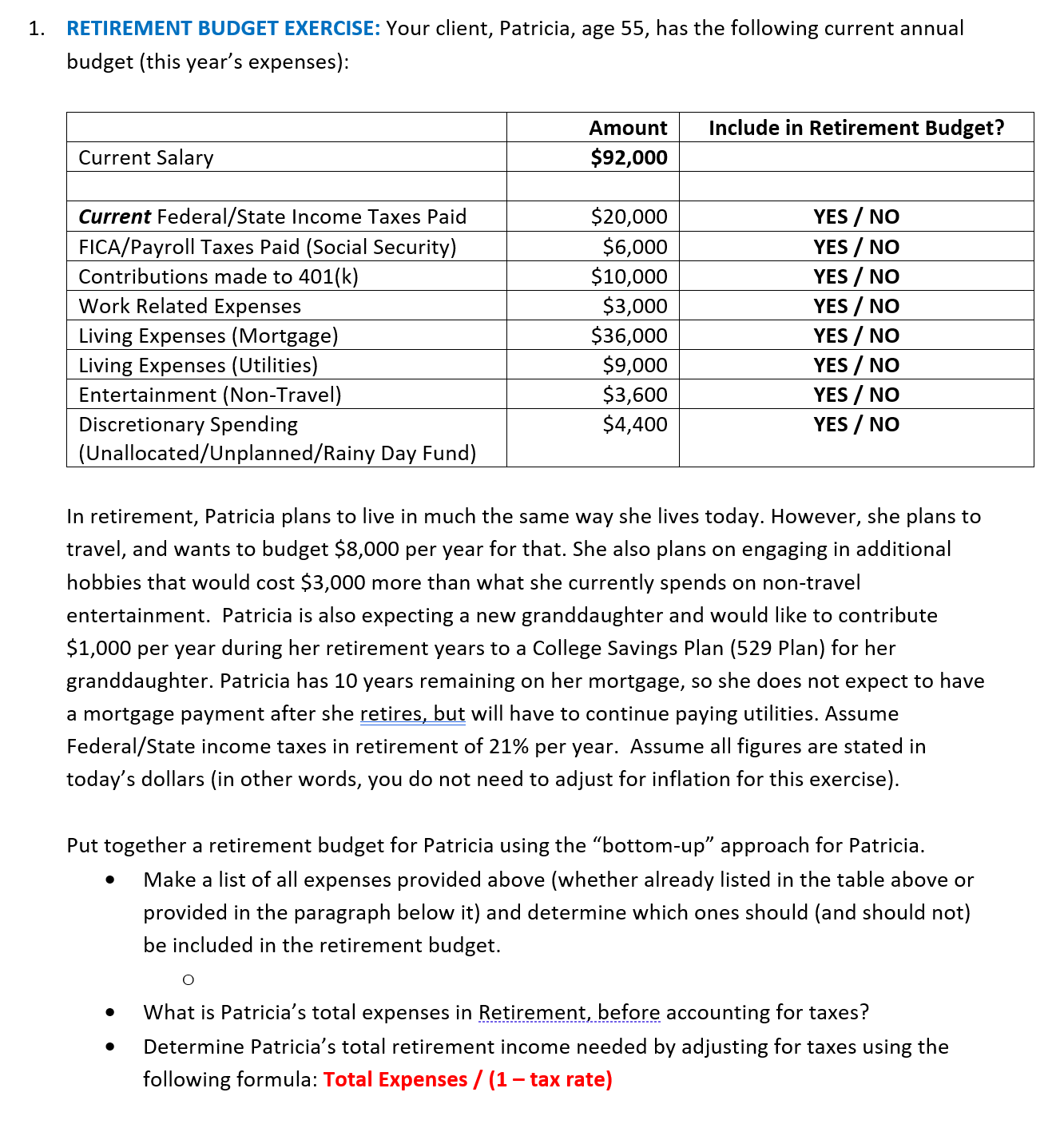

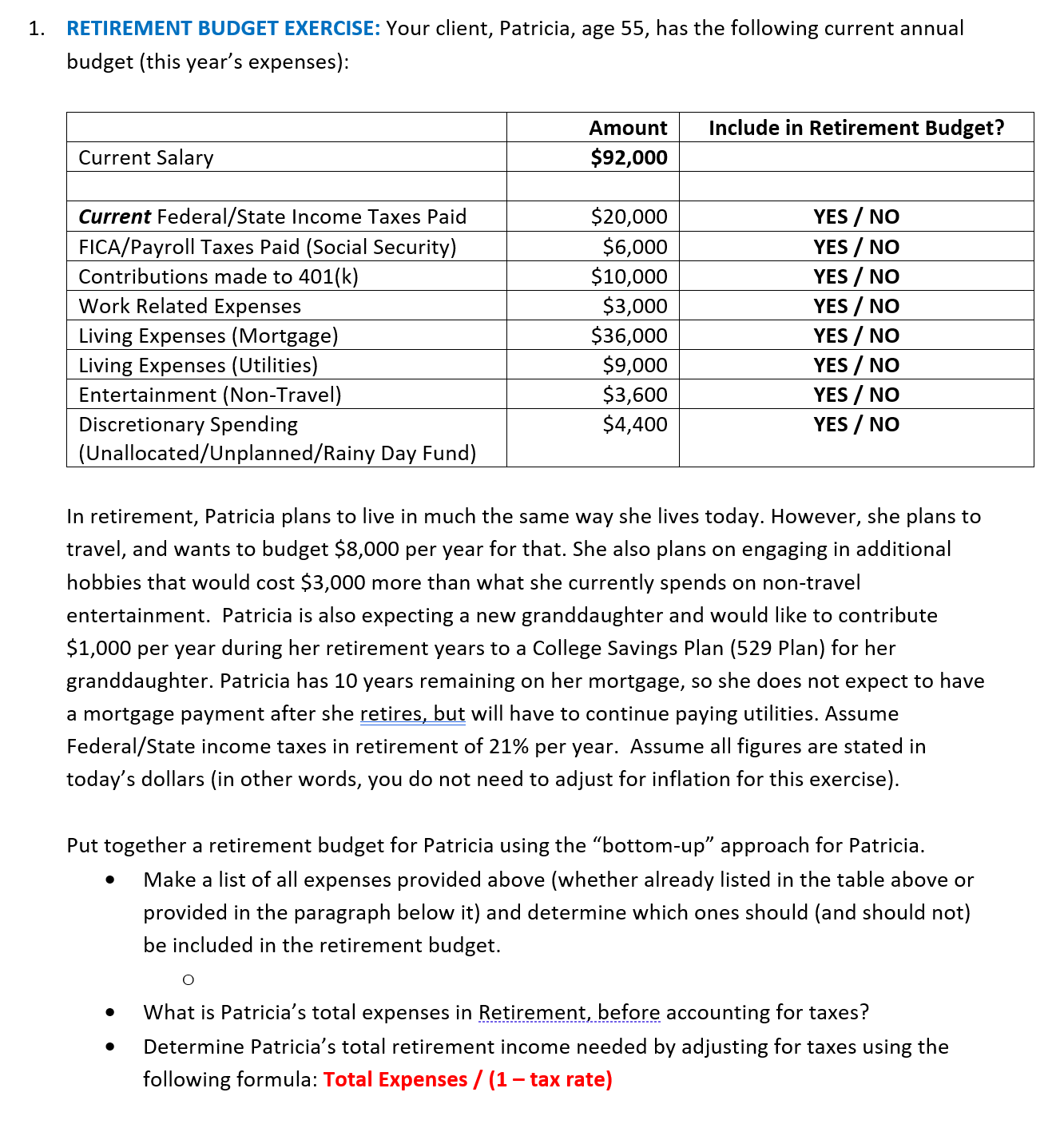

RETIREMENT BUDGET EXERCISE: Your client, Patricia, age 55, has the following current annual budget (this year's expenses): In retirement, Patricia plans to live in much the same way she lives today. However, she plans to travel, and wants to budget $8,000 per year for that. She also plans on engaging in additional hobbies that would cost $3,000 more than what she currently spends on non-travel entertainment. Patricia is also expecting a new granddaughter and would like to contribute $1,000 per year during her retirement years to a College Savings Plan (529 Plan) for her granddaughter. Patricia has 10 years remaining on her mortgage, so she does not expect to have a mortgage payment after she retires, but will have to continue paying utilities. Assume Federal/State income taxes in retirement of 21% per year. Assume all figures are stated in today's dollars (in other words, you do not need to adjust for inflation for this exercise). Put together a retirement budget for Patricia using the "bottom-up" approach for Patricia. - Make a list of all expenses provided above (whether already listed in the table above or provided in the paragraph below it) and determine which ones should (and should not) be included in the retirement budget. O - What is Patricia's total expenses in Retirement, before accounting for taxes? - Determine Patricia's total retirement income needed by adjusting for taxes using the following formula: Total Expenses / (1-tax rate) RETIREMENT BUDGET EXERCISE: Your client, Patricia, age 55, has the following current annual budget (this year's expenses): In retirement, Patricia plans to live in much the same way she lives today. However, she plans to travel, and wants to budget $8,000 per year for that. She also plans on engaging in additional hobbies that would cost $3,000 more than what she currently spends on non-travel entertainment. Patricia is also expecting a new granddaughter and would like to contribute $1,000 per year during her retirement years to a College Savings Plan (529 Plan) for her granddaughter. Patricia has 10 years remaining on her mortgage, so she does not expect to have a mortgage payment after she retires, but will have to continue paying utilities. Assume Federal/State income taxes in retirement of 21% per year. Assume all figures are stated in today's dollars (in other words, you do not need to adjust for inflation for this exercise). Put together a retirement budget for Patricia using the "bottom-up" approach for Patricia. - Make a list of all expenses provided above (whether already listed in the table above or provided in the paragraph below it) and determine which ones should (and should not) be included in the retirement budget. O - What is Patricia's total expenses in Retirement, before accounting for taxes? - Determine Patricia's total retirement income needed by adjusting for taxes using the following formula: Total Expenses / (1-tax rate)