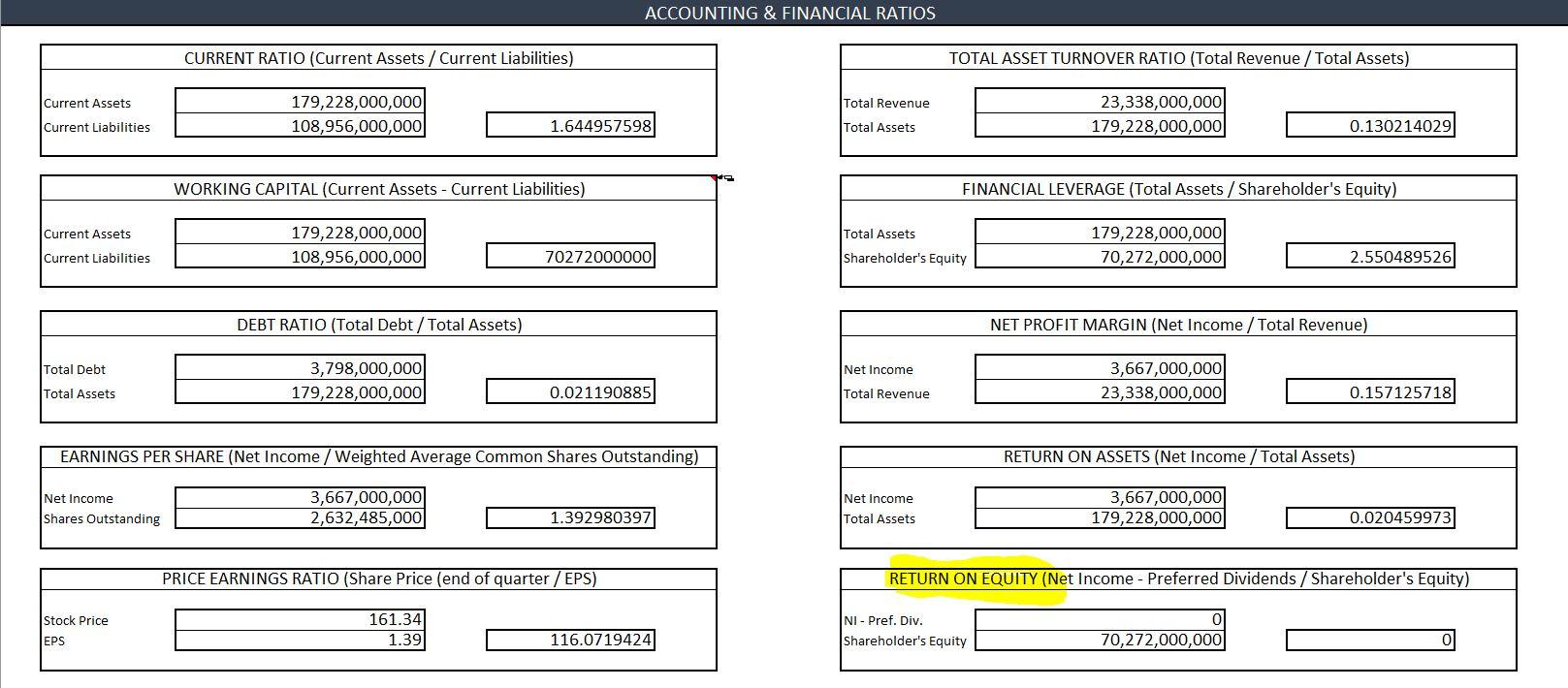

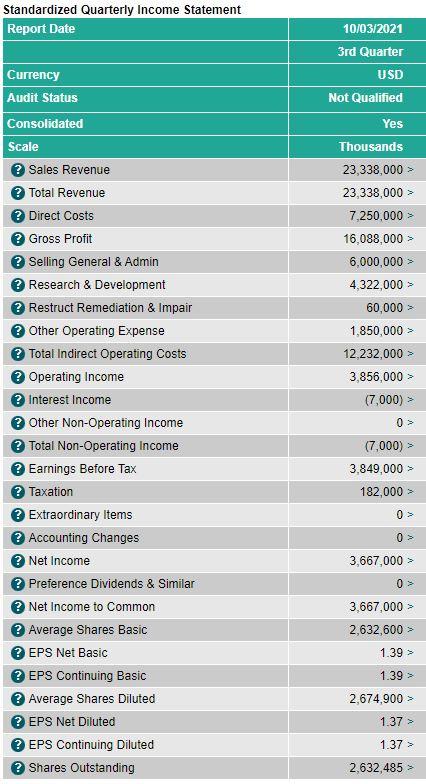

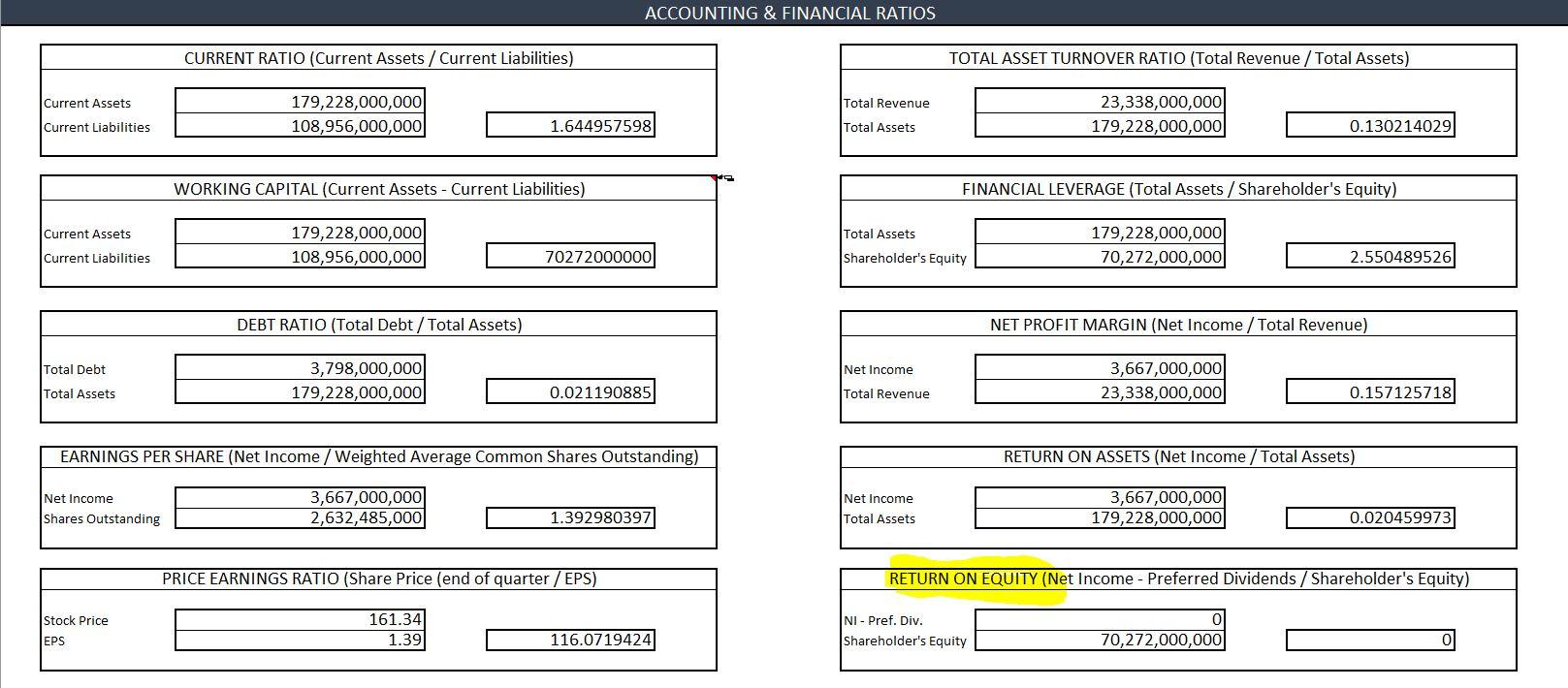

Return on Equity? I can't find anything on the income statement or balance sheet that shows preferred dividends. How do I find the ROE?

