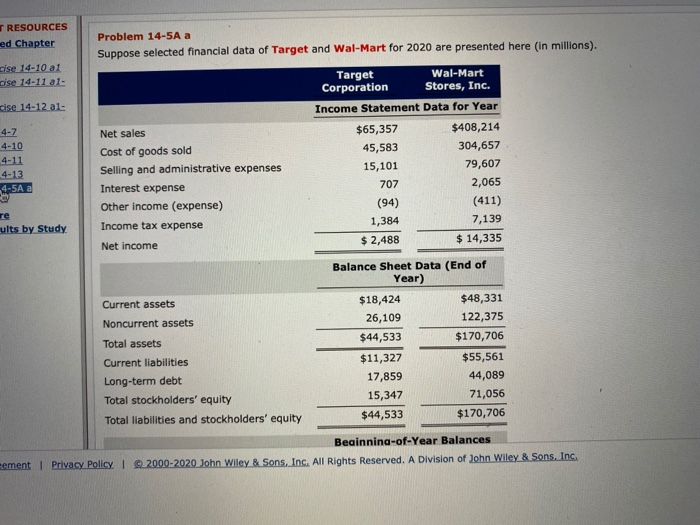

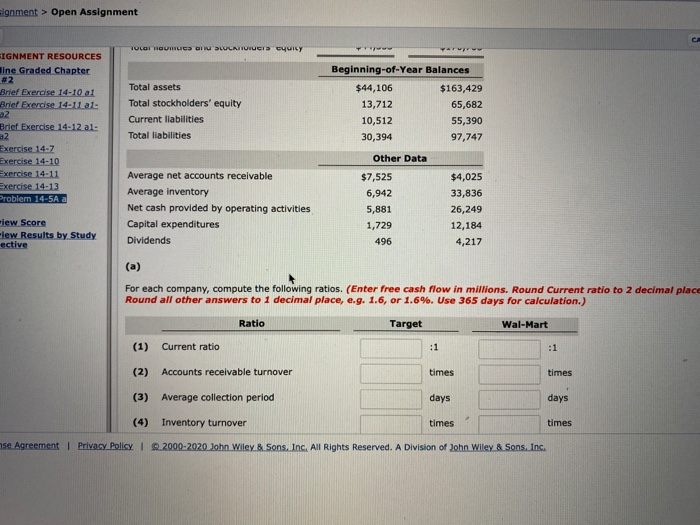

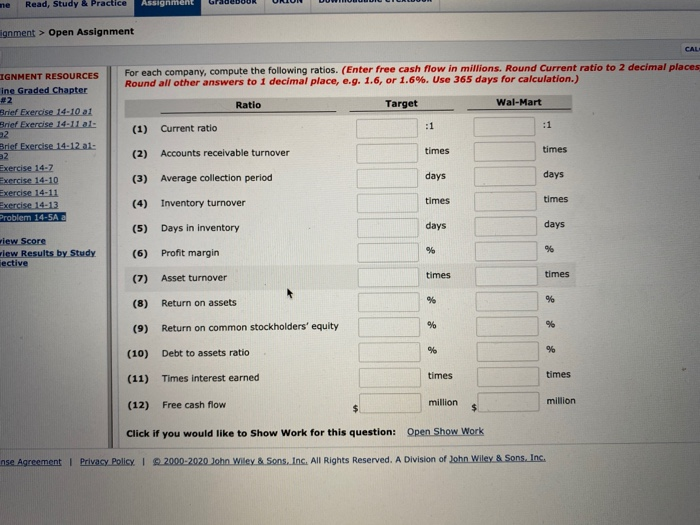

RESOURCES ed Chapter cise 14-10 a1 cise 14-11 a1- cise 14-12 al. 4-Z 4-10 4-11 4-13 4-5A a Problem 14-5A a Suppose selected financial data of Target and Wal-Mart for 2020 are presented here (in millions). Target Wal-Mart Corporation Stores, Inc. Income Statement Data for Year Net sales $65,357 $408,214 Cost of goods sold 45,583 304,657 Selling and administrative expenses 15,101 79,607 Interest expense 707 2,065 Other income (expense) (94) (411) Income tax expense 1,384 7,139 Net income $ 2,488 $ 14,335 re ults by Study Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Balance Sheet Data (End of Year) $18,424 $48,331 26,109 122,375 $44,533 $170,706 $11,327 $55,561 17,859 44,089 15,347 71,056 $44,533 $170,706 Beainnina-of-Year Balances cement | Privacy Policy | 2000-2020 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. ignment > Open Assignment TOLGI HUTIES OF DAUG YUICY Yawww IGNMENT RESOURCES line Graded Chapter #2 Brief Exercise 14-10 a1 Brief Exercise 14.11al- a2 Brief Exercise 14-12 als a2 Exercise 14-7 Exercise 14-10 Exercise 14-11 Exercise 14-13 Problem 14.5A a Total assets Total stockholders' equity Current liabilities Total liabilities Beginning-of-Year Balances $44,106 $163,429 13,712 65,682 10,512 55,390 30,394 97,747 Other Data Average net accounts receivable Average inventory Net cash provided by operating activities Capital expenditures Dividends $7,525 6,942 5,881 1,729 496 $4,025 33,836 26,249 12,184 4,217 iew Score iew Results by Study ective For each company, compute the following ratios. (Enter free cash flow in millions. Round Current ratio to 2 decimal place Round all other answers to 1 decimal place, e.g. 1.6, or 1.6%. Use 365 days for calculation.) Ratio Target Wal-Mart (1) Current ratio :1 :1 (2) Accounts receivable turnover times times (3) Average collection period days days (4) Inventory turnover times times ise Agreement | Privacy PolicyI 2000-2020 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. ne Read, Study & Practice Assignment ignment > Open Assignment CAL For each company, compute the following ratios. (Enter free cash flow in millions. Round Current ratio to 2 decimal places Round all other answers to 1 decimal place, e.g. 1.6, or 1.6%. Use 365 days for calculation.) Ratio Target Wal-Mart (1) Current ratio :1 :1 IGNMENT RESOURCES ine Graded Chapter #2 Brief Exercise 14-10 21 Brief Exercise 14-11 al- 2 Brief Exercise 14.12 al. 2 Exercise 14.2 Exercise 14-10 Exercise 14-11 Exercise 14-13 Problem 14-5A a times times (2) Accounts receivable turnover (3) Average collection period days days Inventory turnover times times (5) Days in inventory days days view Score view Results by Study ective % % Profit margin (6) (7) Asset turnover times times (8) % % Return on assets % 96 (9) Return on common stockholders' equity % % (10) Debt to assets ratio times times (11) Times interest earned (12) Free cash flow million million $ $ Click if you would like to Show Work for this question: Open Show Work nse Agreement | Privacy Policy. I 2000-2020 John Wiley & Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc