Answered step by step

Verified Expert Solution

Question

1 Approved Answer

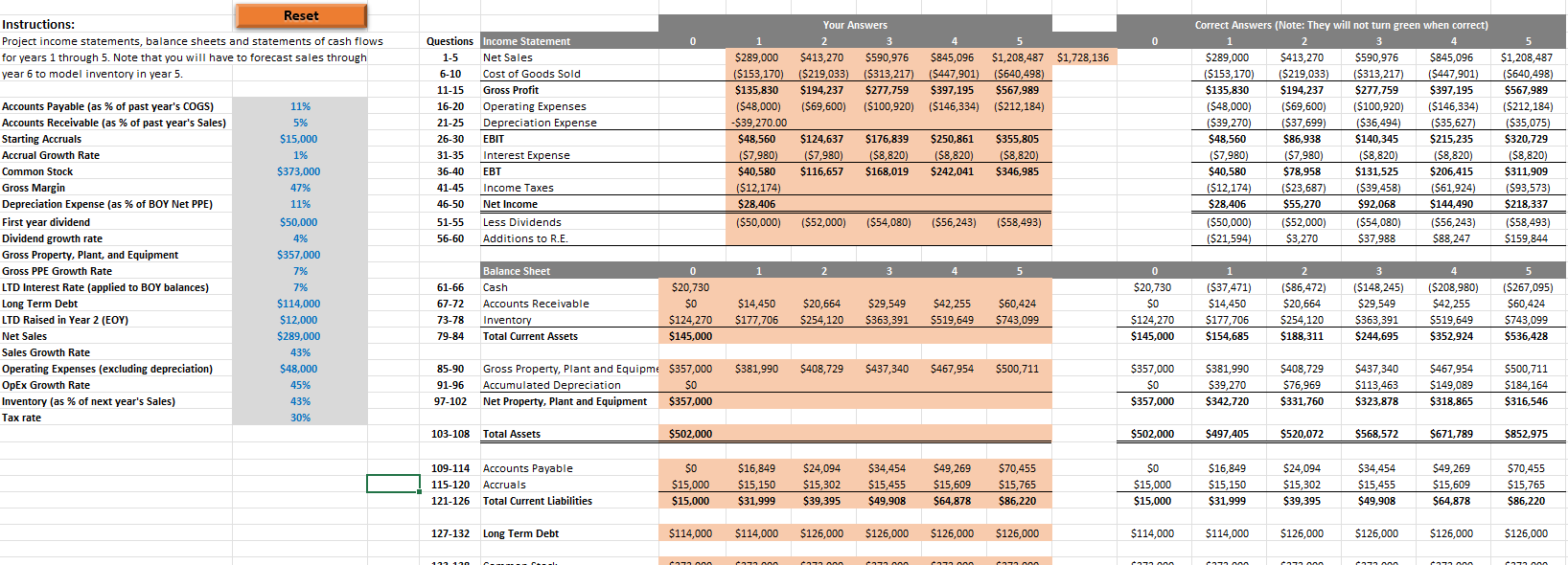

Reset Instructions: Project income statements, balance sheets and statements of cash flows for years 1 through 5. Note that you will have to forecast

