Answered step by step

Verified Expert Solution

Question

1 Approved Answer

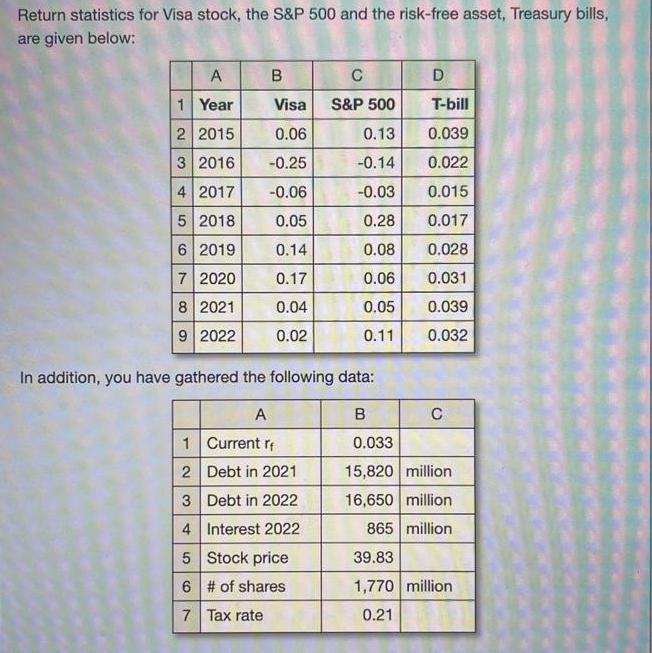

Return statistics for Visa stock, the S&P 500 and the risk-free asset, Treasury bills, are given below: A 1 Year 2 2015 3 2016

