Answered step by step

Verified Expert Solution

Question

1 Approved Answer

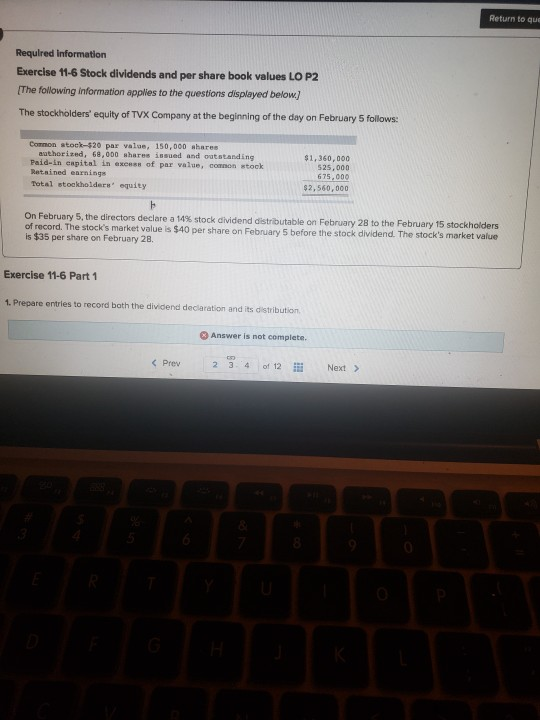

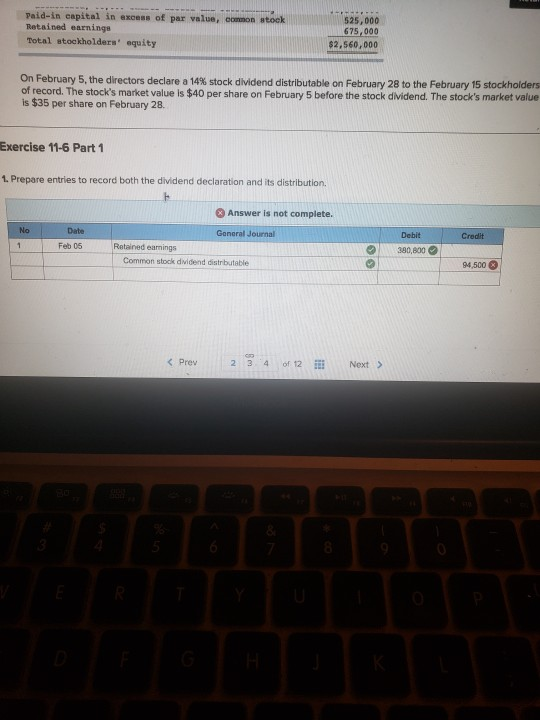

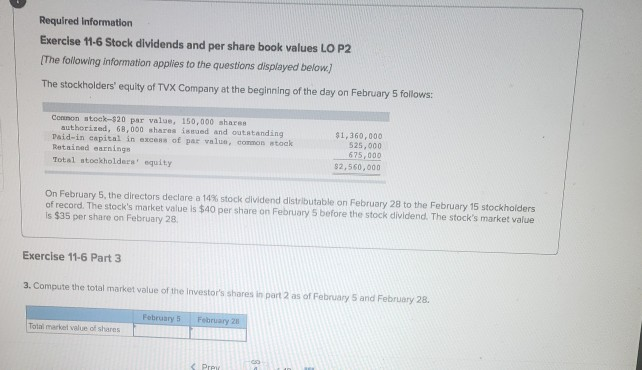

Return to que Required information Exercise 11-6 Stock dividends and per share book values LO P2 [The following information applies to the questions displayed below.)

