Answered step by step

Verified Expert Solution

Question

1 Approved Answer

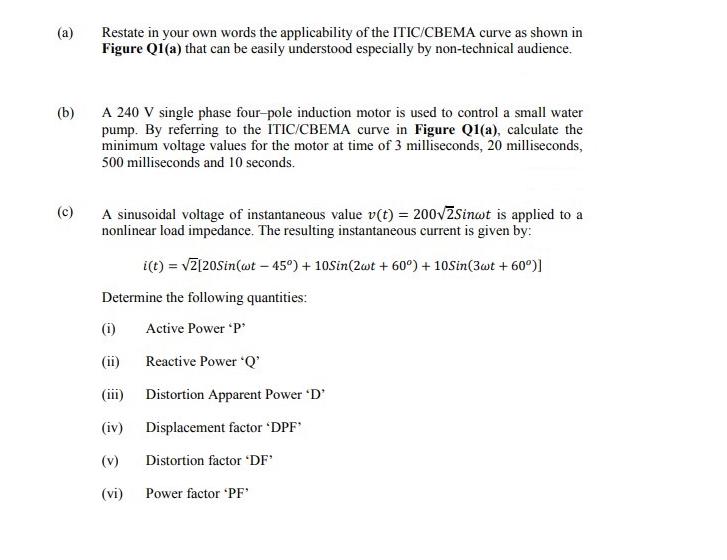

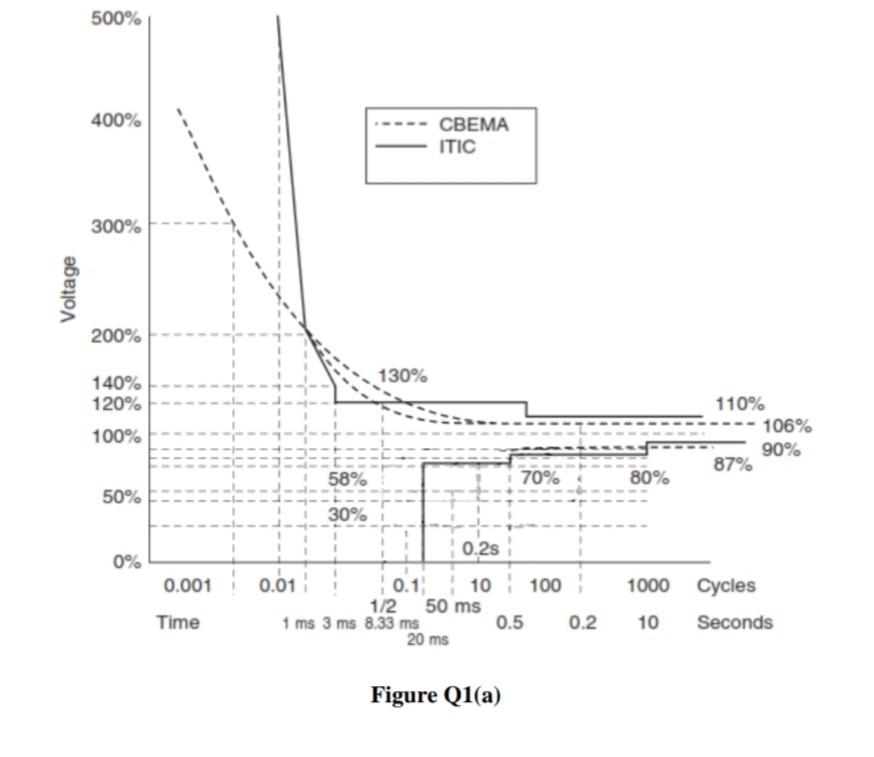

(a) Restate in your own words the applicability of the ITIC/CBEMA curve as shown in Figure Q1(a) that can be easily understood especially by

(a) Restate in your own words the applicability of the ITIC/CBEMA curve as shown in Figure Q1(a) that can be easily understood especially by non-technical audience. (b) A 240 V single phase four-pole induction motor is used to control a small water pump. By referring to the ITIC/CBEMA curve in Figure Q1(a), calculate the minimum voltage values for the motor at time of 3 milliseconds, 20 milliseconds, 500 milliseconds and 10 seconds. (c) A sinusoidal voltage of instantaneous value v(t) = 2002Sinat is applied to a nonlinear load impedance. The resulting instantaneous current is given by: i(t) = 2[20Sin(wt -45) + 10Sin(2wt +60) + 10Sin(3wt +60)] Determine the following quantities: (1) Active Power 'P' (ii) Reactive Power 'Q' (iii) Distortion Apparent Power 'D' (iv) Displacement factor 'DPF" (v) Distortion factor 'DF' (vi) Power factor 'PF' Voltage 500% 400% 300% 200% 140% 120% 100% 50% 0% TTT HI 1111 THE 11 I THE 11 11 11 0.001 Time HE TO OTH 11 111 0.01 58% 22 30% 130% 0.1 1/2 1 ms 3 ms 8.33 ms CBEMA ITIC 0.2s 10 50 ms 70% 100 0.5 20 ms Figure Q1(a) 0.2 80% 1000 10 110% 87% Cycles Seconds 106% 90%

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started