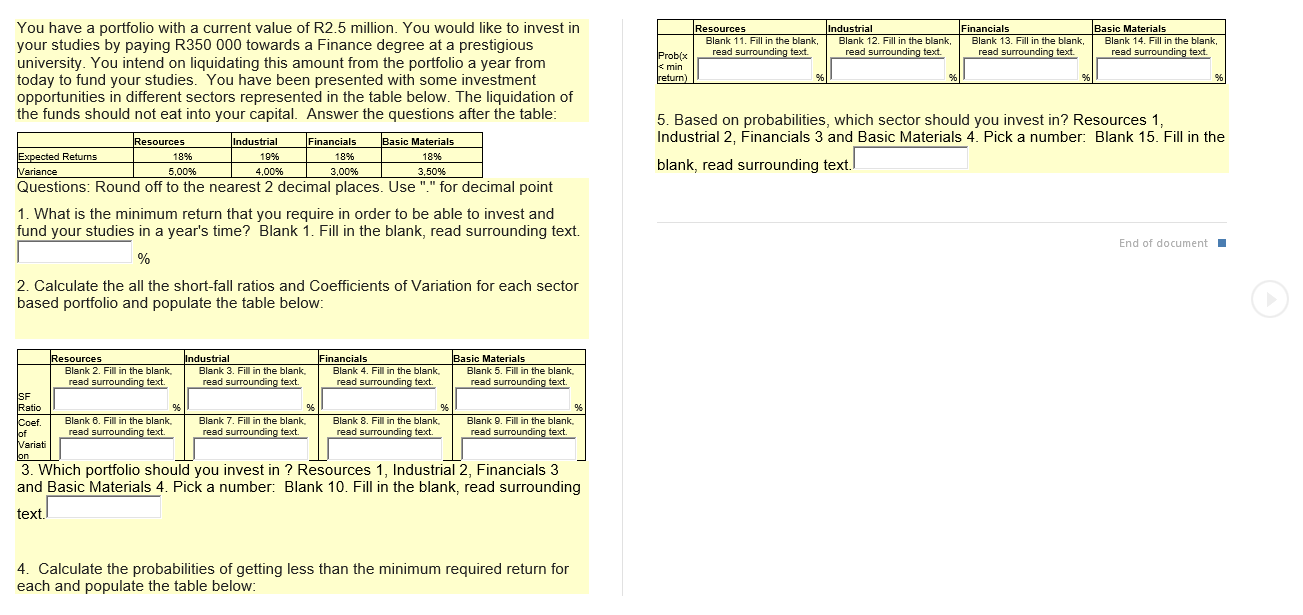

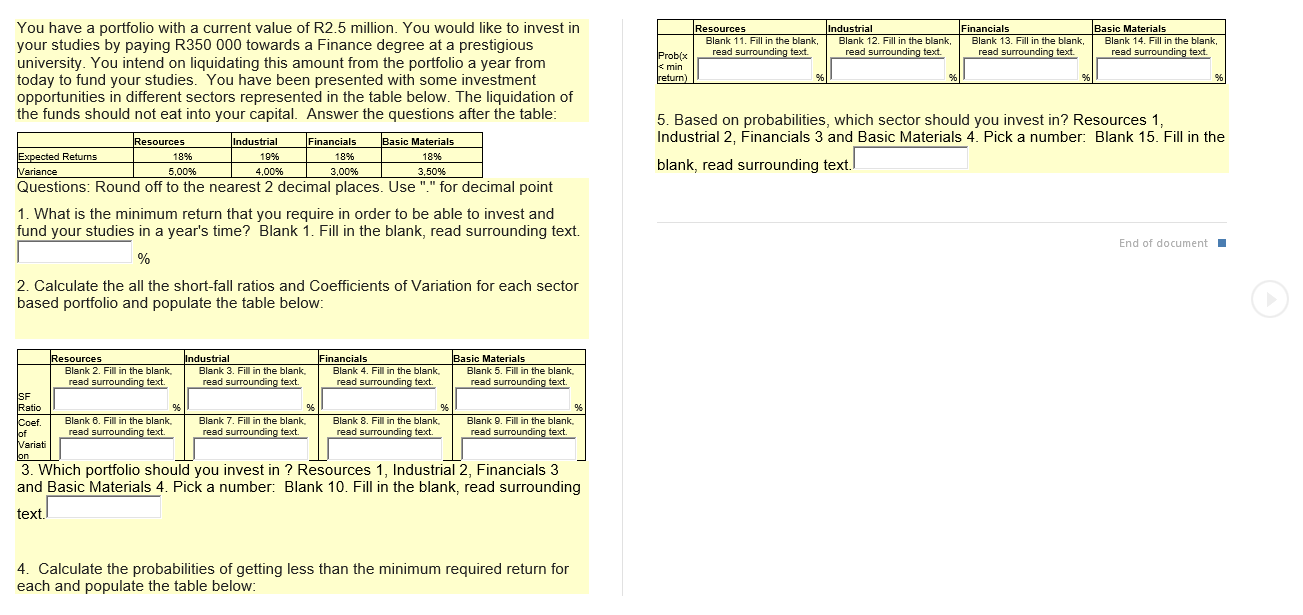

Resources Blank 11. Fill in the blank, read surrounding text. Industrial Blank 12. Fill in the blank, read surrounding text. Financials Blank 13. Fill in the blank, read surrounding text. Basic Materials Blank 14. Fill in the blank, read surrounding text. You have a portfolio with a current value of R2.5 million. You would like to invest in your studies by paying R350 000 towards a Finance degree at a prestigious university. You intend on liquidating this amount from the portfolio a year from today to fund your studies. You have been presented with some investment opportunities in different sectors represented in the table below. The liquidation of the funds should not eat into your capital. Answer the questions after the table: Probix k min return) % 5. Based on probabilities, which sector should you invest in? Resources 1, Industrial 2, Financials 3 and Basic Materials 4. Pick a number. Blank 15. Fill in the blank, read surrounding text. 3,50% Resources Industrial Financials Basic Materials Expected Returns 18% 19% 18% 18% Variance 5,00% 4,00% 3,00% Questions: Round off to the nearest 2 decimal places. Use "." for decimal point 1. What is the minimum return that you require in order to be able to invest and fund your studies in a year's time? Blank 1. Fill in the blank, read surrounding text. % End of document I 2. Calculate the all the short-fall ratios and Coefficients of Variation for each sector based portfolio and populate the table below: Industrial Blank 3. Fill in the blank. read surrounding text. Financials Blank 4. Fill in the blank. read surrounding text. Basic Materials Blank 5. Fill in the blank. read surrounding text. Resources Blank 2. Fill in the blank. read surrounding text. SF Ratio Coef. Blank 6. Fill in the blank. of read surrounding text. Variati lon Blank 7. Fill in the blank. read surrounding text. Blank 8. Fill in the blank, read surrounding text. %6 Blank 9. Fill in the blank. read surrounding text. 3. Which portfolio should you invest in ? Resources 1, Industrial 2, Financials 3 and Basic Materials 4. Pick a number: Blank 10. Fill in the blank, read surrounding text. 4. Calculate the probabilities of getting less than the minimum required