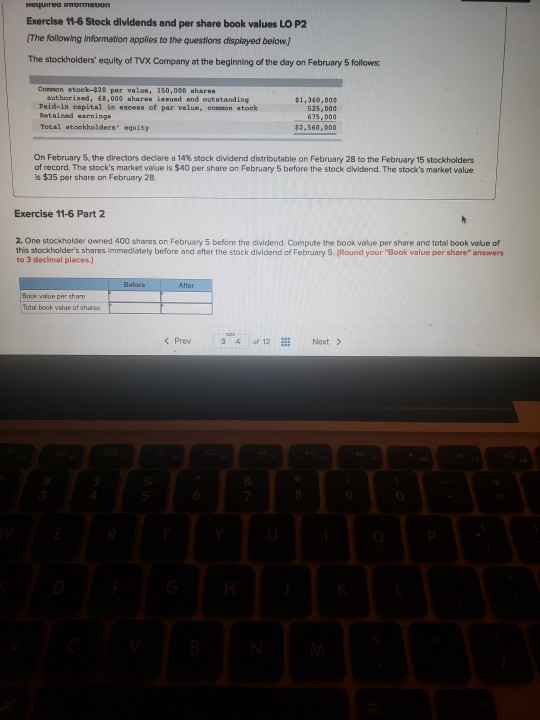

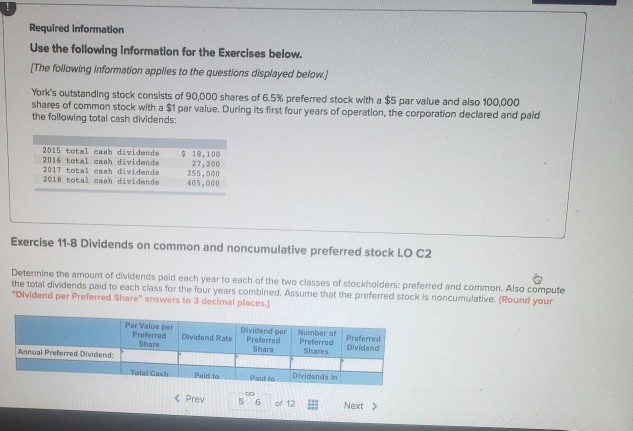

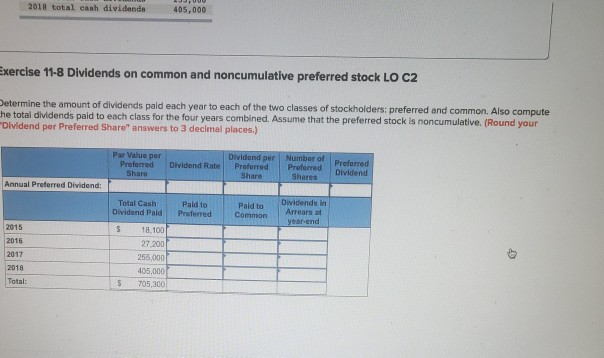

Return to que Required information Exercise 11-6 Stock dividends and per share book values LO P2 [The following information applies to the questions displayed below.) The stockholders' equity of TVX Company at the beginning of the day on February 5 follows: Common stock-$20 par value, 150,000 shares authorised, 68,000 shares inued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $1,360,000 525.000 675,000 $2,560,000 On February 5, the directors declare a 14% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $40 per share on February 5 before the stock dividend. The stock's market value is $35 per share on February 28, Exercise 11-6 Part 1 1. Prepare entries to record both the dividend declaration and its distribution Answer is not complete Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity 525,000 675,000 $2,560,000 On February 5, the directors declare a 14% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $40 per share on February 5 before the stock dividend. The stock's market value is $35 per share on February 28, Exercise 11-6 Part 1 1. Prepare entries to record both the dividend declaration and its distribution, Answer is not complete. No Date Debit Credit 1 Feb 06 General Journal Retained earnings Common stock dividend distrbutable 380,800 94,500 8. requires romauon Exercise 11-6 Stock dividends and per share book values LO P2 The following information applies to the questions displayed below.) The stockholders' equity of TVX Company at the beginning of the day on February 5 follows: Common stock-$20 par value, 150,000 shares authorised, 68,000 sharan is wond and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $1,360,000 525,000 675,000 $2,560,000 On February 5, the directors declare a 14% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $40 per share on February 5 before the stock dividend. The stock's market value is $35 per share on February 28 Exercise 11-6 Part 2 2. One stockholder owned 400 shares on February 5 before the dividend. Compute the book value per share and total book value of this stockholder's shares Immediately before and after the stock dividend of February 5. (Round your "Book value per share" answers to 3 decimal places.) Before Alter Book value per share Total book value of shares Required Information Exercise 11-6 Stock dividends and per share book values LO P2 [The following information applies to the questions displayed below.) The stockholders' equity of TVX Company at the beginning of the day on February 5 follows: Connon stock-$20 par value, 150,000 shares authorized, 68,000 shares issued and outstanding Dald-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $1,360,000 525,000 675,000 $2,560,000 On February 5, the directors declare a 14% stock dividend distributable on February 28 to the February 15 stockholders of record. The stock's market value is $40 per share on February 5 before the stock dividend. The stock's market value is $35 per share on February 28 Exercise 11-6 Part 3 3. Compute the total market value of the investor's shares in part 2 as of February 5 and February 28. February 5 Total market value of shares February 20 PrPr Required Information Use the following information for the Exercises below. [The following information applies to the questions displayed below) York's outstanding stock consists of 90,000 shares of 6.5% preferred stock with a $5 par value and also 100,000 shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and pald the following total cash dividends: 2015 total cash dividends 2016 total con dividends 2017 total cash dividende 2018 total cash dividends $ 18,100 27,200 255.000 405,000 Exercise 11-8 Dividends on common and noncumulative preferred stock LO C2 Determine the amount of dividends paid each year to each of the two classes of stockholderse preferred and common. Also compute the total dividends paid to each class for the four years combined. Assume that the preferred stock is noncumulative. (Round your "Olvidend per Preferred Share answers to 3 decimal places.) Par Value per Preferred Share Dividend Rate Dividend per Preferred Shara Number of Preferred Shares Preferred Dividend Annual Preferred Dividend: Total Paid to Paid to Dividends in 2018 total cash dividende 405,000 Exercise 11-8 Dividends on common and noncumulative preferred stock LO C2 Determine the amount of dividends pald each year to each of the two classes of stockholders: preferred and common. Also compute he total dividends paid to each class for the four years combined. Assume that the preferred stock is noncumulative. (Round your Dividend per Preferred Share" answers to 3 decimal places.) Par Value per Preferred Share Dividend Rate Dividend per Preferred Share Number of Preferred Shares Preferred Dividend Annual Preferred Dividend: Total Cash Dividend Pald Pald to Preferred Paid to Common Dividends in Arrears at year end S 2015 2016 2017 18.100 27.200 255,000 405,000 705,200 2018 Total: S

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started