Answered step by step

Verified Expert Solution

Question

1 Approved Answer

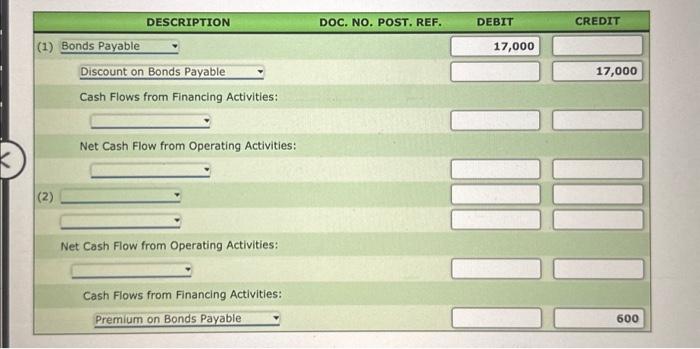

Retirement of Debt Moore Company is preparing its statement of cash flows for the current year. During the year, the company retired two issuances of

Retirement of Debt

Moore Company is preparing its statement of cash flows for the current year. During the year, the company retired two issuances of debt and properly recorded the transactions. These transactions were as follows:

- Paid cash of $14,400 to retire bonds payable with a face value of $17,000 and a book value of $15,000.

- Paid cash of $40,000 to retire bonds payable with a face value of $37,000 and a book value of $39,000.

Required:

Record, in journal entry form, the entries that Moore would make for the preceding transactions on its spreadsheet to prepare its statement of cash flows. If an amount box does not rectire an entry, leave it blank.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started