return for each and populate the table below: Resources Blank 11. Fill in the blank, read surrounding text. Industrial Blank 12. Fill in the blank, read surrounding text. Financials Blank 13. Fill in the blank, read surrounding text. Basic Materials Blank 14. Fill in the blank, read surrounding text. You have a portfolio with a current value of R2.5 million. You would like to invest in your studies by paying R350 000 towards a Finance degree at a prestigious university. You intend on liquidating this amount from the portfolio a year from today to fund your studies. You have been presented with some investment opportunities in different sectors represented in the table below. The liquidation of the funds should not eat into your capital. Answer the questions after the table: Probix k min return) % 5. Based on probabilities, which sector should you invest in? Resources 1, Industrial 2, Financials 3 and Basic Materials 4. Pick a number. Blank 15. Fill in the blank, read surrounding text. 3,50% Resources Industrial Financials Basic Materials Expected Returns 18% 19% 18% 18% Variance 5,00% 4,00% 3,00% Questions: Round off to the nearest 2 decimal places. Use "." for decimal point 1. What is the minimum return that you require in order to be able to invest and fund your studies in a year's time? Blank 1. Fill in the blank, read surrounding text. % End of document I 2. Calculate the all the short-fall ratios and Coefficients of Variation for each sector based portfolio and populate the table below: Industrial Blank 3. Fill in the blank. read surrounding text. Financials Blank 4. Fill in the blank. read surrounding text. Basic Materials Blank 5. Fill in the blank. read surrounding text. Resources Blank 2. Fill in the blank. read surrounding text. SF Ratio Coef. Blank 6. Fill in the blank. of read surrounding text. Variati lon Blank 7. Fill in the blank. read surrounding text. Blank 8. Fill in the blank, read surrounding text. %6 Blank 9. Fill in the blank. read surrounding text. 3. Which portfolio should you invest in ? Resources 1, Industrial 2, Financials 3 and Basic Materials 4. Pick a number: Blank 10. Fill in the blank, read surrounding text. 4. Calculate the probabilities of getting less than the minimum required return for each and populate the table below