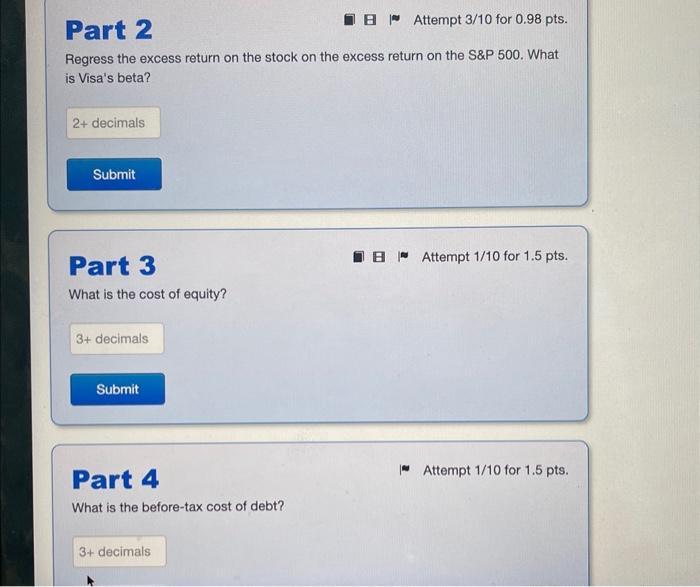

Return statistics for Visa stock, the S&P 500 and the risk-free asset, Treasury bills, are given below: A 1 Year 2 2015 3 2016 4 2017 5 2018 6 2019 7 2020 8 2021 9 2022 B C D Visa S&P 500 T-bill 0.06 0.13 0.039 -0.25 -0.14 0.022 -0.03 0.015 0.28 0.017 0.08 0.028 0.06 0.031 0.05 0.039 0.11 0.032 -0.06 0.05 0.14 0.17 0.04 0.02 In addition, you have gathered the following data: A B 1 Current r 0.033 2 Debt in 2021 15,820 million 3 Debt in 2022 16,650 million 4 Interest 2022 865 million 5 Stock price 6 # of shares 7 Tax rate C 39.83 1,770 million 0.21 BAttempt 3/10 for 0.98 pts. Part 2 Regress the excess return on the stock on the excess return on the S&P 500. What is Visa's beta? 2+ decimals Submit Part 3 What is the cost of equity? 3+ decimals Submit Part 4 What is the before-tax cost of debt? 3+ decimals BAttempt 1/10 for 1.5 pts. Attempt 1/10 for 1.5 pts. Part 5 What is the company's weighted average cost of capital? 3+ decimals BAttempt 1/10 for 1.5 pts. Submit Return statistics for Visa stock, the S&P 500 and the risk-free asset, Treasury bills, are given below: A 1 Year 2 2015 3 2016 4 2017 5 2018 6 2019 7 2020 8 2021 9 2022 B C D Visa S&P 500 T-bill 0.06 0.13 0.039 -0.25 -0.14 0.022 -0.03 0.015 0.28 0.017 0.08 0.028 0.06 0.031 0.05 0.039 0.11 0.032 -0.06 0.05 0.14 0.17 0.04 0.02 In addition, you have gathered the following data: A B 1 Current r 0.033 2 Debt in 2021 15,820 million 3 Debt in 2022 16,650 million 4 Interest 2022 865 million 5 Stock price 6 # of shares 7 Tax rate C 39.83 1,770 million 0.21 BAttempt 3/10 for 0.98 pts. Part 2 Regress the excess return on the stock on the excess return on the S&P 500. What is Visa's beta? 2+ decimals Submit Part 3 What is the cost of equity? 3+ decimals Submit Part 4 What is the before-tax cost of debt? 3+ decimals BAttempt 1/10 for 1.5 pts. Attempt 1/10 for 1.5 pts. Part 5 What is the company's weighted average cost of capital? 3+ decimals BAttempt 1/10 for 1.5 pts. Submit Return statistics for Visa stock, the S&P 500 and the risk-free asset, Treasury bills, are given below: A 1 Year 2 2015 3 2016 4 2017 5 2018 6 2019 7 2020 8 2021 9 2022 B C D Visa S&P 500 T-bill 0.06 0.13 0.039 -0.25 -0.14 0.022 -0.03 0.015 0.28 0.017 0.08 0.028 0.06 0.031 0.05 0.039 0.11 0.032 -0.06 0.05 0.14 0.17 0.04 0.02 In addition, you have gathered the following data: A B 1 Current r 0.033 2 Debt in 2021 15,820 million 3 Debt in 2022 16,650 million 4 Interest 2022 865 million 5 Stock price 6 # of shares 7 Tax rate C 39.83 1,770 million 0.21 BAttempt 3/10 for 0.98 pts. Part 2 Regress the excess return on the stock on the excess return on the S&P 500. What is Visa's beta? 2+ decimals Submit Part 3 What is the cost of equity? 3+ decimals Submit Part 4 What is the before-tax cost of debt? 3+ decimals BAttempt 1/10 for 1.5 pts. Attempt 1/10 for 1.5 pts. Part 5 What is the company's weighted average cost of capital? 3+ decimals BAttempt 1/10 for 1.5 pts. Submit Return statistics for Visa stock, the S&P 500 and the risk-free asset, Treasury bills, are given below: A 1 Year 2 2015 3 2016 4 2017 5 2018 6 2019 7 2020 8 2021 9 2022 B C D Visa S&P 500 T-bill 0.06 0.13 0.039 -0.25 -0.14 0.022 -0.03 0.015 0.28 0.017 0.08 0.028 0.06 0.031 0.05 0.039 0.11 0.032 -0.06 0.05 0.14 0.17 0.04 0.02 In addition, you have gathered the following data: A B 1 Current r 0.033 2 Debt in 2021 15,820 million 3 Debt in 2022 16,650 million 4 Interest 2022 865 million 5 Stock price 6 # of shares 7 Tax rate C 39.83 1,770 million 0.21 BAttempt 3/10 for 0.98 pts. Part 2 Regress the excess return on the stock on the excess return on the S&P 500. What is Visa's beta? 2+ decimals Submit Part 3 What is the cost of equity? 3+ decimals Submit Part 4 What is the before-tax cost of debt? 3+ decimals BAttempt 1/10 for 1.5 pts. Attempt 1/10 for 1.5 pts. Part 5 What is the company's weighted average cost of capital? 3+ decimals BAttempt 1/10 for 1.5 pts. Submit

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Visas beta is 067 To calculate this we can use the following steps Calculate the excess return for Visa and the SP 500 This is done by subtracting the riskfree rate Tbill rate from the total return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started