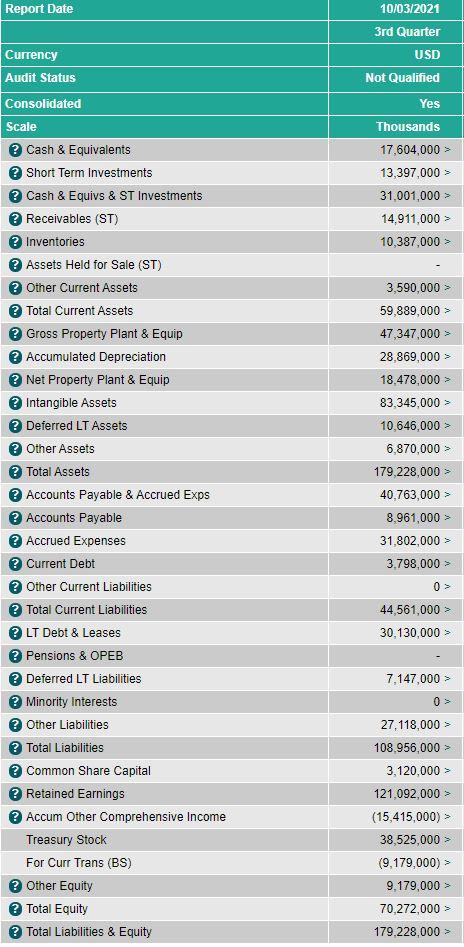

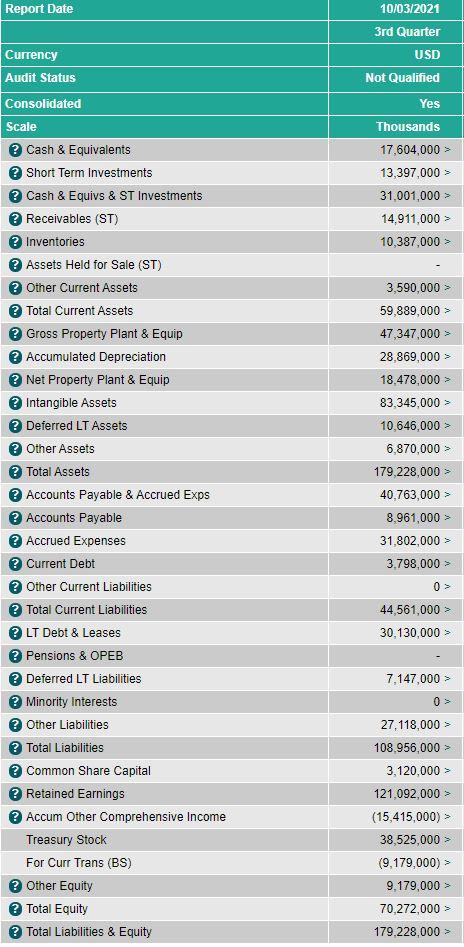

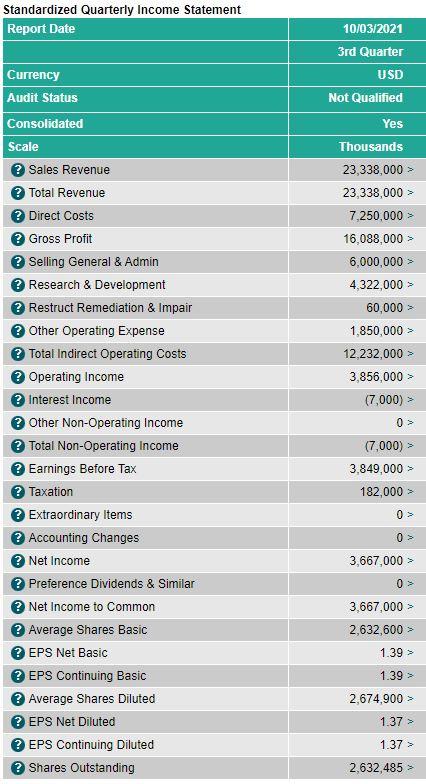

ACCOUNTING & FINANCIAL RATIOS CURRENT RATIO (Current Assets / Current Liabilities) TOTAL ASSET TURNOVER RATIO (Total Revenue / Total Assets) Current Assets Total Revenue 179,228,000,000 108,956,000,000 23,338,000,000 179,228,000,000 Current Liabilities 1.644957598 Total Assets 0.130214029 WORKING CAPITAL (Current Assets - Current Liabilities) FINANCIAL LEVERAGE (Total Assets / Shareholder's Equity) Current Assets Total Assets 179,228,000,000 108,956,000,000 179,228,000,000 70,272,000,000 Current Liabilities 70272000000 Shareholder's Equity 2.550489526) DEBT RATIO (Total Debt/Total Assets) NET PROFIT MARGIN (Net Income / Total Revenue) Total Debt Net Income 3,798,000,000 179,228,000,000 3,667,000,000 23,338,000,000 Total Assets 0.021190885 Total Revenue 0.157125718 EARNINGS PER SHARE (Net Income /Weighted Average Common Shares Outstanding) RETURN ON ASSETS (Net Income Total Assets) Net Income Shares Outstanding 3,667,000,000 2,632,485,000 Net Income Total Assets 3,667,000,000 179,228,000,000 1.392980397 0.020459973 PRICE EARNINGS RATIO (Share Price (end of quarter / EPS) RETURN ON EQUITY (Net Income - Preferred Dividends / Shareholder's Equity) Stock Price EPS 161.34 1.39 NI - Pref. Div. Shareholder's Equity 116.0719424 70,272,000,000 Report Date 10/03/2021 3rd Quarter USD Not Qualified Yes Thousands 17,604,000 > 13,397,000 > 31.001,000 > 14,911,000 > 10,387,000 > Currency Audit Status Consolidated Scale Cash & Equivalents Short Term Investments Cash & Equivs & ST Investments Receivables (ST) Inventories Assets Held for Sale (ST) Other Current Assets Total Current Assets Gross Property Plant & Equip Accumulated Depreciation