial investment on the project will be depreciated on a straight line basis over the life of the project. You should also assume that the asset has no resale value at the end of its useful life.

(d) Calculate the profitability index for this new fertilizer project.

(e) Based on your answers calculated in (a) (e), interpret your findings and evaluate the attractiveness of this investment for Fredricks Feed and Farm.

\begin{tabular}{|l|r|r|r|r|r|r|r|r|} \hline Year & Y 1 & Y 2 & Y 3 & Y 4 & Y 5 & Y 6 & Y 7 & Y 8 \\ \hline Cashflow(inmillions) & 2 & 4 & 6 & 8 & 10 & 15 & 25 & 35 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started