Answered step by step

Verified Expert Solution

Question

1 Approved Answer

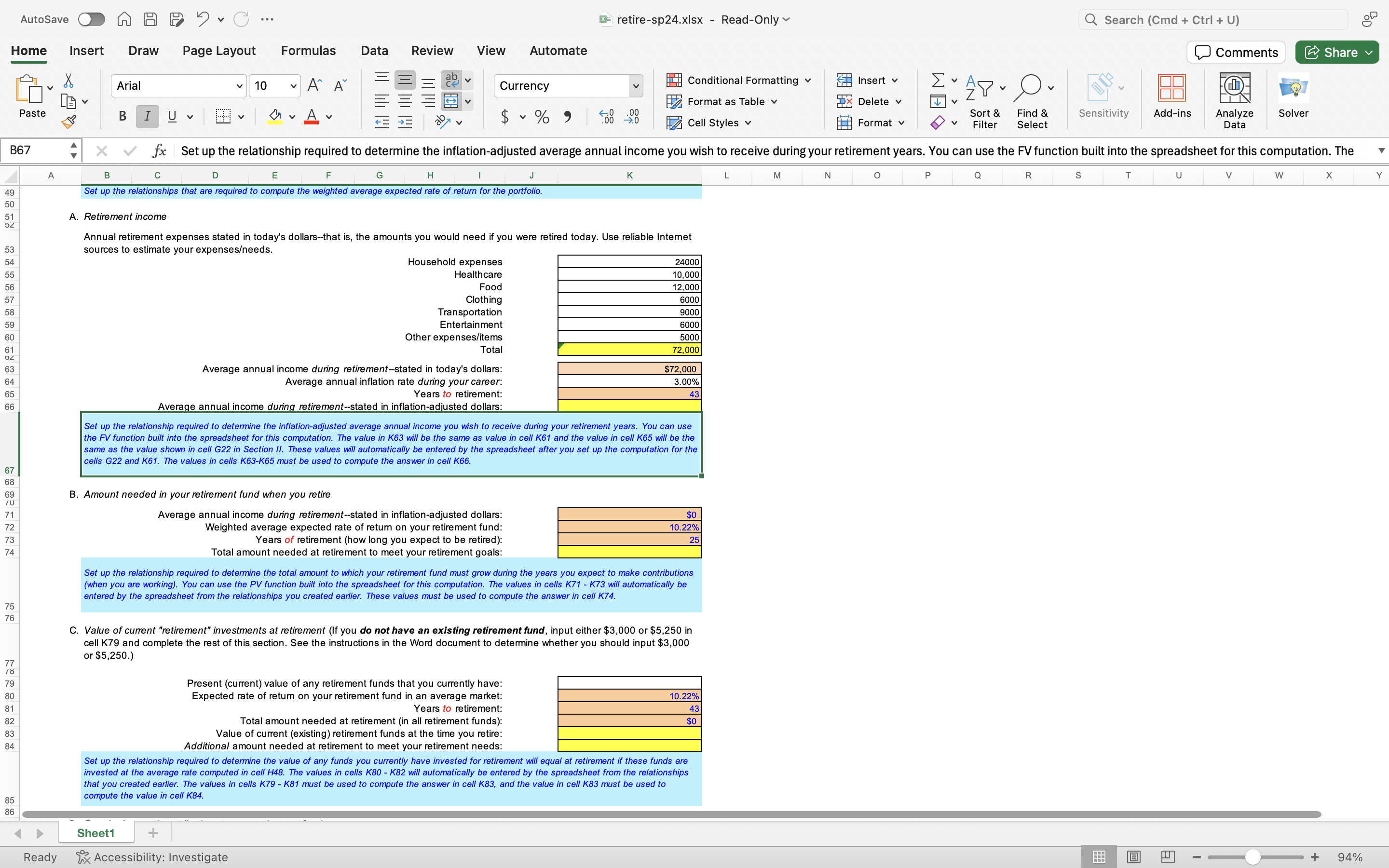

retire-sp24.xlsx - Read-Only Q Search (Cmd + Ctrl + U) BD Home Insert Draw Page Layout Formulas Data Review View Automate Arial 10 A

retire-sp24.xlsx - Read-Only Q Search (Cmd + Ctrl + U) BD Home Insert Draw Page Layout Formulas Data Review View Automate Arial 10 A A Currency Paste B I U %9 0 00 .00 0 B67 Conditional Formatting Format as Table Cell Styles Insert DX Delete v Format A Ov Comments Share Sort & Filter Find & Select Sensitivity Add-ins Analyze Data Solver fx Set up the relationship required to determine the inflation-adjusted average annual income you wish to receive during your retirement years. You can use the FV function built into the spreadsheet for this computation. The L M N P Q R S T U V W X Y AutoSave A B D E Rg C Set up the relationships that are required to compute the weighted average expected rate of return for the portfolio. F G H | J K 51 A. Retirement income 52 Annual retirement expenses stated in today's dollars--that is, the amounts you would need if you were retired today. Use reliable Internet sources to estimate your expenses/needs. Household expenses 24000 55 56 57 58 59 $ R & R? gg 66 65 Healthcare Food Clothing 10,000 12,000 6000 Transportation Entertainment Other expenses/items Total Average annual income during retirement--stated in today's dollars: Average annual inflation rate during your career: Years to retirement: Average annual income during retirement--stated in inflation-adjusted dollars: 5000 Set up the relationship required to determine the inflation-adjusted average annual income you wish to receive during your retirement years. You can use the FV function built into the spreadsheet for this computation. The value in K63 will be the same as value in cell K61 and the value in cell K65 will be the same as the value shown in cell G22 in Section II. These values will automatically be entered by the spreadsheet after you set up the computation for the cells G22 and K61. The values in cells K63-K65 must be used to compute the answer in cell K66. 9000 6000 72,000 $72,000 3.00% 43 69 70 71 73 74 6862227 75 76 B. Amount needed in your retirement fund when you retire Average annual income during retirement--stated in inflation-adjusted dollars: Weighted average expected rate of return on your retirement fund: Years of retirement (how long you expect to be retired): Total amount needed at retirement to meet your retirement goals: $0 10.22% Set up the relationship required to determine the total amount to which your retirement fund must grow during the years you expect to make contributions (when you are working). You can use the PV function built into the spreadsheet for this computation. The values in cells K71 - K73 will automatically be entered by the spreadsheet from the relationships you created earlier. These values must be used to compute the answer in cell K74. 25 8 $ 79 85 86 C. Value of current "retirement" investments at retirement (If you do not have an existing retirement fund, input either $3,000 or $5,250 in cell K79 and complete the rest of this section. See the instructions in the Word document to determine whether you should input $3,000 or $5,250.) Present (current) value of any retirement funds that you currently have: Expected rate of return on your retirement fund in an average market: Years to retirement: Total amount needed at retirement (in all retirement funds): Value of current (existing) retirement funds at the time you retire: Additional amount needed at retirement to meet your retirement needs: 10.22% 43 $0 Set up the relationship required to determine the value of any funds you currently have invested for retirement will equal at retirement if these funds are invested at the average rate computed in cell H48. The values in cells K80 - K82 will automatically be entered by the spreadsheet from the relationships that you created earlier. The values in cells K79 - K81 must be used to compute the answer in cell K83, and the value in cell K83 must be used to compute the value in cell K84. Ready Sheet1 Accessibility: Investigate + 94%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started