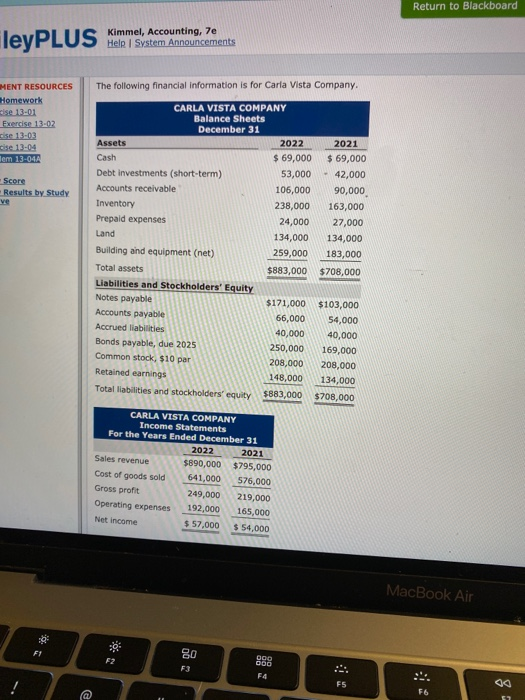

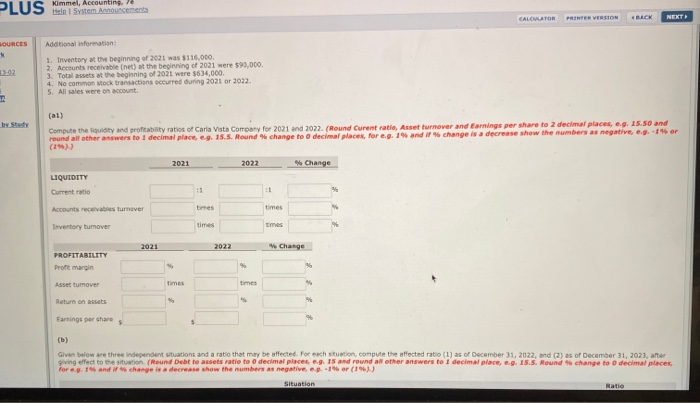

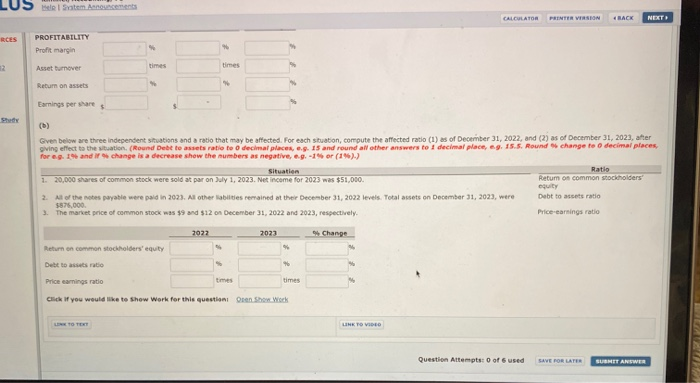

Return to Blackboard leyPLUS Kimmel, Accounting, 7e Help System Announcements The following financial information is for Carla Vista Company. MENT RESOURCES Homework cise 13-01 Exercise 13-02 ise 13-03 cise 13-04 lem 13-04A Score Results by Study ve CARLA VISTA COMPANY Balance Sheets December 31 Assets 2022 2021 Cash $ 69,000 $ 69,000 Debt investments (short-term) 53,000 - 42,000 Accounts receivable 106,000 90,000 Inventory 238,000 163,000 Prepaid expenses 24,000 27,000 Land 134,000 134,000 Building and equipment (net) 259,000 183,000 Total assets $883,000 $708,000 Liabilities and Stockholders' Equity Notes payable $171,000 $103,000 Accounts payable 66,000 54,000 Accrued liabilities 40,000 40,000 Bonds payable, due 2025 250,000 169,000 Common stock, $10 par 208,000 208,000 Retained earnings 148,000 134,000 Total liabilities and stockholders' equity $883,000 $708,000 CARLA VISTA COMPANY Income Statements For the Years Ended December 31 2022 2021 Sales revenue $890,000 $795,000 Cost of goods sold 641,000 576,000 Gross profit 249,000 219,000 Operating expenses 192,000 165,000 Net Income $57,000 $ 54,000 MacBook Air F1 F2 80 F3 898 F4 F5 @ F6 Kimmel, Accounting, PLUS Hiele kosten Aroucaments CALCULATOR PRINTER VERSION NEXT SOURCES Additional information: 1. Inventory at the beginning of 2021 was $116,000. 2. Accounts receivable (net) at the beginning of 2021 were $90.000 3. Total assets at the beginning of 2021 were $634,000. 4. No common stock transactions occurred during 2021 or 2022 5. All sales were on account. Compute the liquidity and profitability rates of Carla Vista Company for 2021 and 2022. (Round Curent ratio, Asset turnover and Earnings per share to 2 decimal places, e.g. 15.50 and round all other answers to 1 decimal place, eg. 15.5. Round change to decimal places, for e.o. 19 and if " change is a decrease show the numbers as negative e.. -14 or 2021 2022 Change LIQUIDITY Current ratio :1 1 Accounts receivables turnover times Inventory turnover times times 2021 2022 e Change PROFITABILITY Profit margin Asset tumover times Return ons Earrings per share Given below are three independent situations and a ratio that may be affected. For each station compute the affected ratio (1) as of December 31, 2022, and (2) as of December 31, 2023, after giving effect to the situation (Round Debt to assets ratio to o decimal places, c.9. 15 and round all other answers to 1 decimal place, e.g. 15.5. Round change to decimal places, for .. 14 and change is a decrease show the numbers as negative ag. -1% or (196).) Situation Ratio Bell Satem Announcements CALCULATOR PRINTER VERSION BACK NEXT RCES PROFITABILITY Profit margin Asset turnover times times Return on assets Earnings per shares She Gven below are three independent stations and a ratio that may be affected. For each stuation, compute the affected ratio (1) as of December 31, 2022, and (2) as of December 31, 2023, after giving effect to the situation, (Round Debt to assets ratio to o decimal places, ... 15 and round all other answers to 1 decimal place, ... 15.5. Round change to decimal places, for 9.1% and it change is a decrease show the numbers as negative, e.g. -1% or (1%).) Situation Ratio 1. 20,000 shares of common stock were sold at par on July 1, 2023. Net income for 2023 was $51,000. Retum on common stockholders ity 2. All of the notes payable were paid in 2023. All other abilities remained at their December 31, 2022 levels. Total assets on December 31, 2023, were Debt to assets ratio 5875,000 3. The market price of common stock was $9 and 512 on December 31, 2022 and 2023, respectively. Price-earnings ratio Change 2072 2023 Return on common stockholders' equity Debt to assets ratio Price earnings ratio times Click If you would like to show Work for this questioni Oren Show Work LEXTO TOT LINE TO VIDEO Question Attempts of 6 used SAVE POR LATER SUBMIT