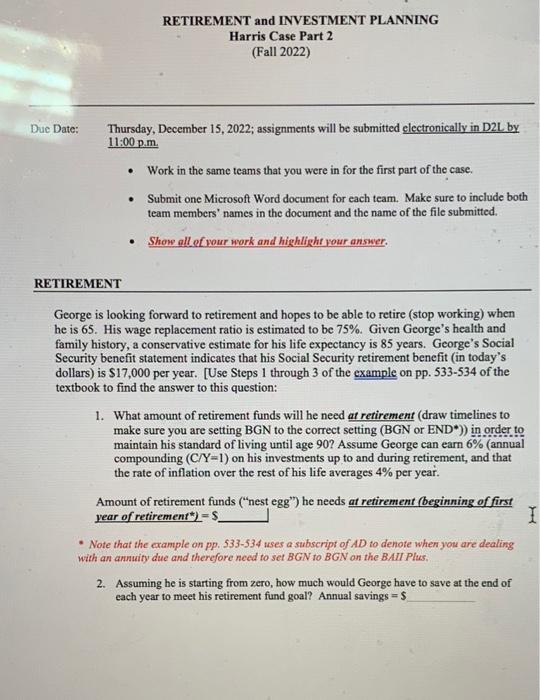

RETIREMENT and INVESTMENT PLANNING Harris Case Part 2 (Fall 2022) Due Date: Thursday, December 15, 2022; assignments will be submitted electronically in D2L by 11:00 p.m. - Work in the same teams that you were in for the first part of the case. - Submit one Microsoft Word document for each team. Make sure to include both team members' names in the document and the name of the file submitted. - Show all of wour work and highlight vour answer. RETIREMENT George is looking forward to retirement and hopes to be able to retire (stop working) when he is 65 . His wage replacement ratio is estimated to be 75%. Given George's health and family history, a conservative estimate for his life expectancy is 85 years. George's Social Security benefit statement indicates that his Social Security retirement benefit (in today's dollars) is \$17,000 per year. [Use Steps 1 through 3 of the example on pp. 533-534 of the textbook to find the answer to this question: 1. What amount of retirement funds will he need at retirement (draw timelines to make sure you are setting BGN to the correct setting (BGN or END*)) in order to maintain his standard of living until age 90 ? Assume George can earn 6% (annual compounding (C/Y=1) on his investments up to and during retirement, and that the rate of inflation over the rest of his life averages 4% per year. Amount of retirement funds ("nest egg") he needs at retirement (beginning of first year of retirement )=$ - Note that the example on pp. 533-534 uses a subscript of AD to denote when you are dealing with an annuity due and therefore need to set BGN to BGN on the BAII Plus, 2. Assuming he is starting from zero, how much would George have to save at the end of each year to meet his retirement fund goal? Annual savings =$ RETIREMENT and INVESTMENT PLANNING Harris Case Part 2 (Fall 2022) Due Date: Thursday, December 15, 2022; assignments will be submitted electronically in D2L by 11:00 p.m. - Work in the same teams that you were in for the first part of the case. - Submit one Microsoft Word document for each team. Make sure to include both team members' names in the document and the name of the file submitted. - Show all of wour work and highlight vour answer. RETIREMENT George is looking forward to retirement and hopes to be able to retire (stop working) when he is 65 . His wage replacement ratio is estimated to be 75%. Given George's health and family history, a conservative estimate for his life expectancy is 85 years. George's Social Security benefit statement indicates that his Social Security retirement benefit (in today's dollars) is \$17,000 per year. [Use Steps 1 through 3 of the example on pp. 533-534 of the textbook to find the answer to this question: 1. What amount of retirement funds will he need at retirement (draw timelines to make sure you are setting BGN to the correct setting (BGN or END*)) in order to maintain his standard of living until age 90 ? Assume George can earn 6% (annual compounding (C/Y=1) on his investments up to and during retirement, and that the rate of inflation over the rest of his life averages 4% per year. Amount of retirement funds ("nest egg") he needs at retirement (beginning of first year of retirement )=$ - Note that the example on pp. 533-534 uses a subscript of AD to denote when you are dealing with an annuity due and therefore need to set BGN to BGN on the BAII Plus, 2. Assuming he is starting from zero, how much would George have to save at the end of each year to meet his retirement fund goal? Annual savings =$