Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Retest Basic Scenario 2 : Cameron and Deirdre Edmunds Interview Notes Cameron, age 3 0 , and Deirdre, age 2 9 , are married and

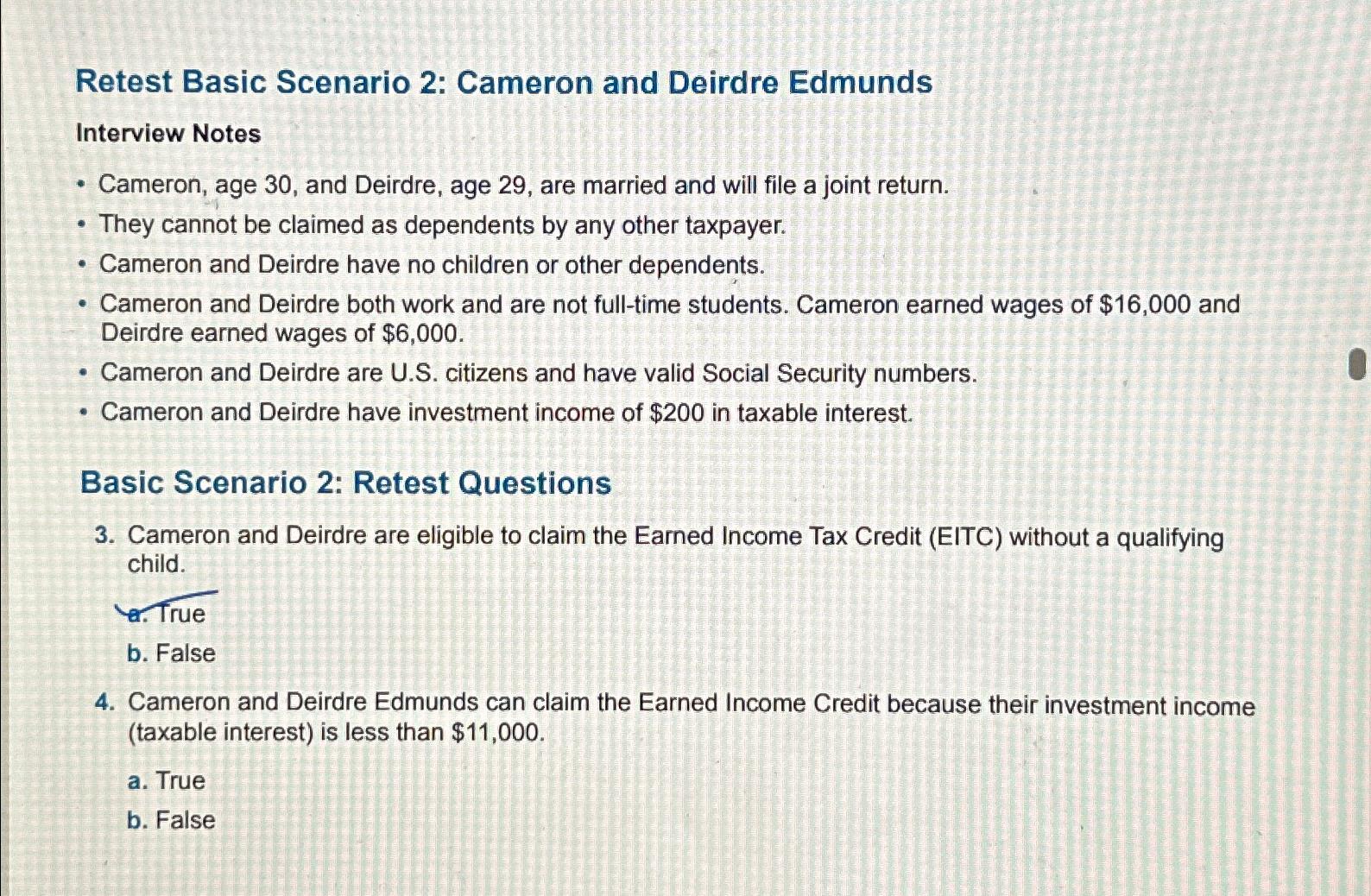

Retest Basic Scenario : Cameron and Deirdre Edmunds

Interview Notes

Cameron, age and Deirdre, age are married and will file a joint return.

They cannot be claimed as dependents by any other taxpayer.

Cameron and Deirdre have no children or other dependents.

Cameron and Deirdre both work and are not fulltime students. Cameron earned wages of $ and Deirdre earned wages of $

Cameron and Deirdre are US citizens and have valid Social Security numbers.

Cameron and Deirdre have investment income of $ in taxable interest.

Basic Scenario : Retest Questions

Cameron and Deirdre are eligible to claim the Earned Income Tax Credit EITC without a qualifying child.

a True

b False

Cameron and Deirdre Edmunds can claim the Earned Income Credit because their investment income taxable interest is less than $

a True

b False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started