Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Retailers across the country are bracing for an anticipated slowdown in consumer spending. As of January 1, the Social Security payroll tax rate moved

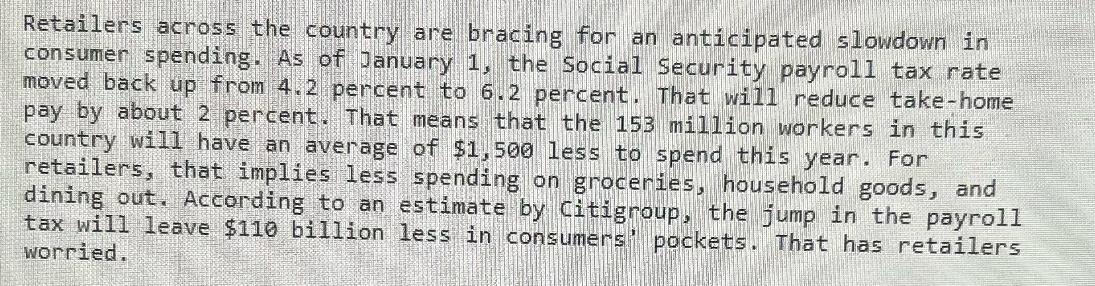

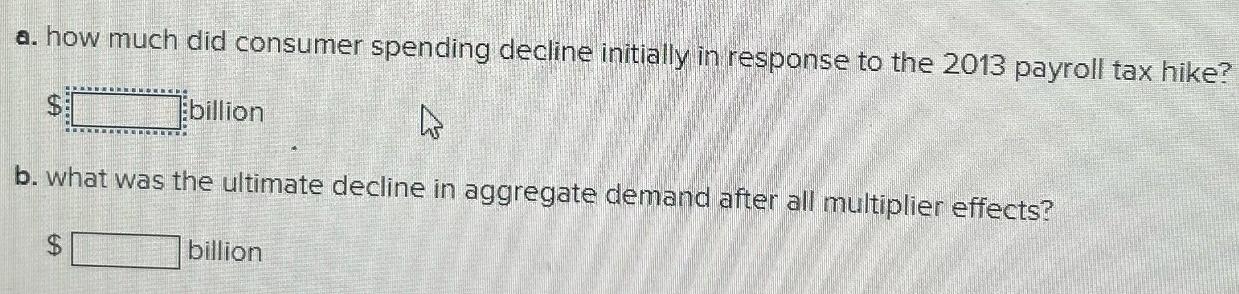

Retailers across the country are bracing for an anticipated slowdown in consumer spending. As of January 1, the Social Security payroll tax rate moved back up from 4.2 percent to 6.2 percent. That will reduce take-home pay by about 2 percent. That means that the 153 million workers in this country will have an average of $1,500 less to spend this year. For retailers, that implies less spending on groceries, household goods, and dining out. According to an estimate by Citigroup, the jump in the payroll tax will leave $110 billion less in consumers' pockets. That has retailers worried. a. how much did consumer spending decline initially in response to the 2013 payroll tax hike? billion b. what was the ultimate decline in aggregate demand after all multiplier effects? 69 billion

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a In 2013 the payroll tax rate increased from 42 to 62 reducing takehome pay by about ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started