Net Property Plant & Equip Intangible Assets Deferred LT Assets Other Assets Total Assets Accounts Payable & Accrued Exps Accounts Payable Accrued Expenses Current Debt Other Current Liabilities Total Current Liabilities LT Debt & Leases Pensions & OPEB Deferred LT Liabilities Minority Interests Other Liabilities Total Liabilities Common Share Capital Retained Earnings Accum Other Comprehensive Income Treasury Stock For Curr Trans (BS) Other Equity Total Equity Total Liabilities & Equity 3,590,000 > 59,889,000 > 47,347,000 > 28,869,000 > 18.478,000 > 83,345,000 > 10,646,000 > 6,870,000 > 179,228,000 > 40,763,000 > 8,961,000 > 31,802,000 > 3,798,000 > 0 > 44,561,000 > 30,130,000 > 7,147,000 > 27,118,000 > 108.956,000 > 3,120,000 > 121,092,000 > (15,415,000) > 38,525,000 > (9,179,000) > 9,179,000 > 70,272,000 > 179,228,000 > Standardized Quarterly Income Statement Report Date 10/03/2021 Currency Audit Status Consolidated Scale Sales Revenue Total Revenue Direct Costs Gross Profit Selling General & Admin Research & Development Restruct Remediation & Impair Other Operating Expense Total Indirect Operating Costs Operating Income Interest Income Other Non-Operating Income Total Non-Operating Income Earnings Before Tax Taxation Extraordinary Items Accounting Changes Net Income Preference Dividends & Similar Net Income to Common Average Shares Basic EPS Net Basic EPS Continuing Basic Average Shares Diluted EPS Net Diluted EPS Continuing Diluted Shares Outstanding 3rd Quarter USD Not Qualified Yes Thousands 23,338,000 > 23,338,000 > 7.250,000 16,088,000 > 6,000,000 > 4,322,000 > 60,000 > 1,850,000 > 12,232,000 > 3,856,000 > (7,000) 0 > (7,000) 3,849,000 > 182,000 0 0 > 3,667,000 > 0 > 3.667,000 > 2,632,600 > 1.39 > 1.39 > 2,674,900 > 1.37 > 1.37 > 2,632,485 >