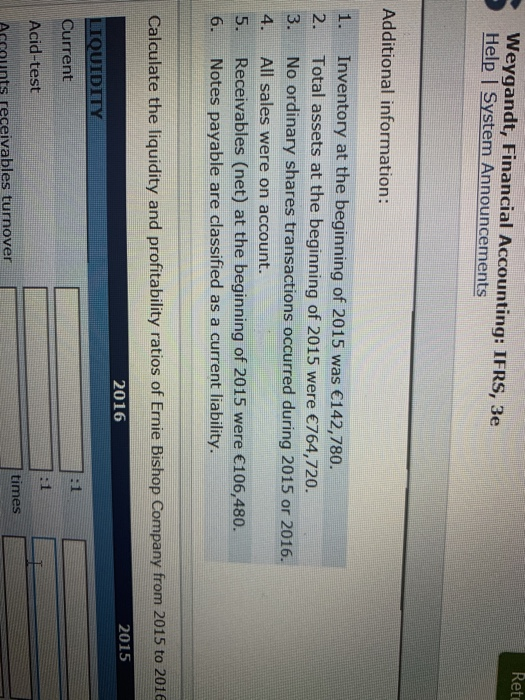

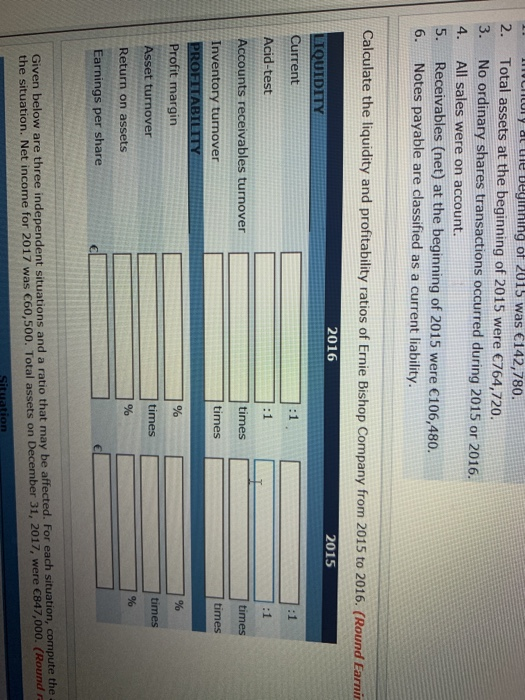

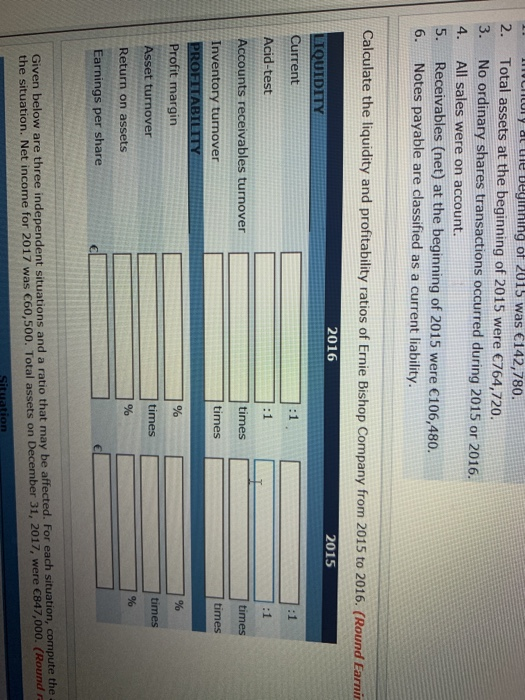

Retu Weygandt, Financial Accounting: IFRS, 3e Help System Announcements Additional information: Inventory at the beginning of 2015 was 142,780. Total assets at the beginning of 2015 were 764,720. No ordinary shares transactions occurred during 2015 or 2016. All sales were on account. Receivables (net) at the beginning of 2015 were 106,480. Notes payable are classified as a current liability. 4. 6. Calculate the liquidity and profitability ratios of Ernie Bishop Company from 2015 to 2016 2016 2015 LIQUIDITY Current Acid-test Accounts receivables turnover times 1 MOCHILUI ya ule beginning of 2015 was 142,780. 2. Total assets at the beginning of 2015 were 764,720. 3. No ordinary shares transactions occurred during 2015 or 2016. 4. All sales were on account. 5. Receivables (net) at the beginning of 2015 were 106,480. Notes payable are classified as a current liability. Calculate the liquidity and profitability ratios of Ernie Bishop Company from 2015 to 2016. (Round Earnir 2016 2015 LIQUIDITY Current Acid-test Accounts receivables turnover times times times times Inventory turnover PROFITABILITY Profit margin % % Asset turnover times times Return on assets Earnings per share Given below are three independent situations and a ratio that may be affected. For each situation, compute the the situation. Net income for 2017 was 60,500. Total assets on December 31, 2017, were 847.000. Round Situation Blackboard * = 20 CALCULATOR PRINTER VERSION CK NEXT und Earnings per share to 2 decimal places, e.g. 1.65, and all others to 1 decimal place, e.g. 6.8 or 6.8%.) Retu Weygandt, Financial Accounting: IFRS, 3e Help System Announcements Additional information: Inventory at the beginning of 2015 was 142,780. Total assets at the beginning of 2015 were 764,720. No ordinary shares transactions occurred during 2015 or 2016. All sales were on account. Receivables (net) at the beginning of 2015 were 106,480. Notes payable are classified as a current liability. 4. 6. Calculate the liquidity and profitability ratios of Ernie Bishop Company from 2015 to 2016 2016 2015 LIQUIDITY Current Acid-test Accounts receivables turnover times 1 MOCHILUI ya ule beginning of 2015 was 142,780. 2. Total assets at the beginning of 2015 were 764,720. 3. No ordinary shares transactions occurred during 2015 or 2016. 4. All sales were on account. 5. Receivables (net) at the beginning of 2015 were 106,480. Notes payable are classified as a current liability. Calculate the liquidity and profitability ratios of Ernie Bishop Company from 2015 to 2016. (Round Earnir 2016 2015 LIQUIDITY Current Acid-test Accounts receivables turnover times times times times Inventory turnover PROFITABILITY Profit margin % % Asset turnover times times Return on assets Earnings per share Given below are three independent situations and a ratio that may be affected. For each situation, compute the the situation. Net income for 2017 was 60,500. Total assets on December 31, 2017, were 847.000. Round Situation Blackboard * = 20 CALCULATOR PRINTER VERSION CK NEXT und Earnings per share to 2 decimal places, e.g. 1.65, and all others to 1 decimal place, e.g. 6.8 or 6.8%.)