Answered step by step

Verified Expert Solution

Question

1 Approved Answer

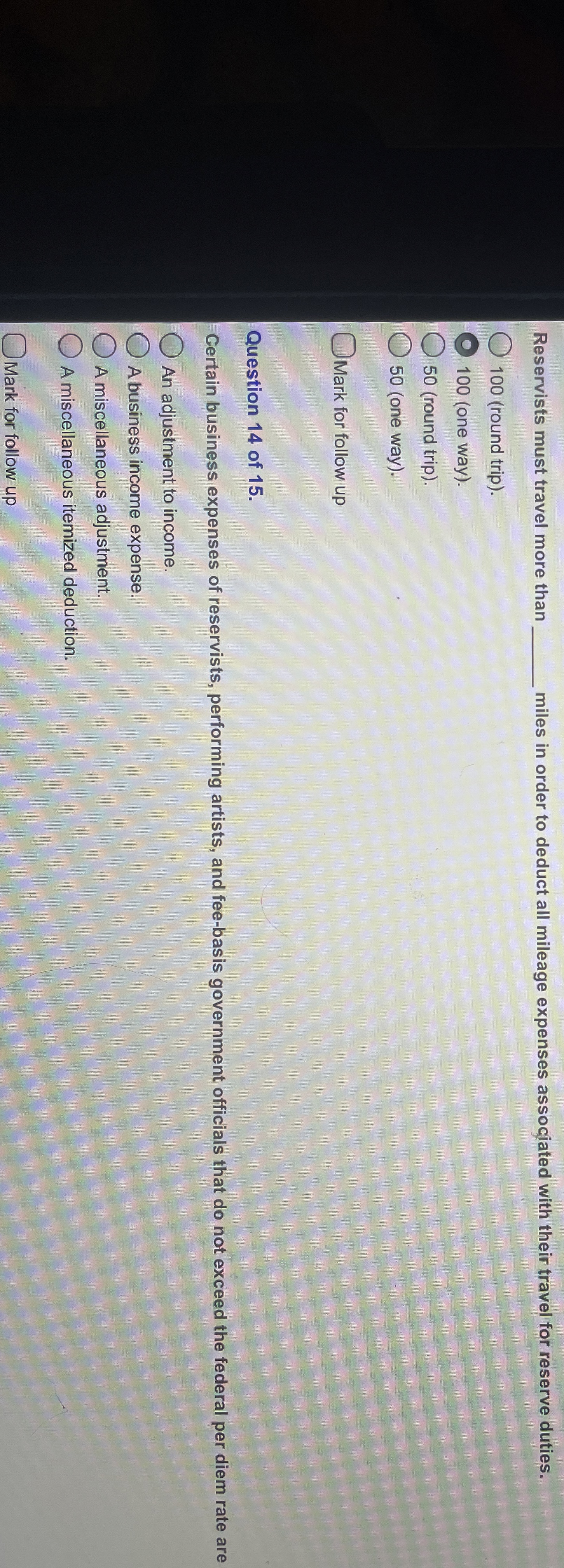

Reservists must travel more than miles in order to deduct all mileage expenses associated with their travel for reserve duties. 1 0 0 ( round

Reservists must travel more than miles in order to deduct all mileage expenses associated with their travel for reserve duties.

round trip

one way

round trip

one way

Mark for follow up

Question of

Certain business expenses of reservists, performing artists, and feebasis government officials that do not exceed the federal per diem rate are

An adjustment to income.

A business income expense.

A miscellaneous adjustment.

A miscellaneous itemized deduction.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started