Reset Instructions: Project income statements, balance sheets and statements of cash flows for years 1 through 5. Note that you will have to forecast sales through year 6 to model inventory in year 5. Questions Income Statement Your Answers 0 1 2 3 Correct Answers (Note: They will not turn green when correct) 5 1-5 Net Sales 6-10 Cost of Goods Sold 11-15 Gross Profit Accounts Payable (as % of past year's COGS) 11% 16-20 Operating Expenses Accounts Receivable (as % of past year's Sales) 5% 21-25 Depreciation Expense Starting Accruals $15,000 26-30 EBIT $289,000 $413,270 $590,976 $845,096 $1,208,487 $1,728,136 ($153,170) ($219,033) ($313,217) ($447,901) ($640,498) $135,830 $194,237 $277,759 $397,195 $567,989 ($48,000) ($69,600) ($100,920) ($146,334) ($212,184) -$39,270.00 $48,560 Accrual Growth Rate 1% 31-35 Interest Expense Common Stock $373,000 36-40 EBT Gross Margin 47% 41-45 Income Taxes Depreciation Expense (as % of BOY Net PPE) 11% 46-50 Net Income First year dividend $50,000 51-55 Less Dividends Dividend growth rate 4% 56-60 Additions to R.E. 1 2 3 $289,000 $413,270 $590,976 $845,096 $1,208,487 ($153,170) ($219,033) ($313,217) ($447,901) ($640,498) $135,830 $194,237 $277,759 $397,195 $567,989 ($48,000) ($69,600) ($100,920) ($146,334) ($212,184) ($39,270) ($37,699) ($36,494) ($35,627) ($35,075) 4 5 $124,637 $176,839 $250,861 $355,805 ($7,980) ($7,980) ($8,820) ($8,820) ($8,820) $40,580 $116,657 $168,019 $242,041 $346,985 ($12,174) $28,406 $48,560 $86,938 $140,345 $215,235 $320,729 ($7,980) ($7,980) ($8,820) ($8,820) ($8,820) $40,580 $78,958 $131,525 $206,415 $311,909 ($12,174) ($23,687) ($39,458) ($61,924) ($93,573) ($50,000) ($52,000) ($54,080) ($56,243) ($58,493) $28,406 $55,270 ($50,000) ($52,000) ($21,594) $3,270 $92,068 $144,490 $218,337 ($54,080) ($56,243) ($58,493) $37,988 $88,247 $159,844 0 Gross Property, Plant, and Equipment $357,000 Gross PPE Growth Rate 7% Balance Sheet 0 1 2 3 4 5 LTD Interest Rate (applied to BOY balances) 7% 61-66 Cash $20,730 Long Term Debt $114,000 67-72 Accounts Receivable LTD Raised in Year 2 (EOY) $12,000 73-78 Inventory Net Sales $289,000 79-84 Total Current Assets $0 $14,450 $20,664 $124,270 $177,706 $254,120 $145,000 $29,549 $42,255 $363,391 $519,649 $60,424 $743,099 0 $20,730 $0 1 2 3 4 5 ($37,471) $14,450 ($86,472) $20,664 $42,255 ($148,245) ($208,980) ($267,095) $29,549 $60,424 $124,270 $177,706 $254,120 $363,391 $519,649 $743,099 $145,000 $154,685 $188,311 $244,695 $352,924 $536,428 Sales Growth Rate 43% Operating Expenses (excluding depreciation) $48,000 85-90 OpEx Growth Rate 45% 91-96 Gross Property, Plant and Equipme $357,000 Accumulated Depreciation $381,990 $408,729 $437,340 $467,954 $500,711 $357,000 $381,990 $408,729 $437,340 $467,954 $500,711 Inventory (as % of next year's Sales) 43% 97-102 Net Property, Plant and Equipment $0 $357,000 $0 $357,000 $39,270 $76,969 $113,463 $149,089 $184,164 $342,720 $331,760 $323,878 $318,865 $316,546 Tax rate 30% 103-108 Total Assets $502,000 $502,000 $497,405 $520,072 $568,572 $671,789 $852,975 109-114 Accounts Payable $0 $16,849 $24,094 $34,454 $49,269 $70,455 $0 $16,849 $24,094 $34,454 $49,269 $70,455 115-120 Accruals $15,000 $15,150 $15,302 $15,455 $15,609 $15,765 $15,000 $15,150 $15,302 $15,455 $15,609 $15,765 121-126 Total Current Liabilities $15,000 $31,999 $39,395 $49,908 $64,878 $86,220 $15,000 $31,999 $39,395 $49,908 $64,878 $86,220 127-132 Long Term Debt $114,000 $114,000 $126,000 $126,000 $126,000 $126,000 $114,000 $114,000 $126,000 $126,000 $126,000 $126,000 433 130

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started